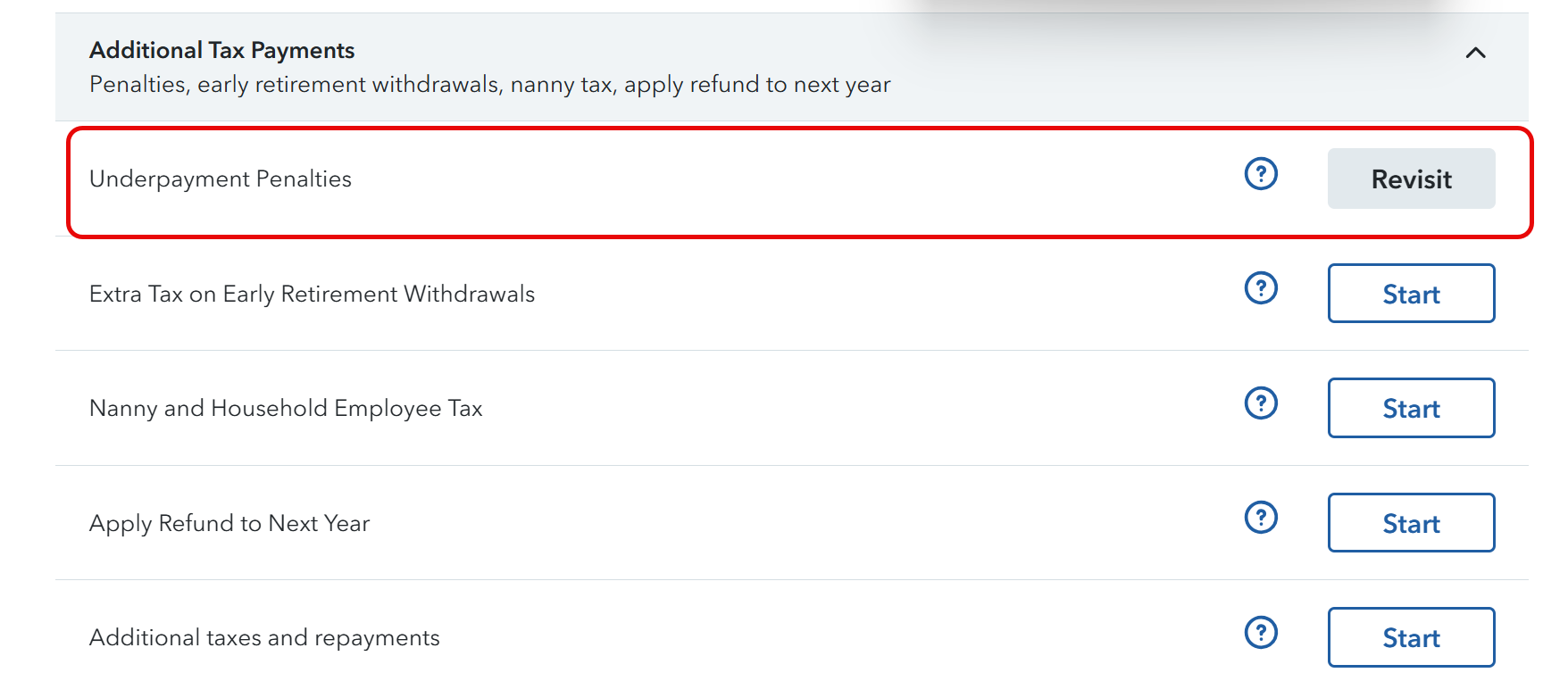

For the federal, go to Other Tax Situations, under Additional Tax Payments-- Underpayment Penalties.

You'll have to pay an underpayment penalty for 2024 if you owe $1,000 or more in taxes (after withholding) and:

- Your taxes withheld don't cover at least 90% of what you owe for 2024, or

- Your taxes withheld aren't at least 100% of what you owed for your 2023 taxes, if your adjusted gross income (AGI) is up to $150,000, or

- Your withholding is 110% if your AGI is more than $150,000. (The AGI amount is $75,000 if you're Married Filing Separately.)

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"