- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Help with Form 8283

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with Form 8283

I donated car with a value greater than $5000 and Turbotax is automatically populating section A of Form 8283 when it should populate Section B of Form 8283. I don't know why it is not recognizing the value I entered is greater than $5000. (I use the desktop version of turbotax)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with Form 8283

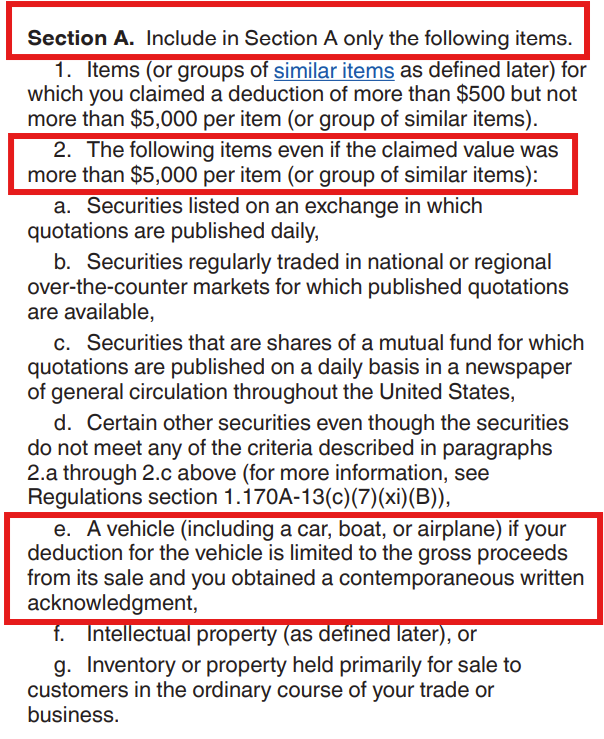

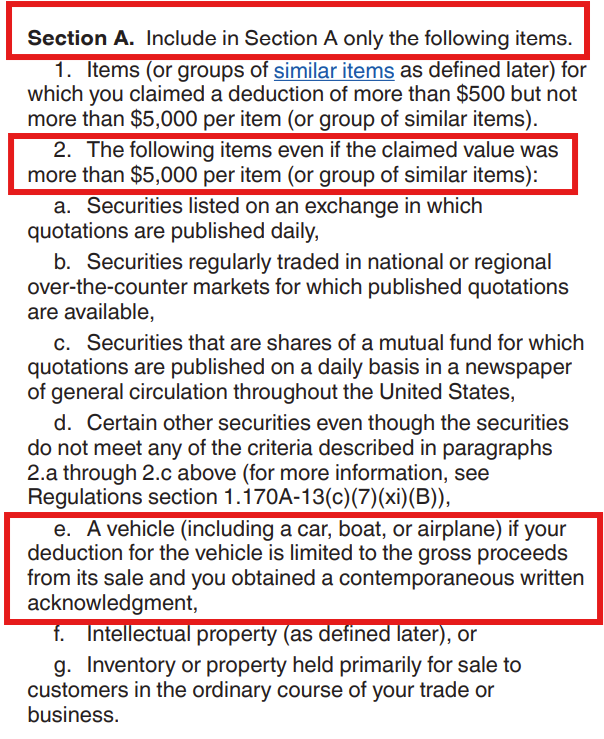

Reporting the car donation with a value over $5000 in section A of Form 8283 is correct. See the following screenshot from the IRS Instructions for Form 8283:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with Form 8283

If you claim a deduction of more than $5,000 (per item) you must obtain a qualified appraisal of the item or group of items and fill out Form 8283 (TurboTax will complete this for you).

When you donate a car that is valued more than $500, you should receive a Form 1099-C or a written statement for the donation.

Also, if your total noncash donations are $5,000 or more, you will not be able to e-file your tax return, which includes Form 8283.

Starting in tax year 2024, the IRS requires a Form 8283 that has a noncash donation where the donee's name is listed and the appraised value is $5,000 or more, then the return must be mailed in with an acknowledgment from the donee. You can follow the steps here to print and file your tax return.

Click here for "Can I e-file Form 8283?"

Click here for "What Is the IRS Form 8283?"

Click here for How Do Tax Deductions Work When Donating a Car?

Click here for IRS guidance explains rules for vehicle donations

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with Form 8283

Thank you. I have all items listed. All set there so I really appreciate your information.

The problem is that Turbotax is populating the incorrect section of 8283 - it is populating Section A (for less than $5000) instead of Section B (for more than $5000). My donation was greater than $5000 and thus I am required to use Section B.

Why is Turbotax populating the incorrect section and how do I change it to populating Section B?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with Form 8283

I'm not sure why TurboTax is doing that other than, as per my above response, the way you are answering the questions in TurboTax. I entered the information in my TurboTax program and TurboTax correctly entered the car in Part B of Form 8283. You could try deleting the donation and re-enter it.

