- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 2555 Covid-19 Physical Presence Test Changes (Rev. Proc. 2020-27)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 Covid-19 Physical Presence Test Changes (Rev. Proc. 2020-27)

Hey guys,

The IRS recently posted Rev. Proc. 2020-27 which changes how they will handle the Form 2555 Physical Presence Test (IRC 911(d)(4) , 330 Days in 12 Month Period).

For us folks who had to come home early due to Covid-19, this means we can still claim the Foreign Earned Income Exclusion if we were reasonably going to be there for the 330 days.

PDF of Form 2555 Covid-19 Changes

In my case, I arrived in the UK on September 18th, 2019, and had a 1-year employment contract which was going to end on November 4th, 2020.

When Covid-19 hit the streets, we came home early to the USA on March 22nd, 2020.

TurboTax, however, won't accept anything less than 330 days for the Form 2555 entries, and also will not let me enter anything manually into the Form before filing, in order to explain the circumstances.

Is TurboTax planning to include this update into Form 2555 in the Online edition of the software to handle the new Revenue Procedures?

Else, are there any work-arounds, or am I going to have to fill out the forms by hand and mail them?

Thanks everyone, and I hope this post helps someone else who's stuck in the same situation as I am!

-Ben

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 Covid-19 Physical Presence Test Changes (Rev. Proc. 2020-27)

We are stuck too, we qualify for the 2555 exclusion but can’t enter the actual dates cause it keep erroring at the very final step of the electronic filing after we paid to file . Do you know is turbo tax going to fix this so it enters the required information on the top of the form 2555 per the IRS and then allows the electronic submission of the taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 Covid-19 Physical Presence Test Changes (Rev. Proc. 2020-27)

We are stuck too, we qualify for the 2555 exclusion but can’t enter the actual dates cause it keep erroring at the very final step of the electronic filing after we paid to file . Do you know is turbo tax going to fix this so it enters the required information on the top of the form 2555 per the IRS and then allows the electronic submission of the taxes? And we don’t want to mail in if at all possible

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 Covid-19 Physical Presence Test Changes (Rev. Proc. 2020-27)

You should be able to go back into your return in both TurboTax online and TurboTax Desktop and answer I reasonably expected to meet the Physical Presence Test but failed to do so due to the COVID-19 emergency.

Enter your actual dates of presence on the next screen. If you get a pop-up saying you need a waiver to qualify, enter Revenue Procedure 2020-27. You will then qualify for the FEIE.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 Covid-19 Physical Presence Test Changes (Rev. Proc. 2020-27)

it still errors and wont let me electronically file, how do i get this to work, THis is crap if I have to mail it in just to write per Rev.Proc. 2020-27 across the top of the form 2555

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 Covid-19 Physical Presence Test Changes (Rev. Proc. 2020-27)

Did you come across the screen about the Covid Emergency under "Foreign Earned income section"? Here are the steps:

In TurboTax online,

- After sign into your account, select Pick up where you left off

- At the right upper corner, in the search box, type in foreign income and Enter

- Select Jump to foreign income

- Follow prompts

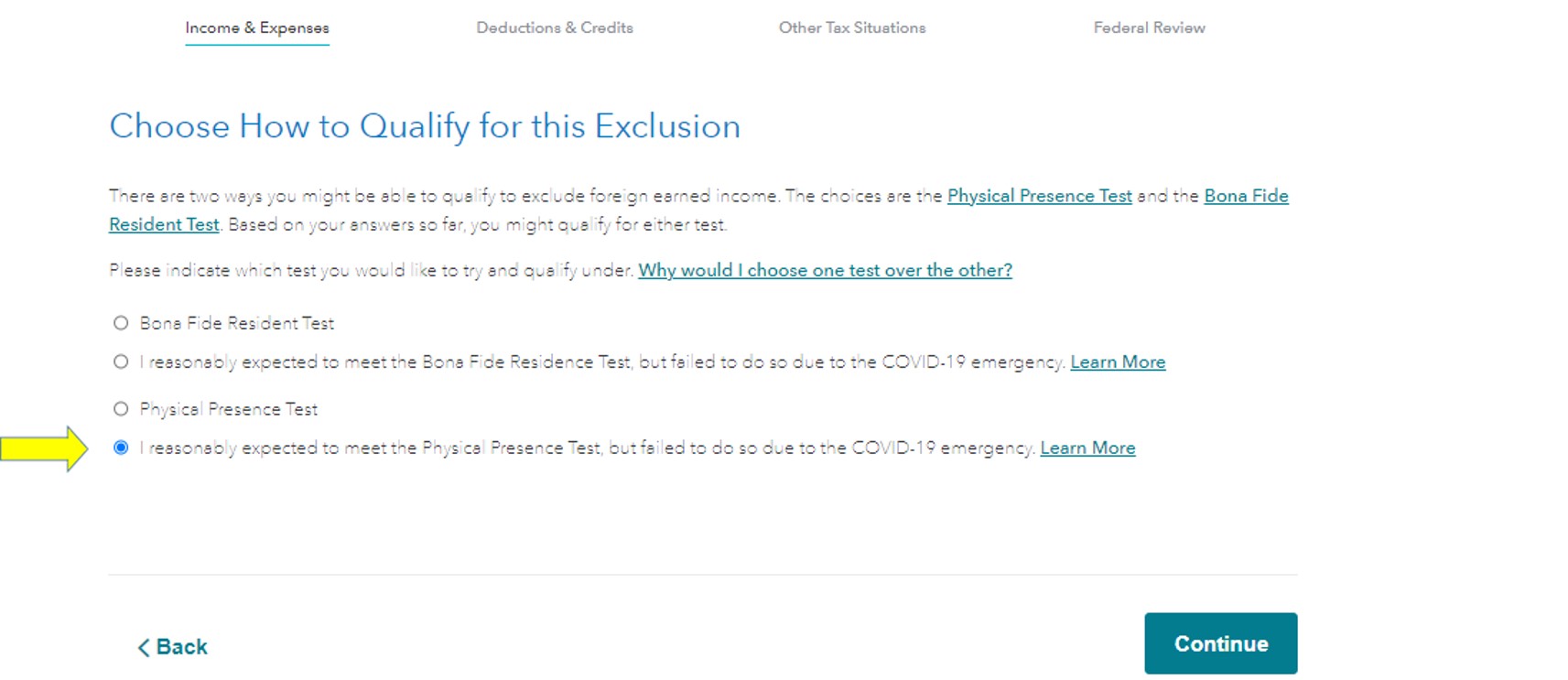

- On screen, "Choose How to Qualify for this Exclusion", select the last option. See image below.

- Next screen" Choose Your Qualifying 12 Month Period", you will enter 9/18/2019- 9/17/2020 ( This is asking for start and end date of the 12 month period, not when you left UK)

When you look at page 1 of your Form 2555, the Covid-19 Emergency Relief box should be checked. This notifies IRS you are taking the relief treatment to claim this exclusion. See image below.

Due to the global health emergency caused by the COVID-19 pandemic, the IRS is providing a waiver of the time requirements that allow a qualified individual to exclude foreign income and the housing amount from income. For details, see https://www.irs.gov/forms-pubs/covid-19-relief-for-form-2555-filers

Therefore, if you left UK between February 1 and July 15, 2020, you should qualify for the exclusion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Vern24434

New Member

shil3971

New Member

rroop1

New Member

alainncat

Level 2

dejwal

New Member