- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- form 1065 and Amended tax question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1065 and Amended tax question

I finally received my form 1065 yesterday.

Because I owed money and needed to file a form 2210, I filed my taxes in April so as to avoid any further interest penalties, with a "best guess" as to what would be on the 1065. Of course it wasn't quite accurate -- fortunately I guessed high so I should get a refund on the amended return. My guess was high enough so that TurboTax says I'll get a $162 refund, so of course I'll file it.

That said, I have questions:

1) the form 1065 has both box 1 and box 2 checked. I believe that means I have to separate it in to two forms in Turbo Tax, correct? There is also a statement for Box 20 Z. Should I logically put the "Rental Real Estate Income" in the box 2 form and the rest in the box 1 form, or does it even matter?

2) This is "income attributable to another state" in my Michigan state return, so essentially a no-op for state. HOWEVER, the updated 1065 does marginally lower my AGI (the out of state income is lower by the same amount). Due to how Michigan does taxes, this ends up lowering my tax burden by $3. But, when I go to the form for the Amended Michigan Return, for which I also did MI-2210, there is an entry for "Payment with Original Return" with "NOTE: Do not include penalties or interest." So when I bring it up in TurboTax, is shows me owing $119 -- the original form 2210 $122 penalty, minus the $3 I just referenced. How and where do I make the update to show that I already paid the $122? I literally see no place to put that in -- there's "payment with original return" and "overpayment from original return," and this is neither, it's the form 2210 amount. Or, do I just skip doing a Michigan Amended Return altogether? This could conceivably cause an issue next year, I suppose, since the 2024 Federal AGI is changing.

Thanks for any help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1065 and Amended tax question

In regards to the K-1 information, as long as you have entered all of the information, it will match what was reported to the IRS and should not be an issue.

