- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do i enter a 1099-INT received from the IRS from interest income. there is no bank information its asking for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter a 1099-INT received from the IRS from interest income. there is no bank information its asking for.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter a 1099-INT received from the IRS from interest income. there is no bank information its asking for.

It is not necessary or a required entry for the Federal identification number on Forms 1099-INT. You can proceed to enter the interest and move to the next entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter a 1099-INT received from the IRS from interest income. there is no bank information its asking for.

i received a letter from the IRS saying that they gave me interest with my refund. no 1099 just said that i must report it as income and gave me their tax ID. how does it get reported in turbotax???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter a 1099-INT received from the IRS from interest income. there is no bank information its asking for.

IRS interest 1099 form probably only says 1099 (rev. 9-07) on it. The IRS EIN # on it is 38-1798424.

Enter interest from the IRS like a 1099Int and put the amount in box 1.

Enter a 1099-Int under

Federal

Wages & Income

Interest and Dividends

Interest on 1099INT - Click the Start or Update button

Put the interest amount in box 1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter a 1099-INT received from the IRS from interest income. there is no bank information its asking for.

It’s asking for zipcode for Ogden ut

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter a 1099-INT received from the IRS from interest income. there is no bank information its asking for.

For the IRS? Delete that one and Enter interest from the IRS like a 1099Int and put the amount in box 1. Enter it manually and just enter IRS for the payer. Don't enter any other info like the address or a EIN.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter a 1099-INT received from the IRS from interest income. there is no bank information its asking for.

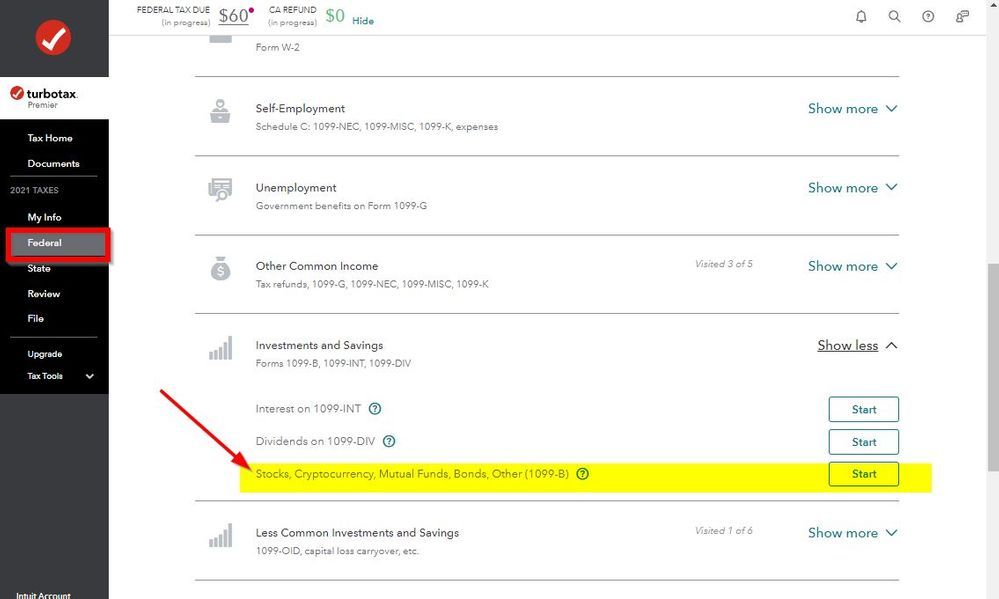

It says "Investments and Savings" now on the updated version rather than "Interest and Dividends." Is this correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter a 1099-INT received from the IRS from interest income. there is no bank information its asking for.

No. It is called Interest and Dividends.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter a 1099-INT received from the IRS from interest income. there is no bank information its asking for.

@jpro1231 Where does it say Investments and Savings? Can you post a screenshot?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter a 1099-INT received from the IRS from interest income. there is no bank information its asking for.

Oh you are right!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17539892623

Returning Member

pivotresidential

New Member

jjon12346

New Member

user17549300303

New Member

jstan78

New Member