- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 8822-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

Turbo tax says I cannot file until for 8822-B (change of address of a business is available.) So I signed up to receive an email when the form is available. I got and email saying the form is available and I could file but when I go to Turbo tax it still says that I cannot file.

What gives!!! This appears this is some bad software your emails are notifying me that the form 8822 - B is available and I can file. However, Turbo tax software does not let me file! The message is "Cannnot E-File"

What is going on here?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

Although the form is now available in TurboTax, the e-file form is unsupported. In this case, the form must be printed and you'll need to mail your return. Refer to the Federal Individual Forms Availability list.

Source: IRS forms availability table for TurboTax individu ...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

I'm having the same issue. What are we supposed to do? Delete the form so you can efile? And just mail it ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

@DaraLO any updates here?

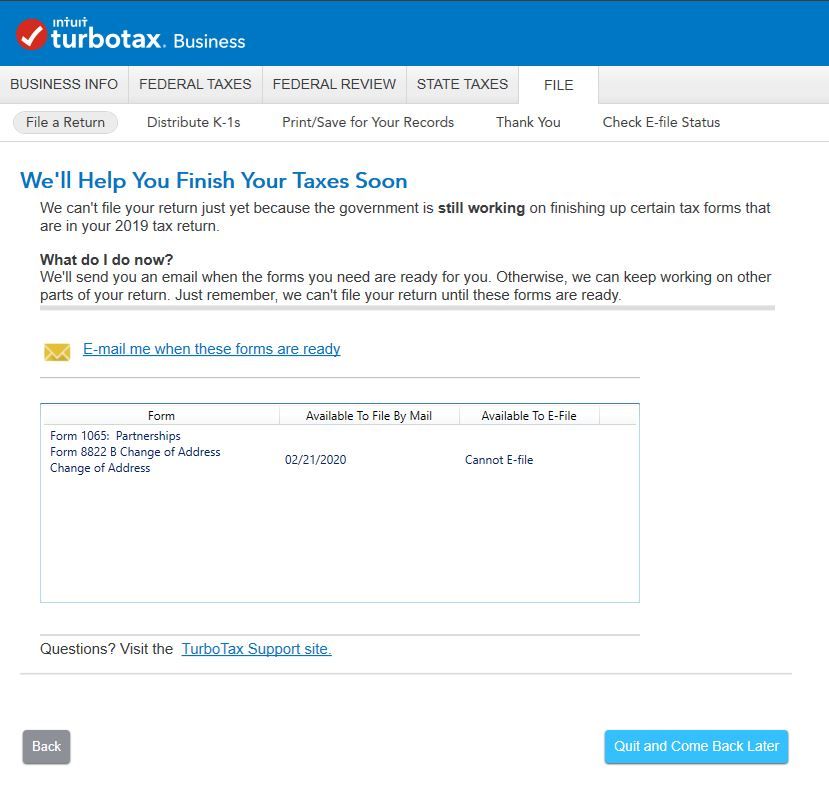

Trying to finish filing taxes for my business and not able too because turbotax business 2019 is stating I need to wait for the 8822-B to be ready. I have already filed this when my business moved so it is not even necessary to mail this in.

In the app it says it will be available 02/21, Lovley how this blocks from progressing further with filing. Based on this the window to file is now 3 weeks till the IRS deadline.

Your website via the link below states 02/14 the form will be ready.

Why is this blocking me, is there a work around? Why does the app state something separate from your website?

I subscribed to the email and received an email the forms are ready, log back in and still the same, clearly there is a defect in some of your programs logic, making me think about moving away from using TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

I would suggest you mail it. Per our updates, if you e-file, this form is not supported. You are recommended to print it out and submit along with other tax forms.

@pmoreira

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

I don't have a problem mailing the form and understand it can not be efiled. Mailing is irreverent in my situation as I sent Form 8822B to the IRS a week after relocating my business 9 months or so ago. The problem is this completely blocks from progressing to file via efile or mail the forms in.

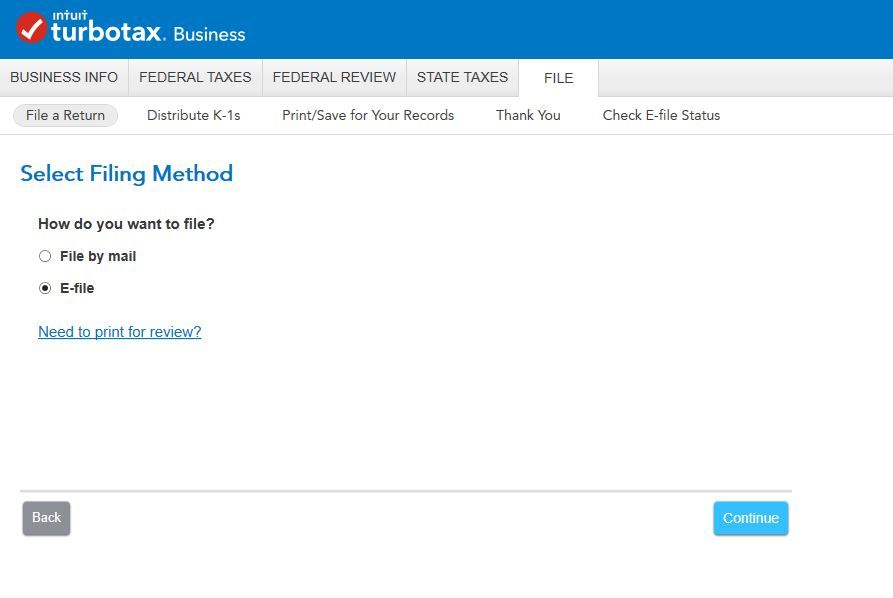

When walking through the workflow I encounter the following(Screenshots Attached)

When navigating to File a return and selecting a filing method, file by mail and efile both result in a blockage due to the change of address form.

