- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

This error code means that the IRS rejected your return because a dependent listed has filed their own return without indicating they would be claimed as a dependent.

A dependent's Social Security number (SSN) cannot be used on two separate tax returns.

If you are claiming more than one dependent, review and look for a number in brackets to indicate which dependent is causing the issue. For example: "[2]" will refer to the second dependent from the top.

Verify all dependent information is accurate and correct any misspellings, omissions, or transpositions. Make sure their SSN is correct. If all of these are correct and you want to file this return electronically, you cannot claim them on this return.

To keep the dependent on this return, you need to print and file your return by mail.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

Another possibility is that someone else--maybe even accidentally --- used your child's SSN on a tax return. Once the SSN is in the system, no one else can e-file using it. You will have to print, sign and mail your own return to claim your daughter and let the IRS sort out the duplicate use of the SSN.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Federal and state returns must be in separate envelopes and they are mailed to different addresses. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

Okay, so with this other possibility of someone else mistakenly using my daughter's SSN..

She filed for her tax return (she worked while being a full-time student) - and she got her tax refund already in March. So doesn't that mean exclude the possibility that there is someone else using her SSN, since THAT application would have been rejected?

None of this is making sense... please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

Sorry, but could you clarify what the following sentence means?

" If all of these are correct and you want to file this return electronically, you cannot claim them on this return. "

So this sentence seems to be saying: if you verify that everything is already correct, and you want to file this return electronically, then I have go back and remove my dependents (and therefore make the information INcorrect).. Is that what you're saying? Or is this sentence basically saying: if everything is correct, then you cannot file this return electronically..?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

No. If your daughter correctly indicated on her own return that she can be claimed as a dependent, that does not block someone else from claiming her and e-filing. Have you looked at her Form 1040 to make extra sure that the box for someone can claim her has an "x" in it? If there is an "x" there then it is still possible for someone else to e-file with her SSN on their return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

Thank you, xmasbaby0

I haven't snail-mailed tax returns in over 15 years, so I am asking:

Do I need to also mail in all the receipts for donations and such? Turbotax ended up just giving me the standard deduction, but still there are all these itemized deduction worksheets that I had to work through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

You will want to sort out if your child made a mistake---it is very common---but whether she did or did not make a mistake----your only recourse now to file and claim her as a dependent is to file by mail. You cannot defeat a duplicate use of an SSN once it is in the system.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

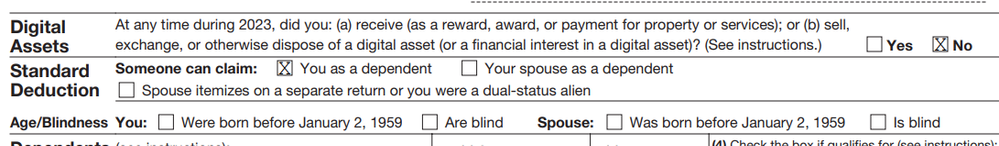

Yes, she sent me a screenshot of the form she filled out, and it has that "X" on that checkbox that someone can claim her as a dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

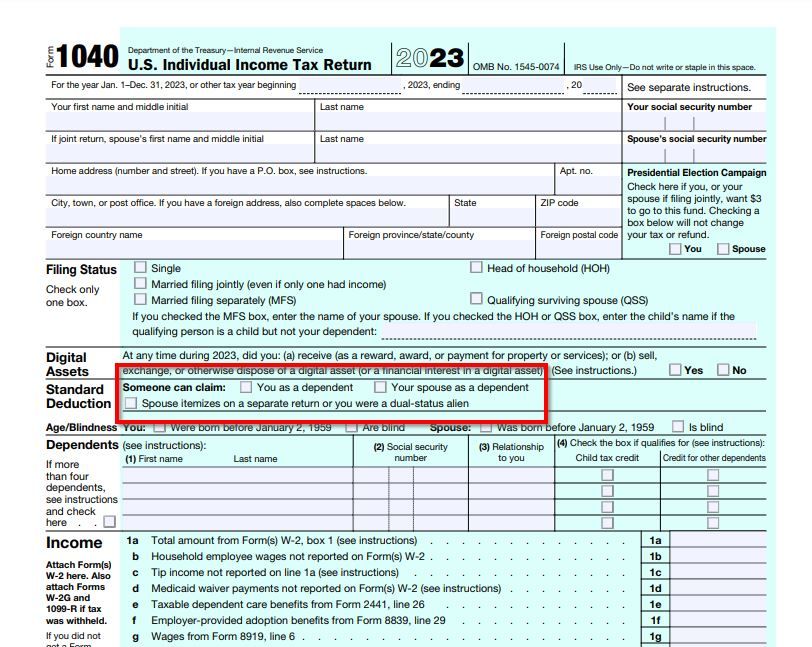

Have you looked at her actual return? Here's a screen shot. And yes the sentence means both....you can efile if you remove the dependent or have to mail to leave in the dependent. Once a ssn has been filed and entered into the IRS you can't efile it again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

Yup,

This is from her PDF.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

Yes---she did it correctly. But someone---somewhere -- put her SSN into the system. You have to file by mail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

Just a thought......Could she have checked that box AFTER she filed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

Interesting theory..

But she filed using freetaxusa.com, and this is the pdf that it spit out upon submitting online, so unless my daughter is playing an elaborate trick on me for no apparent reason, I don't think she would edit this pdf after she filed. But I guess I don't understand the random humor of Gen Z.. 😓

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got rejection IND-517-01, meaning my dependent didn't indicate herself as dependent. But verified that she DID indicate herself as dependent. What can be done?

Hi, I have the exact same issue; I filed my dependents return for him and the box indicating he can still be claimed as a dependent was correctly marked and indicated. To the OPs question, if I'm getting a rejection on my taxes, wouldn't that also mean that any one else (intentionally or erroneously) trying to use their SSN to would be rejected as well? I submitted his return 10 min before submitting mine, could the order of submission be an issue? This is his 3rd year filing and we've never had this issue before with e-filing. Thank you in advance for any clarity you can provide!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

AlexSagrat

Level 2

maryjin2003

New Member

lilredwomen2006

New Member

willkills

New Member

casraecav

New Member