- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

Yes, you are on the right track. Click "Enter a different way" and Continue. The next screen will have the option "I'll type it myself.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

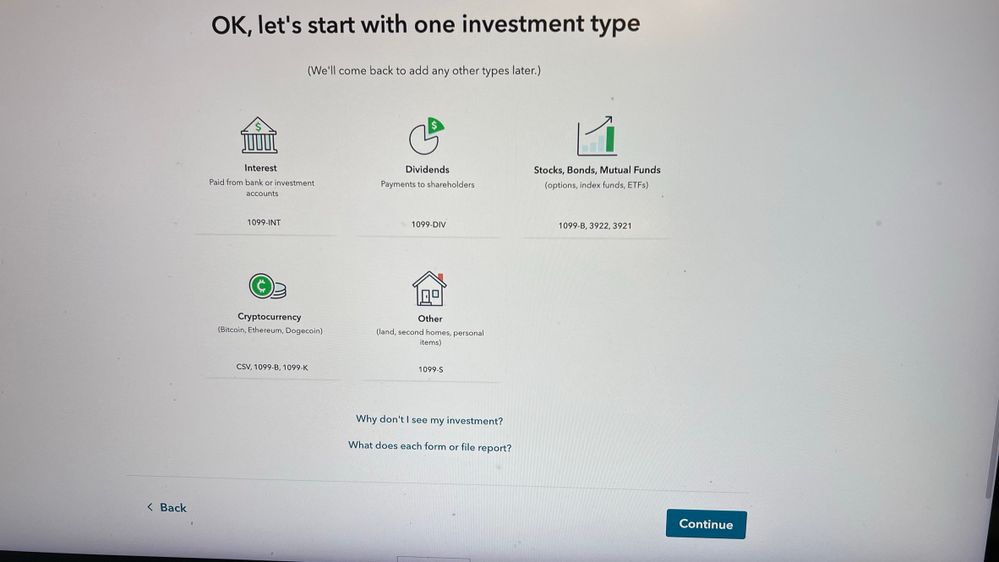

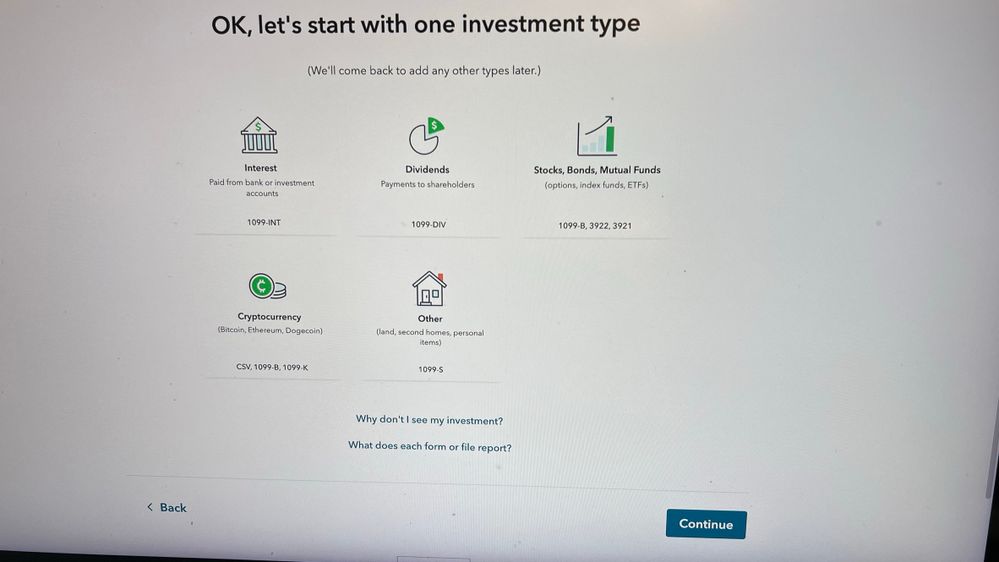

Thanks for the reply. When I click Add Investments—>Continue—>Enter a Different way I get to a screen that makes me choose an investment type. If I click Continue without a selection it gives a red message to make a selection. So I chose Stocks,Bonds Mutual funds box which is related to a 1099-B. Then all I can do is import. I never see a button that says I’ll do it myself.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

On the screen that makes you choose an investment type there should be an option at the bottom of the page where you toggle between "import" and "type it myself". You need to click type it myself before you click continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

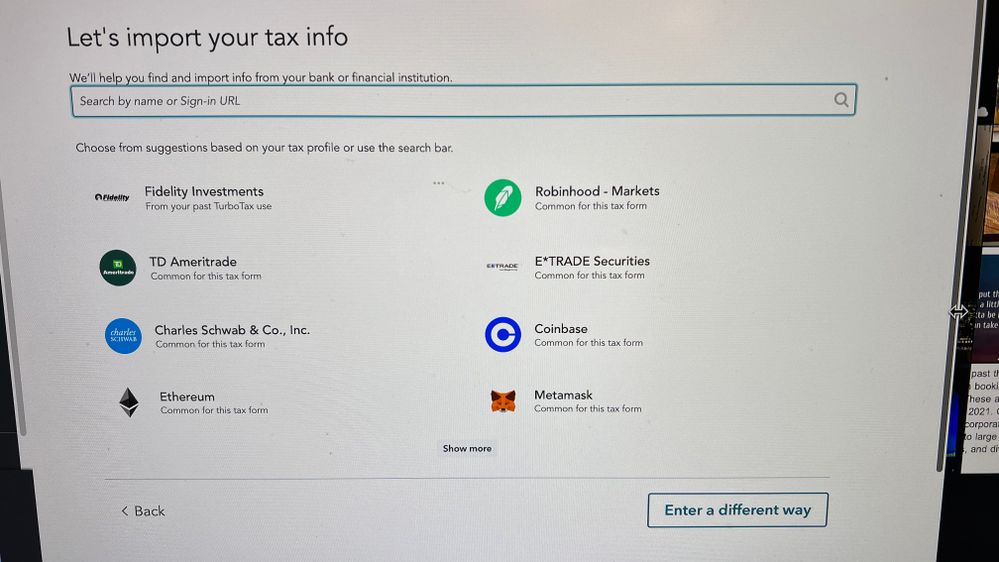

On the Import screen I see the Enter a different way button at the bottom and that is all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