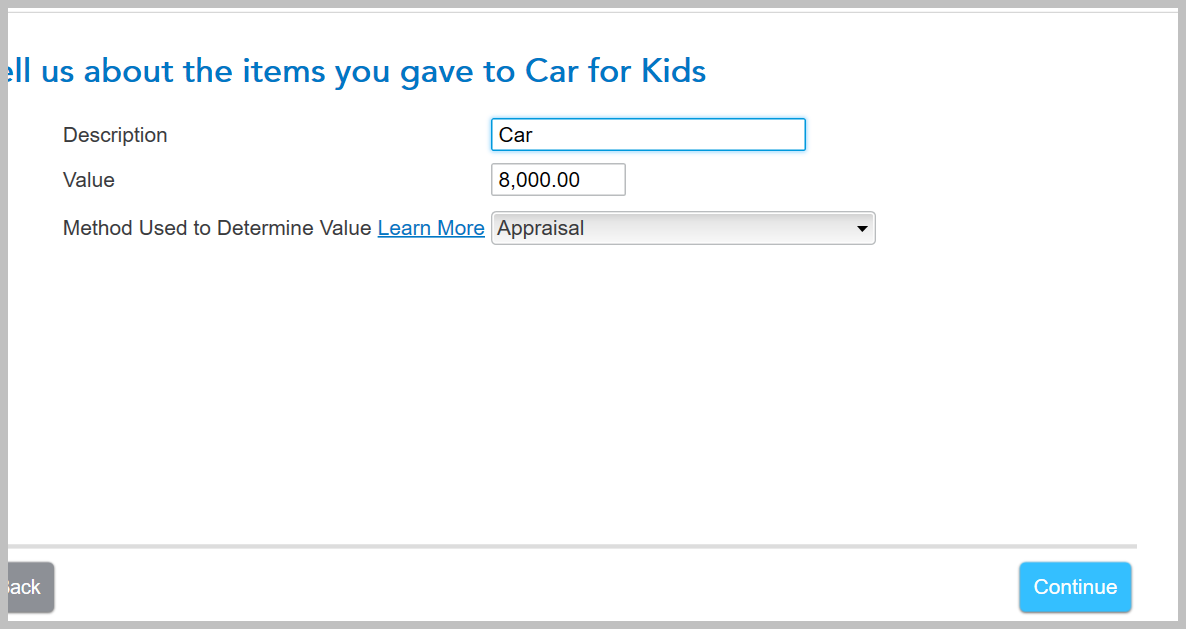

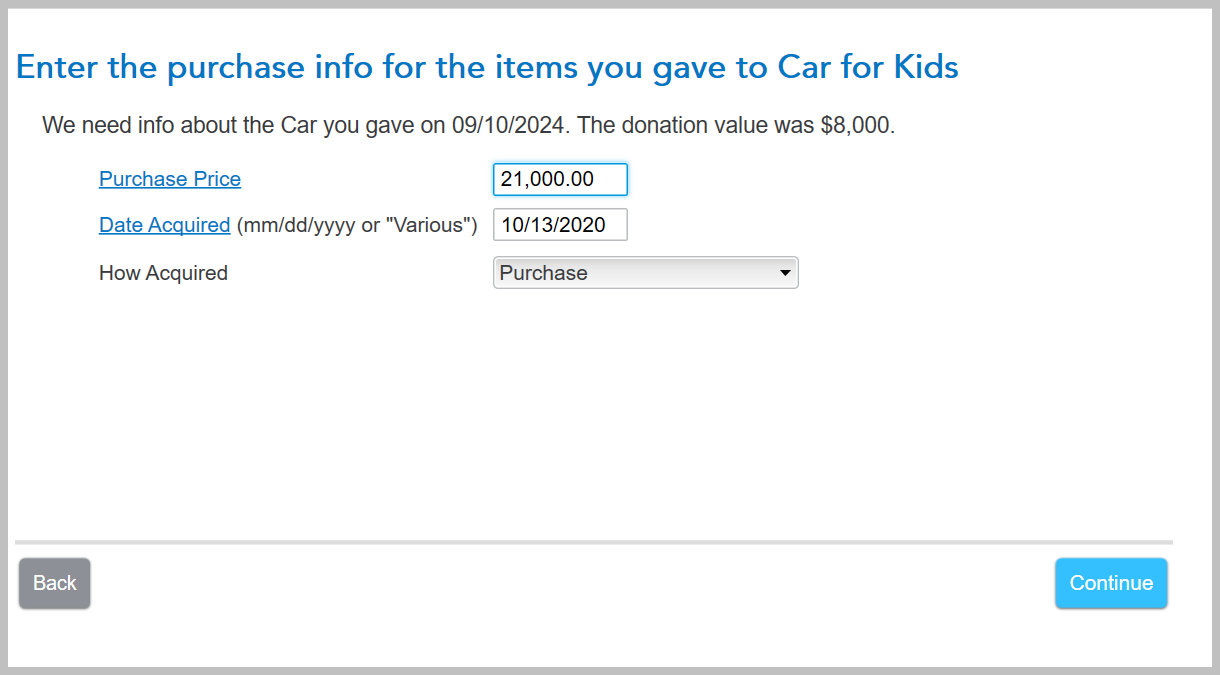

Did you select "Appraisal" for "Method Used to Determine Value"? Getting an appraisal is required for a donation over $5,000.

Did you receive a Form 1098-C? These all affect your deduction.

Your screens will look something like this:

Click here for What is a 1098-C: Contributions of Motor Vehicles, Boats and Airplanes

Click here for How Do Tax Deductions Work When Donating a Car?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with Form 8283

Thank you.

Still not working. Deleted everything and started over. Turbotax Desktop (in the program) says an appraisal is not needed if the value was set with an arms length sale and you are claiming gross proceeds. (my car was sold and I am claiming gross proceeds) Either way its still populating the incorrect section.

I suppose this can be completed manually without Turbotax....don't know how to move forward in another way. Very frustrating and confusing and no Turbotax helpdesk or anything to guide through a workaround. There is nothing to do wrong here; it takes the information and populates it...so it's not user error. Its simply not recognizing the dollar amount is over $5000.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with Form 8283

Reporting the car donation with a value over $5000 in section A of Form 8283 is correct. See the following screenshot from the IRS Instructions for Form 8283:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alina_radea

New Member

Kegan

Level 1

knixonlane

New Member

jcmarson

New Member

juleyh

Level 3