- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- form 8606

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 8606

Hi. I have a question about taxes that I filed for 2021 year.

In 2020 I contributed to trad IRA $6000 (maximum allowed IRS limit) as after tax money and bought some ETF with this. I used form 8606 to report them as nondeductible contributions.

In 2021 I sold those ETF on tad IRA and got $5986. So it was loss of $14. Now I added additional $6000 (maximum allowed IRS limit) as after tax money to trad IRA. So in total it my trad IRA had $11,986. All those funds are after tax money. Now I transferred those funds to Roth IRA.

I got following tax forms for 2021:

1 Gross distribution: $11,986

Taxable amount not determined: X

Total distribution: X

7 Distribution Code: 2

IRA/SEP/SIMPLE: X

All other filed are empty

and also I got form 5498 for IRA contributions.

1.IRA contributions: $6,000.00

I used tax software and here is form 8606 that was generated:

1. 6,000.

2. 6,000.

3. 12,000.

5. 12,000.

13. 11,986.

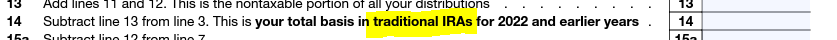

14. 14.

16. 11,986.

17. 11,986.

21. 0

My concern is about line 14. It looks like it says that I had $14 in my account after trad IRA to roth IRA transfer but it is not correct because $11,986 is total amount of money that was in account. $14 is just loss from investment.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 8606

Line 14 is your basis in traditional IRA's at end of year. Since you transferred all of your traditional IRA money to the ROTH IRA, your basis in the traditional IRA would be minimal.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Section108

Level 1

moses0020

Level 2

michelleb193

Level 1

dpreas2017

Level 3

bobw75087

Level 2