On the next page that lists Investments Type I have a Continue button only ! Hopefully the photo is being uploaded with this message

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

On the Investment Type page I only have a Continue and Back button.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

On the screen which gives you the option to upload a 1099-B, there is another option to enter your transaction information manually. Do you see "Enter a different way," about mid-screen on the right side? Or do you see the option to "I'll type it in myself?" Either of these options will give you the ability to enter your information manually.

@briancostello1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

@GeorgeM777 I see an "Enter a different way" button. And if i click that button I go to the Investment Type page that has a Continue button. Both the Import Your Tax Info and Investment Type pages do not have a button to manually input data

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

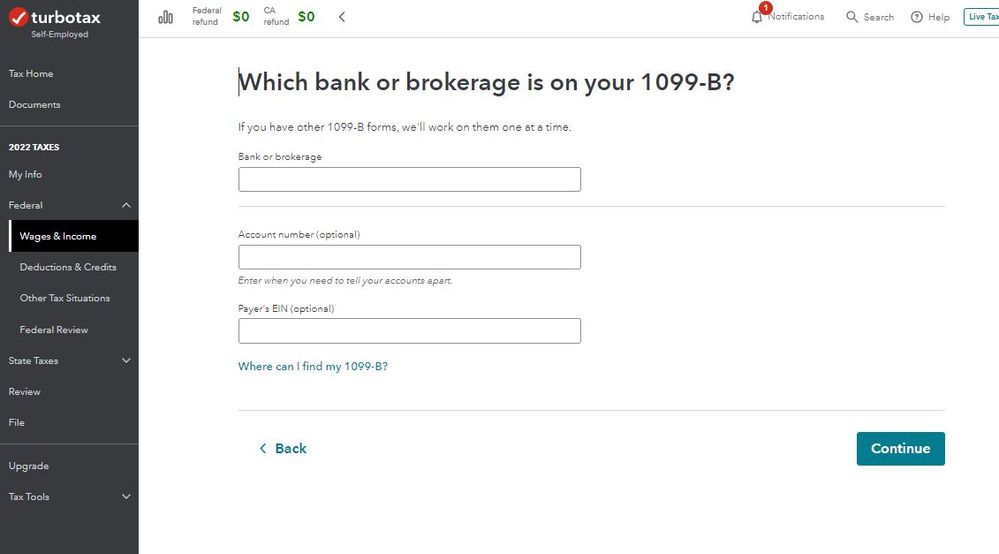

@GeorgeM777 and if I click the Continue button the next page is expecting to Import a 1099 and asking for a Bank or Brokerage..... I don't see any way I can manually input my capital gain/loss info.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

Select Stocks, Bonds, Mutual Funds. Then click Continue.

- On the next screen enter your Bank or Brokerage information.

- You will then have to respond to a few questions about the type of stock you sold and the number of transactions.

- You will then be given the option to enter your information as one or separate transactions or as a summary. Select the appropriate option and click Continue.

- At the screen Look for your sales on your 1099-B, click on Continue.

- At the screen Now, enter [sale] on your [name of bank or brokerage] enter your information about your transaction. Click Continue when done.

@briancostello1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

this is an interesting way of doing it because I have no 1099-B. That is why I want to input the data on my own. If I had access to the Form View like prior years I could simply input the data in the columns and it would be captured on Form 8960 and Schedule D. Now it almost seems like there is a limitation on the ability to manually input capital gain/loss unless you have a 1099-B and do the import. Last years version of Home and Business allowed manual capital gain/loss entries. Home and Business is now Self Employed.

Maybe enter a bank/brokerage of N/A and just continue? It seems there is a dropdown that could be used: Short term no 1099 / Long Term 1099. But I wonder if that will work.

Can't believe no other folks are having this issue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

Ah--reread your message very carefully---# 5. input SALE in the Bank/Brokerage cell.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

After you click on the Stock Box and Continue, don't you get this screen? I can put anything I want in and continue. It doesn't make me import . You can put any description you want.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I input manual capital gain in Self-Employed Turbotax? Let's Import Your Tax Info screen ->"Enter a different way" all I can do is Import. No I'll type it myself?

@VolvoGirl Yes, I do get that screen. And I can input data but that screen is all about data coming off of a 1099-B. Theoretically, the capital gain/loss data could be from a 1099 or not. So, it looks like maybe the confusion is getting to the input screen and then realizing you can use if for 1099 and non- 1099 entries. Note that you do have to put in a Bank/Brokerage name. I've never had to do that in past years--just had to input the stock name, purchase and sale dates, basis, and gain/loss,

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

teenadie

New Member

denissedelgadovazquez

New Member

wachsmuth6

New Member

wagsyardsolution

New Member

kirbyfred

New Member