- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I processs my taxes under my father's account which allows 5 people to complete for free?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I processs my taxes under my father's account which allows 5 people to complete for free?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I processs my taxes under my father's account which allows 5 people to complete for free?

If your father has a desktop version (CD/Download) of Turbotax, it can prepare as many returns as you want but it will only allow you to e-file 5 returns (this is an IRS limitation).

(The online version of TurboTax can only prepare one return per TurboTax account/email address).

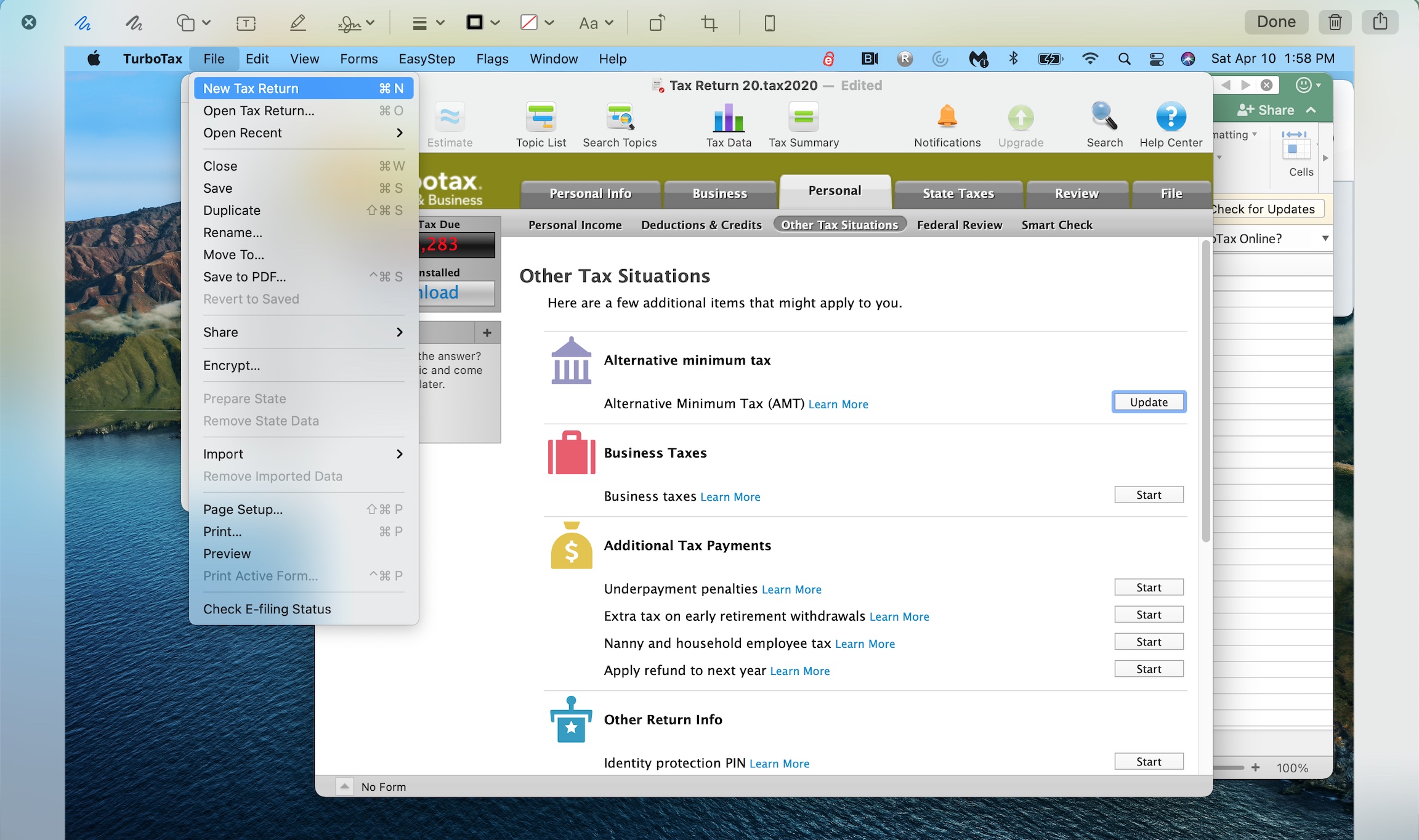

To start a new return in a desktop version (CD/Download) of Turbotax, select "File from the upper menu bar and then select "New Tax Return" from the drop-down menu. See the attached screenshot for aid in navigation:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I processs my taxes under my father's account which allows 5 people to complete for free?

Actually, it was a learning lesson, unfortunately. My daughter lives in another state, 960 miles away. I interpreted the 5 returns meant (like my MS Office 365) she could load a version on her computer. Unfortunately, the 5 returns means she would have to travel to my home, use my computer to do her return. Ain't gonna happen!! Now she may or may not buy Turbo Tax, do it manually, go to Block, who knows.

The Intuit Help desk thought if I uninstalled it from my computer, she would be able to install it as only one would be installed. Not the case.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I processs my taxes under my father's account which allows 5 people to complete for free?

Just an FYI - TurboTax 2020 software can be installed, authenticated, and activated on up to 5 different computers per the TurboTax Desktop Software End User License Agreement for Tax Year 2020. Just send the CD to your daughter (with the license code).

I do this for two computers every year, using a download license. I used to do it with a CD.

There is still a 5-return limit on e-filing from the same "program" (program serial number). For example, if I efile 3 returns from my traveling laptop, I can only file 2 returns from my stationary desktop.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

carbowl

Returning Member

yiovani22

New Member

lonnyandmary

New Member

Divideby7

Level 1

78Caldwell

New Member