- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- FTC for Passive Income -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FTC for Passive Income -

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FTC for Passive Income -

You will need to manually make adjustments in the foreign tax screens to get where you need to be first check "none of these apply" on the screen Tell Us About Your Foreign Taxes

Continue through the "No Other Income or Expenses" screen and select NO.

On the Screen Choose the Income Type choose Passive Income.

On the next screen select "Add a Country" if necessary (Germany may already be showing in which case, just click Done (or Continue) here.)

If all of the income is already entered from 1099s, leave the Other Gross Income - Germany screen blank.

Continue through the to the Foreign Taxes Paid - Germany section and enter the taxes not already accounted for in the section Foreign Taxes on Other Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FTC for Passive Income -

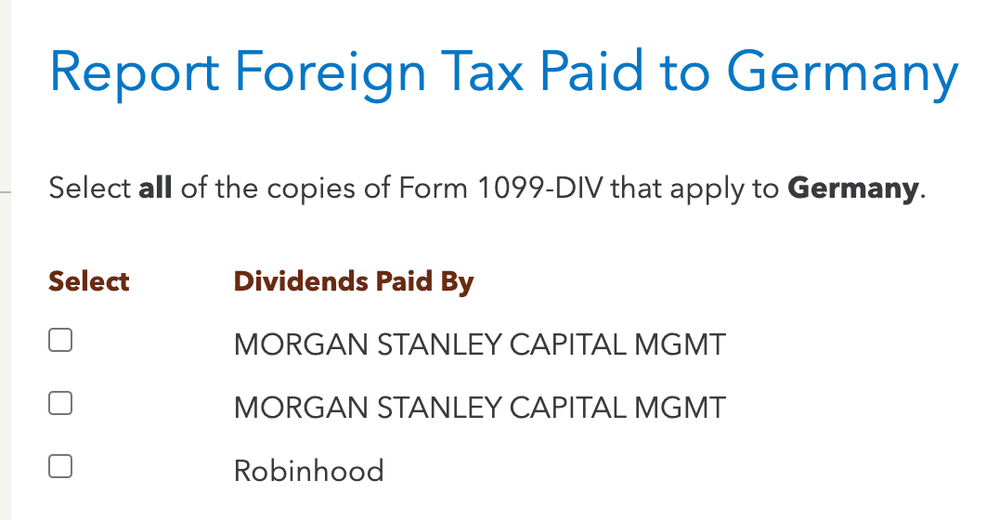

Let me illustrate with an image. When I get to this screen, it lists only SOME of my 1099s. Specifically, it lists only those which had "foreign taxes paid" marked in the official 1099 form. However, this is just a subset of the 1099s I received.

I need to be able to add ALL 1099s to be associated with Germany.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FTC for Passive Income -

Yes, only the 1099-Div's with Foreign Tax on them will transfer over to the Foreign Tax Credit section. You will need to enter the amount of Foreign Income associated with these.

Then continue in the FTC section until you come to a screen where you can indicate you have more Foreign Income to report and choose 'Passive Income'. Add up the the total amount of Foreign Income you were taxed on by Germany on your 1099-Div's (other than what you already entered), and enter that amount.

Continue, and enter the total amount of Foreign Tax paid on this income.

Here's more info on Claiming the Foreign Tax Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

howjltx

Level 3

user17645583867

Level 2

alder1321

Returning Member

datarmd

Level 2

dac10012

Returning Member