- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- head of household questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

Taxpayer's girlfriend and girlfriends grand daughter both lived with taxpayer all year long. Taxpayer made 64,000.00, girlfriend made 7,000.00 in social security and will not be filing a tax return. the girlfriends grandchild gets 200.00 a month in government assistance. the childs parents do not provide any support at all and are not involved in their childs life and neither file tax returns. The girlfriends grand child is 8 years old. the taxpayer pays all of the rent, utilities, 3/4 of the food for the household, buys the childs clothes and pays for school activities and recreation. Can the taxpayer claim head of household with the grandmother meeting the relative requirements? If so how do you record this in turbo tax, it does not want to allow me to claim head of household due to the taxpayer not being related to the child? would i override the filing status or what?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

TurboTax is correct. A qualifying person must be related to the taxpayer to qualify the taxpayer for Head of Household. However both the girlfriend and her grandchild can be claimed as qualifying relatives for dependency and you would file as single.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

there is not an exception that allows the grandmothers relationship to the granddaughter qualify the taxpayer to claim HH since he provides more than half the support to both the grandmother and granddaughter, and they both lived with the taxpayer all year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

Head of household requires that the dependent be legally related to you which neither is so you can't file as HOH. The GF won't qualify as a dependent if she's over 19 or a full-time student over 24. the daughter would qualify you for the $500 other dependent credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

Qualifying Person for HOH:

- To qualify for Head of Household, the taxpayer must have a qualifying person.

- The grandchild could potentially be the qualifying person if they meet the criteria.

Qualifying Child vs. Qualifying Relative:

- For Head of Household, a qualifying child is one option, but there’s also another possibility: a qualifying relative.

- Let’s explore both scenarios:

a. Qualifying Child: - A qualifying child must meet specific conditions: - Relationship: The grandchild must be the taxpayer’s child (including legally adopted), stepchild, foster child, sibling, half-sibling, step-sibling, or a descendant (e.g., grandchild or niece). - Age: The grandchild must be either: - Permanently and totally disabled, OR - Under the age of 19 as of December 31, 2023 (or under 24 if a full-time student) and younger than the taxpayer (or the taxpayer’s spouse if filing jointly). - Residency: The grandchild must have lived with the taxpayer for more than half the year. - Marital Status: If the grandchild is married, the taxpayer would need to qualify to claim them as a dependent (even if not claiming them as such).

b. Qualifying Relative: - A qualifying relative can also be considered for Head of Household: - The grandchild’s grandmother fits this category. - The grandchild’s grandmother must: - Have lived with the taxpayer for more than half the year. - Be someone the taxpayer can claim as a dependent (even if not claiming them as such).

Financial Support and Home Maintenance:

- The taxpayer provides more than half of the grandchild’s financial support.

- The taxpayer maintains the cost of the home where they all live.

Parents’ Involvement:

- The fact that the grandchild’s parents are not involved in the grandchild’s life and do not file tax returns does not impact the taxpayer’s eligibility for HOH status.

Conclusion:

- If the grandchild meets the criteria for a qualifying child or if the grandchild’s grandmother qualifies as a qualifying relative, the taxpayer can potentially file as Head of Household.

- Based on the information provided, it seems likely that the taxpayer qualifies for HOH status.

- However, it’s essential to verify all details and consult with a tax professional to ensure accurate filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

I think the taxpayer can claim the girlfriend as a dependent. Social Security doesn't count towards income limit. But has to be a blood relative to claim Head of Household .

Here's a FAQ for Head of Household

https://ttlc.intuit.com/community/family/help/do-i-qualify-for-head-of-household/00/25539

Who is a qualifying person for Head of Household

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

The grandchild misses the first condition, it's not your child.