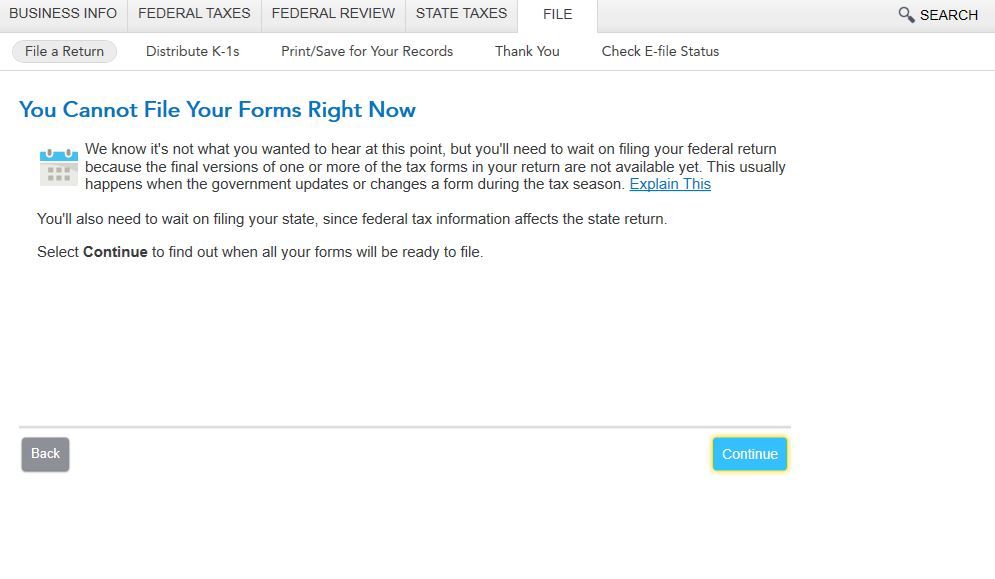

After clicking either option it comes up to a "You Cannot File Your Forms Right Now" page which navigates you to a page that says "We'll Help You Finish Your Taxes Soon"

I can not figure out how I can progress to file as the only option i have is "Quit and Come Back Later"

Is there any way to get around this without waiting until this form is ready in turbotax? Pretty frustrating to be blocked by something as simple as a change of address form. This is the 4th weekend in a row I've tried to finish taxes and still am not able too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

That particular form does not need to be filed from within the software. Per the IRS instructions, that form can also be signed and mailed directly to the IRS.

Here is a link to the addresses and the form on IRS.gov: Form 8822-B

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

No kidding, we get that part. The problem everyone is facing is that we can't get the program to let us FILE. We did our part, now fix your software so we can get what we paid for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

This is ridiculous. I went to irs.gov, printed the form, completed the form, signed and mailed weeks ago when I simply changed the company mailing address. After making the necessary changes to the information transferred from last years return with TurboTax, I completed the return, however, when ready to file, the program said I could not e-file because the Form 8822 B was still being worked on. This is not true, as I already completed and filed the form by mail. It is not an IRS problem, but a TurboTax issue. I've received two emails telling me the form is ready, to log back in, update and they will walk me through the form. The program is up to date, yet I am still getting the same message refusing to allow me to e-file. I have wasted over two weeks trying to file my return. TurboTax needs to resolve this issue ASAP. I have used the TurboTax program for years, but am now considering switching to another tax program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

Seems a lot of us are having the same issue. It will be very helpful if at least intuit support can help us bypass the form requirement so that we can file our taxes soon.

From the comments it seems everyone understands the requirement of having to mail the form, but the main problem still persists, which is the fact that the SW doesn't allow us to proceed and efile just the taxes without the 8822 form even after receiving the confirmation email that the form is ready.

@DaraLO please help and clarify how to proceed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

I went to irs.gov, printed the form 8822 and form 8822-B, completed, signed and mailed the forms a while ago when I had an address change for both personal and business. TurboTax instructed me to do the same thing after importing last years information and then editing my address. However, when I completed my return, at first the program said the form was not ready, but I received an email saying it was ready, which I knew because I had already completed the form. Then TurboTax said the form was not compatible and still would not let me e-file. I called support and explained how the Form 8822-B was preventing me from filing my return even though the form is not required or even suppose to be filed with the return. The solution I was given was to go out of step-by-step to forms, scroll down to Form 8822-B which had a yellow exclamation point (!) next to it and delete the form. With the representative on the phone, I followed her instructions, deleted the form, went back to the review, re-ran the check for errors and then continued to follow the step by step instructions, the message that I couldn’t e-file was no longer there and I was able to continue on and e-file the return. I had to actually call and speak to a representative and even that took some explaining to about the problem but we came to the conclusion that if it’s a form that is mailed separate from the return the problem could be solved by simply deleting the form. It’s a valiant effort on the part of TurboTax to let you know that the IRS requires the form for change of address and that it must be printed and mailed separately, but the program will not let you e-file until you manually go to the list of forms and delete it yourself. I couldn’t wait any longer for TurboTax to fix their own problem!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

Switch from step-by-step to forms (Upper right menu bar) . Scroll down your list of forms until you get to Form 2288-B (It will have an exclamation point next to it). Highlight the form and delete it. After that you will no longer get the message and can continue on to e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

I followed these steps and deleted the form, and I was able to e-file!

Thanks for the tip!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8822-B

Got it! After deleting the form I was able to file.

Thanks for the info.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

britishsteele

New Member

allymia

New Member

watergirl2

Level 4

Anonymous

Not applicable

KSK

Level 2