- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How can I add health insurance information to my California return when TurboTax forces me to skip that section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

/CA-Return/CA-ReturnData/CAForm540NR/ISRPenalty/PaymentsAfterISRPenalty - Healthcare coverage information in the return is missing or invalid. Please double check your entries.

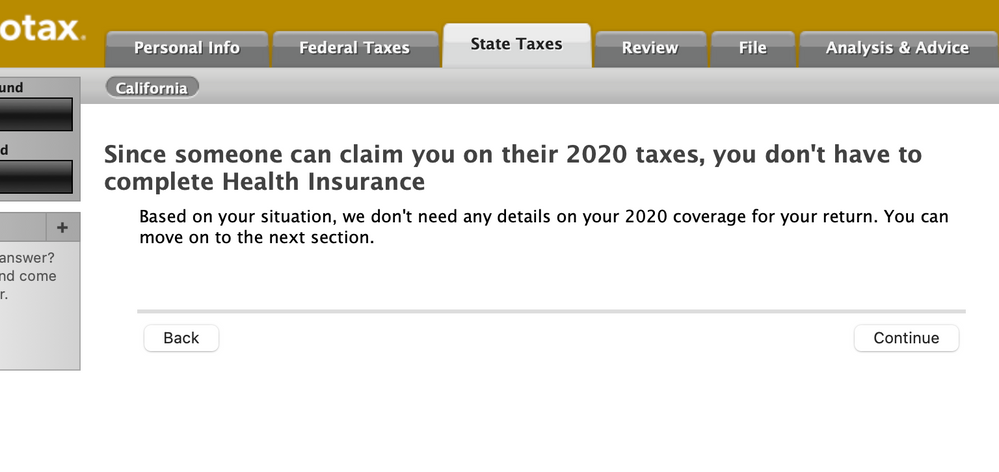

However, I have gone through the California interview questions multiple times and the closest I get to being able to enter this information is on the screen where TurboTax says:

Since someone else can claim you on their 2020 taxes, you don't have to complete Health Insurance.

I cannot override this. I'm not sure exactly what information I'm missing but I think this is an issue on my 540NR form.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

You need your parent's or the person who claimed your exemption 1095-A statement, if any and add it on your income tax return. You can also verify from them what insurance coverage they had for the family, or if hey had employer provided insurance plan.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

I received health insurance from my parent's coverage for part of the year, and received it for free from my CA job for the other part of the year. Also, while my parents can claim me as a dependent they will not this year because I payed for more than half of my living expenses. Does that change anything?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

I have the same problem as the original poster, my state filing got rejected.

I have health insurance from my parents (my Dad's employer), so he didn't get a 1095-A form, but has a 1095-B form, but there is no where to enter it.

Where can I enter this information?

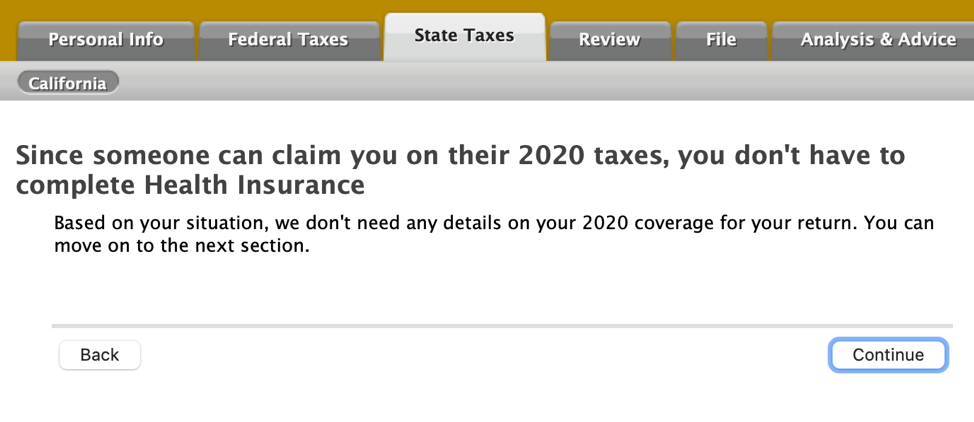

Ultimately I need turbotax to check box 91 on California form 540NR (Full-Year health coverage)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

I am having the same issue. From what I can tell I just need to check off the box in 540NR Line 91 but there's no way to do that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

You will need to go through your state interview section again and make your corrections there.

- Select State in the black panel on the left hand side of your screen when logged into TurboTax.

- This will take you to a screen titled Let's get your state taxes done right. Click continue on this screen.

- You will see the following screen titled Status of your state returns. Select Edit to the right of California.

Continue through the California screens until you see Did you have health insurance coverage in 2020?

Your answers in this section will prepare the correct form for the California health coverage reporting requirement.

