- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I enter Schedule k1 Line 20AH Additional supplemental information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Schedule k1 Line 20AH Additional supplemental information

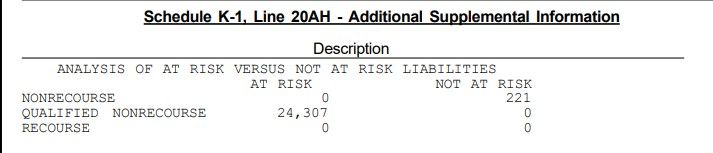

I received a k1 with the following information. On Turbotax Business it just allows me to enter AH-Other information and an amount. But it doesnt give me a way to differentiate the different line items. So how do I let turbotax know that nonrecourse not at risk is 221 and qualified nonrecourse at risk is 24307?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Schedule k1 Line 20AH Additional supplemental information

In TurboTax Home and Business for Windows, once you enter your Code AH, you'll get a follow up screen with "boxes". Your at risk and not at risk amounts will be entered at the bottom of that screen in the "Other Description Enter Below" boxes.

Because some of the investment is not at risk, on the "Describe the Partnership" screen you don't check the "all may investment is at risk" box. Next, TurboTax will walk you through the screens to calculate your at risk limitations.

If you have questions about how to complete your at risk limitations, I recommend contacting the K-1 preparer for guidance.

[Edited 6/18/2020| 3:57pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Schedule k1 Line 20AH Additional supplemental information

I get no such follow up pop up box. Can you please post a screenshot of that. With mine, it doesnt do anything when I dont enter an amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Schedule k1 Line 20AH Additional supplemental information

Once you enter your code AH (with or without an amount), the next screen should have the "boxes" to enter your code AH amounts. The question about "at-risk" and the follow-up questions about at-risk limitations are on later screens.

Here are the screenshots of the box 20 screen, and the subsequent box 20 code AH amounts screens:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Schedule k1 Line 20AH Additional supplemental information

Are you seeing this on Turbotax business or some other version. I dont get any subsequent screens on my version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Schedule k1 Line 20AH Additional supplemental information

After i select code ah and click continue it takes me back to my list of k1s.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Schedule k1 Line 20AH Additional supplemental information

In TurboTax Business you won't get the screens I described for the TurboTax Home & Business product. When you go to Forms mode (icon upper right in blue bar) and click on the K-1 in the left column, you'll see the notation for the the box 20 code AH that all your AH information must be entered manually.

More information about the type of return you are preparing (partnership, trust, etc.) may help with instructions about how to complete your manual entries in TurboTax Business for

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Schedule k1 Line 20AH Additional supplemental information

Its for a partnership.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter Schedule k1 Line 20AH Additional supplemental information

The liabilities being reported in box 20 code AH for the “pass-through” partnership are relevant to the individual partners in the partnership preparing the Form 1065. So, each partner’s share of those box 20 code AH liabilities will be reported in box 20 code AH on that partner’s Schedule K-1. The individual partner will then take those liabilities into account when calculating the at-risk limits related to their partnership interest on their individual (Form 1040) tax return.

[Edited 7/4/2020|11:14am PDT]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

thomas-l-tarbox

New Member

BillyDB

Level 2

ddm_25

Level 2

pjfrnc

New Member

brcrump

Level 2