- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I convert Form 1040-SR to 1040?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I convert Form 1040-SR to 1040?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I convert Form 1040-SR to 1040?

The 1040SR is new starting in 2019. It is the same as the regular 1040 just larger type and the Standard Deduction chart is added to page 1. But has the same line numbers. You automatically get the SR if you are 65. If you are using the Desktop program there is a way to force the one you want.

Even the regular 2019 1040 return is now different than 2018. They changed the line numbers again and reduced the new schedules from 6 to 3.

1040SR https://www.irs.gov/pub/irs-pdf/f1040s.pdf

1040 https://www.irs.gov/pub/irs-pdf/f1040.pdf

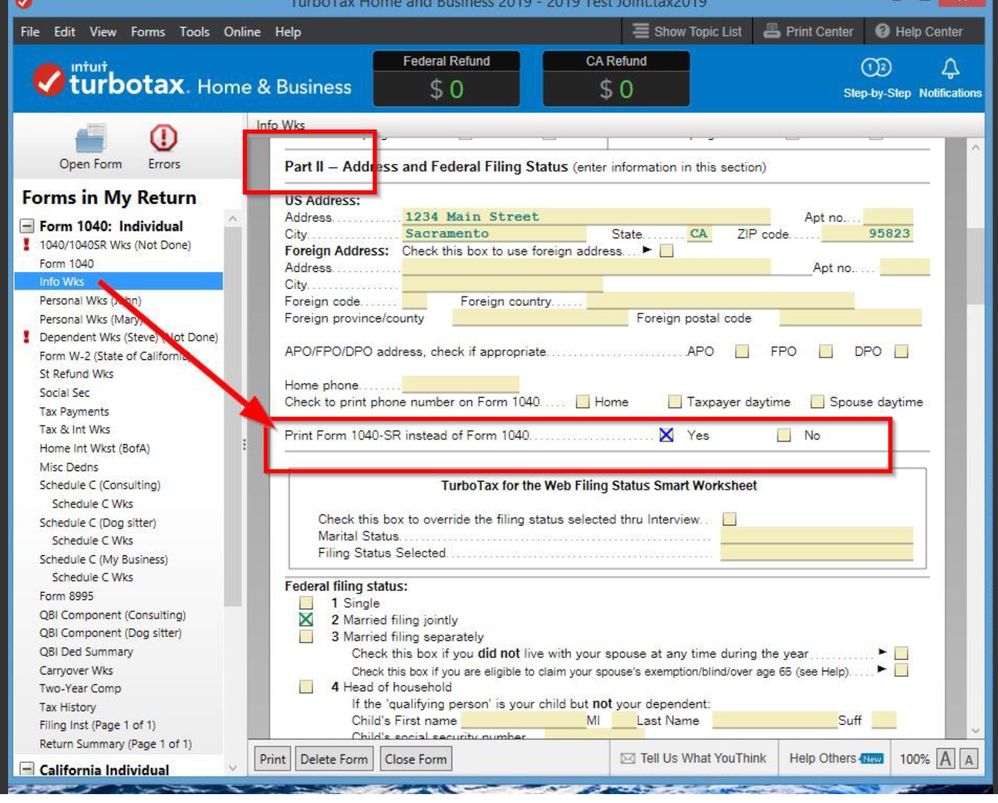

If you use the Desktop program you can switch to forms and the Info Wks part II has a selection to select 1040SR or not. You can not change it in the Online versions. In the Online version if you want to use the regular 1040 form, you can print out the 1040SR and copy the amounts onto the 1040 and then mail your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I convert Form 1040-SR to 1040?

TurboTax automatically prints Form 1040-SR if you are 65 or older. Since you are using the CD/Download TurboTax software, you can make it print Form 1040 instead. Go to forms mode and open the Federal Information Worksheet. In Part II of the worksheet, below your address, there is a line that says "Print Form 1040-SR instead of Form 1040." Click the No box on that line.

Note that the only difference between Form 1040-SR and Form 1040 is the appearance of the printed form. The calculations are exactly the same. Changing the form will not make any difference in your tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I convert Form 1040-SR to 1040?

The 1040SR is new starting in 2019. It is the same as the regular 1040 just larger type and the Standard Deduction chart is added to page 1. But has the same line numbers. You automatically get the SR if you are 65. If you are using the Desktop program there is a way to force the one you want.

Even the regular 2019 1040 return is now different than 2018. They changed the line numbers again and reduced the new schedules from 6 to 3.

1040SR https://www.irs.gov/pub/irs-pdf/f1040s.pdf

1040 https://www.irs.gov/pub/irs-pdf/f1040.pdf

If you use the Desktop program you can switch to forms and the Info Wks part II has a selection to select 1040SR or not. You can not change it in the Online versions. In the Online version if you want to use the regular 1040 form, you can print out the 1040SR and copy the amounts onto the 1040 and then mail your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I convert Form 1040-SR to 1040?

I think I have resolved this problem. I believe there is a bug in the TurboTax SW that does not transfer PIN to both the 1040 and the 1040SR forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I convert Form 1040-SR to 1040?

How do I import my 2021Form 1040-SR pdf file (done by another vendor) to Turbotax 2022? Turbotax 2022 gives me an error message and will not let me import it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I convert Form 1040-SR to 1040?

How did you resolve this issue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I convert Form 1040-SR to 1040?

I don't think you can transfer a 1040SR pdf. But even if you could, a pdf file only transfers your basic Personal Info like name, ssn and AGI. You might as well manually enter tour info.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lgreene1964

Level 1

Rickpr

New Member

1jrj

Returning Member

crazydj

Returning Member

howjltx

Level 3