If you had health insurance, please check the box that says We both(I) had health insurance coverage all year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

When editing the California state return only mention of health insurance that I can find is a screen reading:

Since someone can claim you on their 2020 taxes, you don't have to complete Health Insurance

Based on your situation, we don't need any details on your 2020 coverage for your return. You can move on to the next section.

When I select Continue it proceeds and there is no further mention of insurance coverage.

It seems the software thinks that the health insurance info on the 540NR does not need to be filled out if you are a dependent. When I look over the PDF of the 540NR it does indicate that I am a dependent on Line 6, and Line 91 where you would either indicate full health coverage or your ISR penalty is blank.

I get the error:

/CA-Return/CA-ReturnData/CAForm540NR/ISRPenalty/PaymentsAfterISRPenalty - Healthcare coverage information in the return is missing or invalid. Please double check your entries.

Which from what I understand means that although I am a dependent, I do still need to indicate on Line 91 that I had full coverage or whatever my ISR penalty is. Turbotax, however, does not seem to allow me to give any health insurance information since it thinks it's unnecessary as I am filing as a dependent.

It looks like the screen you show under Did you have health insurance coverage in 2020? is exactly what I need, but Turbotax is not letting me fill out that information.

Please let me know if there is any way I can get around this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

thanks for the reply, but in my case I'm using TT on a Mac and when I go through the California interview I get the following message. This is because my parents can claim me on their taxes this year. The problem is my California return gets rejected.

Ultimately I need turbotax to check box 91 on California form 540NR (Full-Year health coverage)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

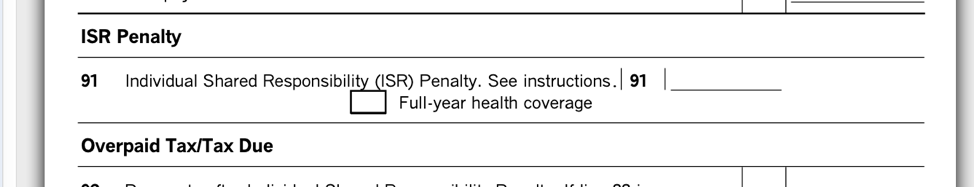

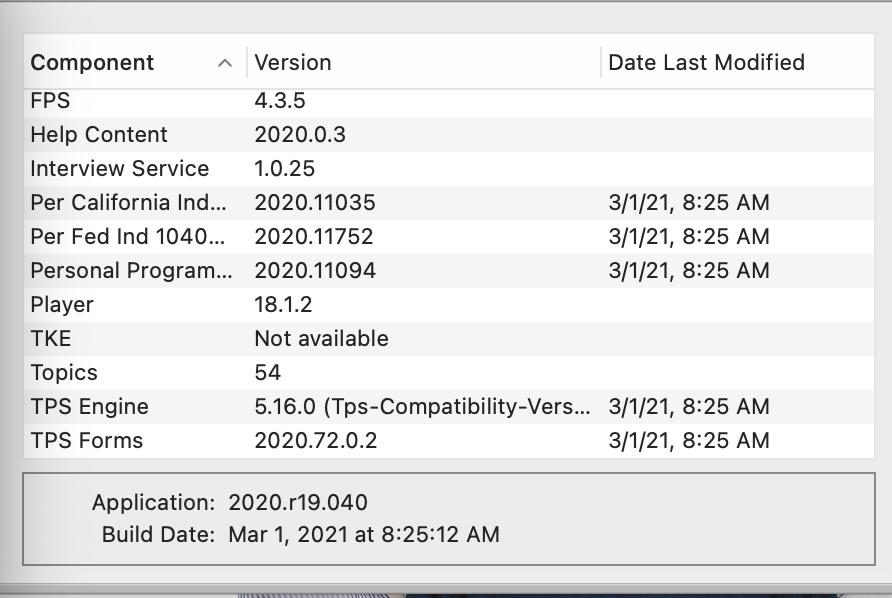

I just checked and the Line 91 checkbox is being filled in now. Thank you to the TurboTax team for fixing the problem.

EDIT: My return just got accepted, so that was the issue. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

I'm seeing the same problem, I've gone through the wizard again after updating and box 91 is still not checked

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

Did you update your software on or after Feb 26? I did it online so it updated automatically, but I think you have to do it manually if you use a desktop program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

Yes, I updated this morning

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

Go to forms and enter it or override what you need there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add health insurance information to my California return when TurboTax forces me to skip that section?

@rhugg3 - In line 91 there is a check box and also a number entry box. It will allow me to override the number entry box, but it will not allow me to check the check box (which is what I need).

here's a video of my attempt:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Vickiez1121

New Member

Vickiez1121

New Member

Vickiez1121

New Member

user17524531726

Level 1

PaintBallGuy1

New Member