- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I need to manually enter information for Form 1099-INT Christian Financial Resources, Inc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I need to manually enter information for Form 1099-INT Christian Financial Resources, Inc.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I need to manually enter information for Form 1099-INT Christian Financial Resources, Inc.

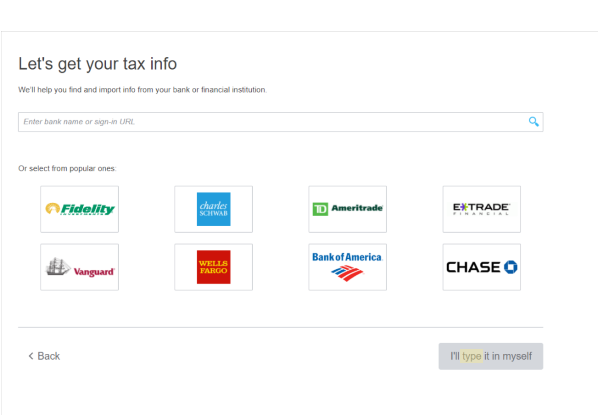

There is a button at the bottom of the screen that you can click.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I need to manually enter information for Form 1099-INT Christian Financial Resources, Inc.

Select "forms" Schedule B. You can enter interest and dividends on Schedule B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I need to manually enter information for Form 1099-INT Christian Financial Resources, Inc.

@ dwick61-bellsout After you have logged in and are in your return:

- Go to Search at the top of the screen.

- Enter Form 1099-INT in the search box.

- You will see a Jump To function that will take you to the 1099-INT input screens.

- There add the 1099-INT.

- At the financial services import screen, indicate "Change how I enter my form"

- Then "Type it myself"

The 1099 Series are informational reporting forms submitted to the IRS by third parties. The IRS then matches the form information to your tax return to insure all income is reported and taxed. If you do not include a 1099 received from a third party on your tax return, you will receive a notice from the IRS asking why. This is the CP2000 matching notice.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KarenL

Employee Tax Expert

JFHJR

Returning Member

KarenL

Employee Tax Expert

mapaww

Level 2

Dot222dot

New Member