- Your child (including legally adopted), stepchild, foster child, sibling, half-sibling, step-sibling, or a descendant of any of them (for example, your grandchild or niece) AND

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

Qualifying Child: - A qualifying child must meet specific conditions: - Relationship: The grandchild must be the taxpayer’s child (including legally adopted), stepchild, foster child, sibling, half-sibling, step-sibling, or a descendant (e.g., grandchild or niece). - Age: The grandchild must be either: - Permanently and totally disabled, OR - Under the age of 19 as of December 31, 2023 (or under 24 if a full-time student) and younger than the taxpayer (or the taxpayer’s spouse if filing jointly). - Residency: The grandchild must have lived with the taxpayer for more than half the year. - Marital Status: If the grandchild is married, the taxpayer would need to qualify to claim them as a dependent (even if not claiming them as such).

b. Qualifying Relative: - A qualifying relative can also be considered for Head of Household: - The grandchild’s grandmother fits this category. - The grandchild’s grandmother must: - Have lived with the taxpayer for more than half the year. - Be someone the taxpayer can claim as a dependent (even if not claiming them as such).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

No. The grandmother doesn't qualify either. They only qualify as dependents. They have to be related to the taxpayer. Head of Household has stricter rules. Read the links I posted. I have a hard time reading your posts and trying to understand what you are pointing out as qualifying.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

See IRS Pub 501 page 10 for qualifying person.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

No. The important relationship is between the qualifying person and the taxpayer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

Neither "taxpayer"'s GF or her grandchild can be qualified dependent for Head of Household because neither of them is related to the taxpayer. They might be dependents for the $500 credit for other dependents, but that is all. No Head of Household filing status, no earned income credit, no childcare credit, no child tax credit for the grandchild who is not biologically related to the taxpayer.

Sorry---You cannot override tax laws.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

But what about the qualifying Relative sections below #2 and scenerio b? And the Conclusion #5?

Qualifying Person for HOH:

- To qualify for Head of Household, the taxpayer must have a qualifying person.

- The grandchild could potentially be the qualifying person if they meet the criteria.

Qualifying Child vs. Qualifying Relative:

- For Head of Household, a qualifying child is one option, but there’s also another possibility: a qualifying relative.

- Let’s explore both scenarios:

a. Qualifying Child: - A qualifying child must meet specific conditions: - Relationship: The grandchild must be the taxpayer’s child (including legally adopted), stepchild, foster child, sibling, half-sibling, step-sibling, or a descendant (e.g., grandchild or niece). - Age: The grandchild must be either: - Permanently and totally disabled, OR - Under the age of 19 as of December 31, 2023 (or under 24 if a full-time student) and younger than the taxpayer (or the taxpayer’s spouse if filing jointly). - Residency: The grandchild must have lived with the taxpayer for more than half the year. - Marital Status: If the grandchild is married, the taxpayer would need to qualify to claim them as a dependent (even if not claiming them as such).

b. Qualifying Relative: - A qualifying relative can also be considered for Head of Household: - The grandchild’s grandmother fits this category. - The grandchild’s grandmother must: - Have lived with the taxpayer for more than half the year. - Be someone the taxpayer can claim as a dependent (even if not claiming them as such).

Financial Support and Home Maintenance:

- The taxpayer provides more than half of the grandchild’s financial support.

- The taxpayer maintains the cost of the home where they all live.

Parents’ Involvement:

- The fact that the grandchild’s parents are not involved in the grandchild’s life and do not file tax returns does not impact the taxpayer’s eligibility for HOH status.

Conclusion:

- If the grandchild meets the criteria for a qualifying child or if the grandchild’s grandmother qualifies as a qualifying relative, the taxpayer can potentially file as Head of Household.

- Based on the information provided, it seems likely that the taxpayer qualifies for HOH status.

- However, it’s essential to verify all details and consult with a tax professional to ensure accurate filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

Again, the grandchild has to be related to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

head of household questions

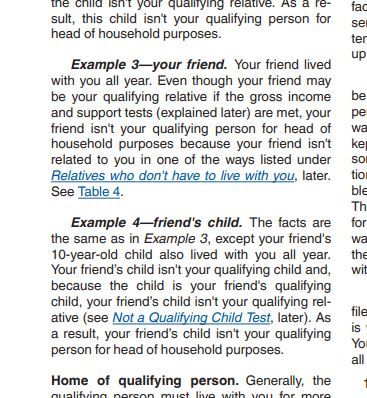

See IRS pub 501 page 9 Qualifying Person examples 3&4 and the chart on page 10

https://www.irs.gov/pub/irs-pdf/p501.pdf

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

willkills

New Member

Gizlua

Level 1

lettersnumbersdashesaunderscores

Level 1

szettellan1

Returning Member