- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How am I only getting $277 in CTC and I have 4 dependents? Why is it reducing my tax liability to 0, thus cancelling out my CTC?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I only getting $277 in CTC and I have 4 dependents? Why is it reducing my tax liability to 0, thus cancelling out my CTC?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I only getting $277 in CTC and I have 4 dependents? Why is it reducing my tax liability to 0, thus cancelling out my CTC?

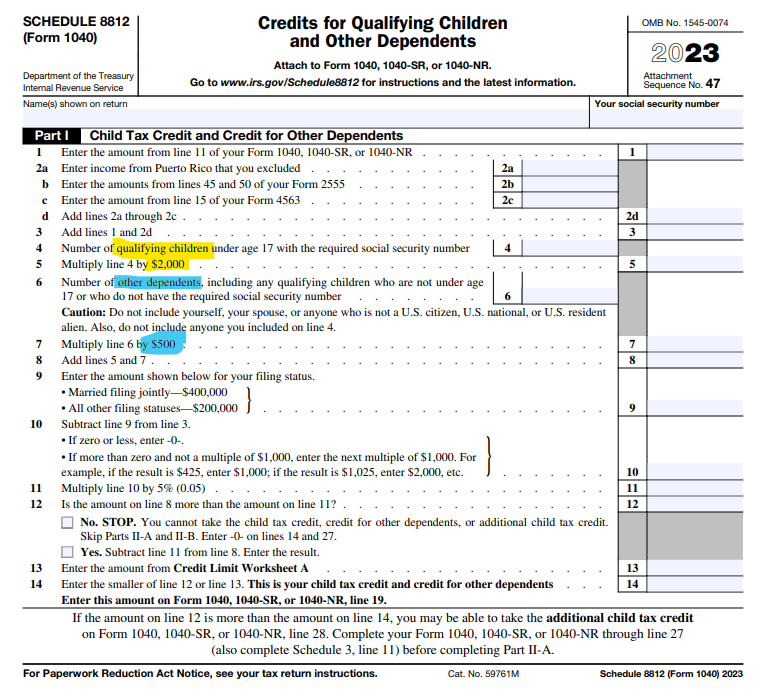

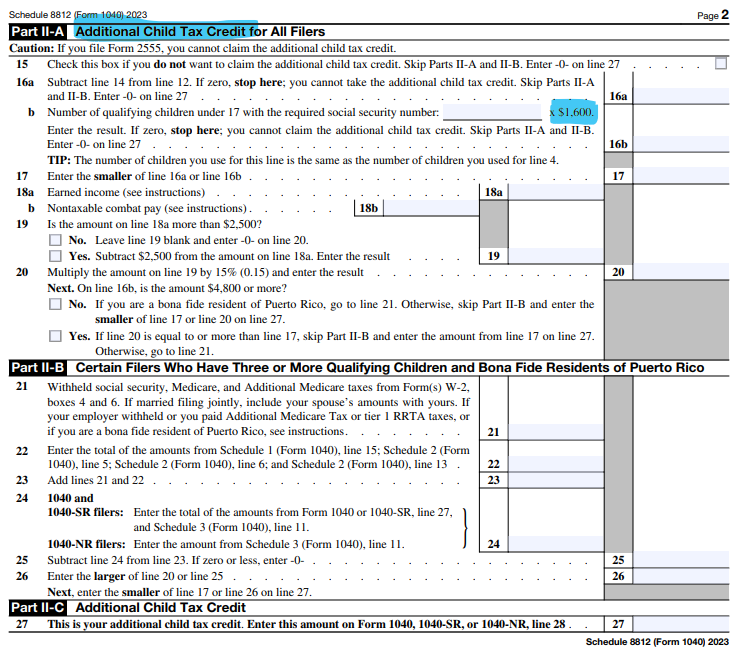

Without the CTC, you would have a tax liability and could potentially owe. There are 2 credits - one is Child Tax Credit and the other is Additional Child Tax Credit. The first one is nonrefundable and reduces your tax liability. The second one is refundable up to $1600 each depending on how much of the first credit was used to reduce your tax liability. These credits are for children under 17.

There is a bill in Congress that if signed into law will affect your tax return. Learn more here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mike-molecular

New Member

dive767

New Member

heatherknowles76

New Member

Helper82468ASD

Level 2

emilyjue0

New Member