- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I declare foster care income? The 1099-MISC from the county marks it as "non employee compensation"; TurboTax doesn't have that option; "other" makes it taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I declare foster care income? The 1099-MISC from the county marks it as "non employee compensation"; TurboTax doesn't have that option; "other" makes it taxable.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I declare foster care income? The 1099-MISC from the county marks it as "non employee compensation"; TurboTax doesn't have that option; "other" makes it taxable.

Well one way of not reporting the income would be to not enter the 1099-MISC at all. The IRS might never follow up on the matter or, if they do, a well-written, well-documented letter might put the matter to rest.

Another approach would be to actually report the 1099-MISC income, allowing the IRS's computers to do their "matching", but then reverse out that income so that your AGI is left unchanged:

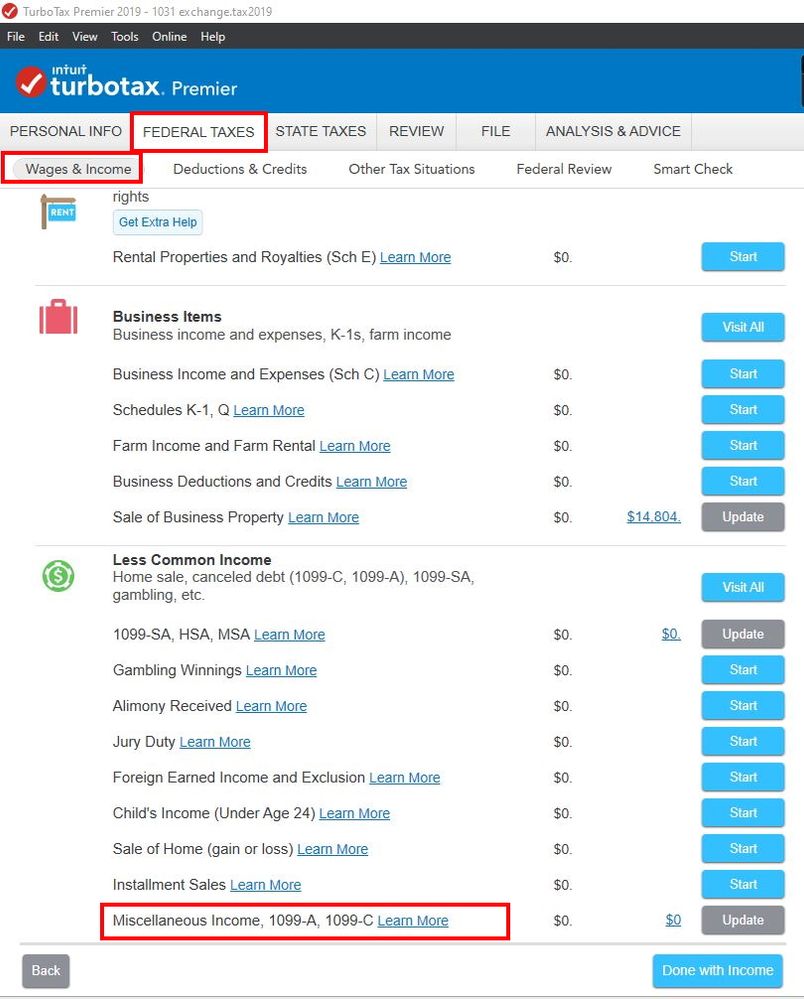

- Start the "Miscellaneous Income, 1099-A, 1099-C" interview down at the bottom of the "Your 2017 Income Summary" page.

- Start the "Other reportable income" interview

- On the page "Any Other Taxable Income?" click YES

- On the page "Other Taxable Income" ignore the "Do NOT enter income reported on Form 1099-MISC" warning enter a description and amount, e.g., "1099-MISC issued by [County Name] foster care agency".

- Go back and start the "Miscellaneous Income, 1099-A, 1099-C" interview again, following the same path, and enter a description and a NEGATIVE amount, e.g., "1099-MISC:Section 131(a) exclusion of qualified foster care payments".

That provides visibility to the 1099-MISC but excludes the amount from your AGI and explains the reason why.

Tom Young

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I declare foster care income? The 1099-MISC from the county marks it as "non employee compensation"; TurboTax doesn't have that option; "other" makes it taxable.

Hello Tom,

Would you please help me navigate in the Personal and Business software version using your instructions.

I cannot seem to find the Miscellaneous Income, 1099-A, 1099-C" interview--down at the bottom.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I declare foster care income? The 1099-MISC from the county marks it as "non employee compensation"; TurboTax doesn't have that option; "other" makes it taxable.

I have Premier (desktop) but I assume all the desktop versions look the same:

ARE YOU SURE the income isn't taxable to you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I declare foster care income? The 1099-MISC from the county marks it as "non employee compensation"; TurboTax doesn't have that option; "other" makes it taxable.

Tom!

Thanks for quick reply!!

Yes, I am sure!!

Once again, thanks a bunch!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I declare foster care income? The 1099-MISC from the county marks it as "non employee compensation"; TurboTax doesn't have that option; "other" makes it taxable.

Tom,

I have another question!

I understand that I may not be able to claim all my expenses that have to do with the foster care.

I am told it falls under Code section 265.

Based on that code 265, I believe I would be able to claim a certain percentage of my total foster care expenses.

Where and how do I do this in TurboTax and for the software to run its calculation!

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I declare foster care income? The 1099-MISC from the county marks it as "non employee compensation"; TurboTax doesn't have that option; "other" makes it taxable.

I'm not sure about the code 265 reference maybe that is a state code? For the IRS that code deals with interest deductions.

But IRS code 131 does exclude income from Foster Care Placement agencies. Also, if the agency is a charitable organization and is able to receive charitable donations you would put your expenses as a charitable donation on your Schedule A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I declare foster care income? The 1099-MISC from the county marks it as "non employee compensation"; TurboTax doesn't have that option; "other" makes it taxable.

DMarkM1,

Thanks for the reply back.

The agency is not a charitable organization.

I might have made a mistake when I mentioned code 265.

Following is actually what I was asking about and was wondering how it applies at deducting my expenses. Not fully understanding what it says, I am guessing its basically saying I cannot deduct my expenses--but can you please translate it and inform me what it says and how it applies to my situation!:

Thanks!

Internal Revenue Code Section 265(a)(1)

Expenses and interest relating to tax-exempt income

(a) General rule.

No deduction shall be allowed for-

(1) Expenses.

Any amount otherwise allowable as a deduction which is allocable to one or more

classes of income other than interest (whether or not any amount of income of

that class or classes is received or accrued) wholly exempt from the taxes

imposed by this subtitle, or any amount otherwise allowable under section 212

(relating to expenses for production of income) which is allocable to interest

(whether or not any amount of such interest is received or accrued) wholly

exempt from the taxes imposed by this subtitle.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

margomustang

New Member

troyponton

New Member

KarenL

Employee Tax Expert

benborkott

New Member

tucow

Returning Member