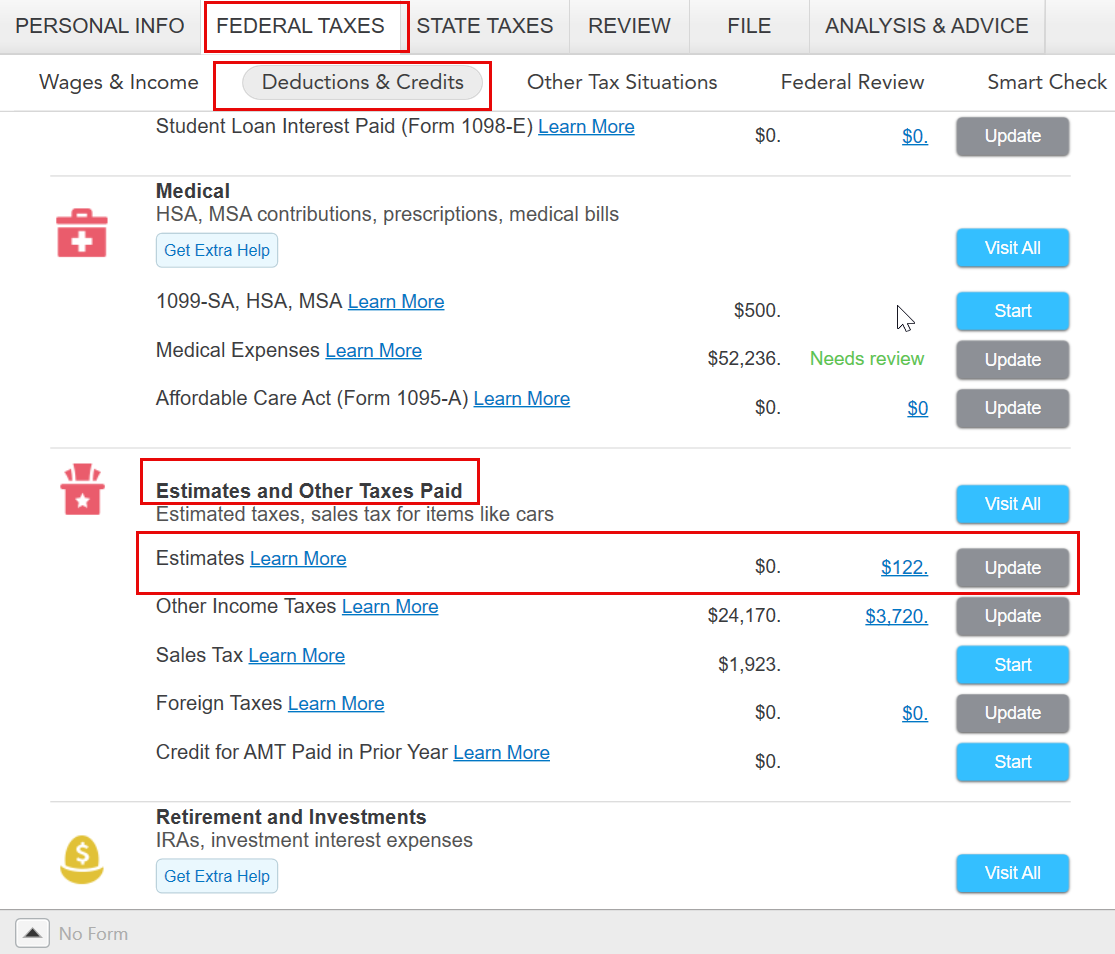

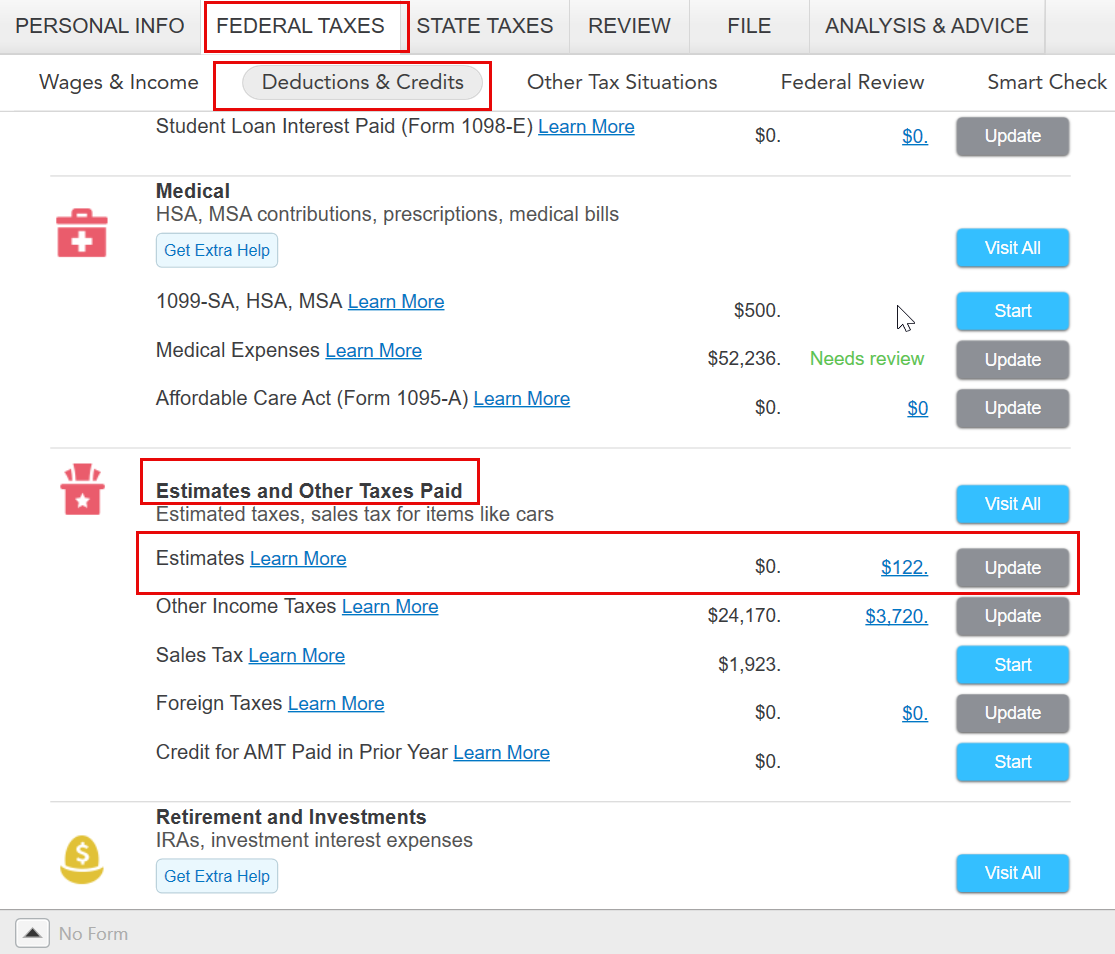

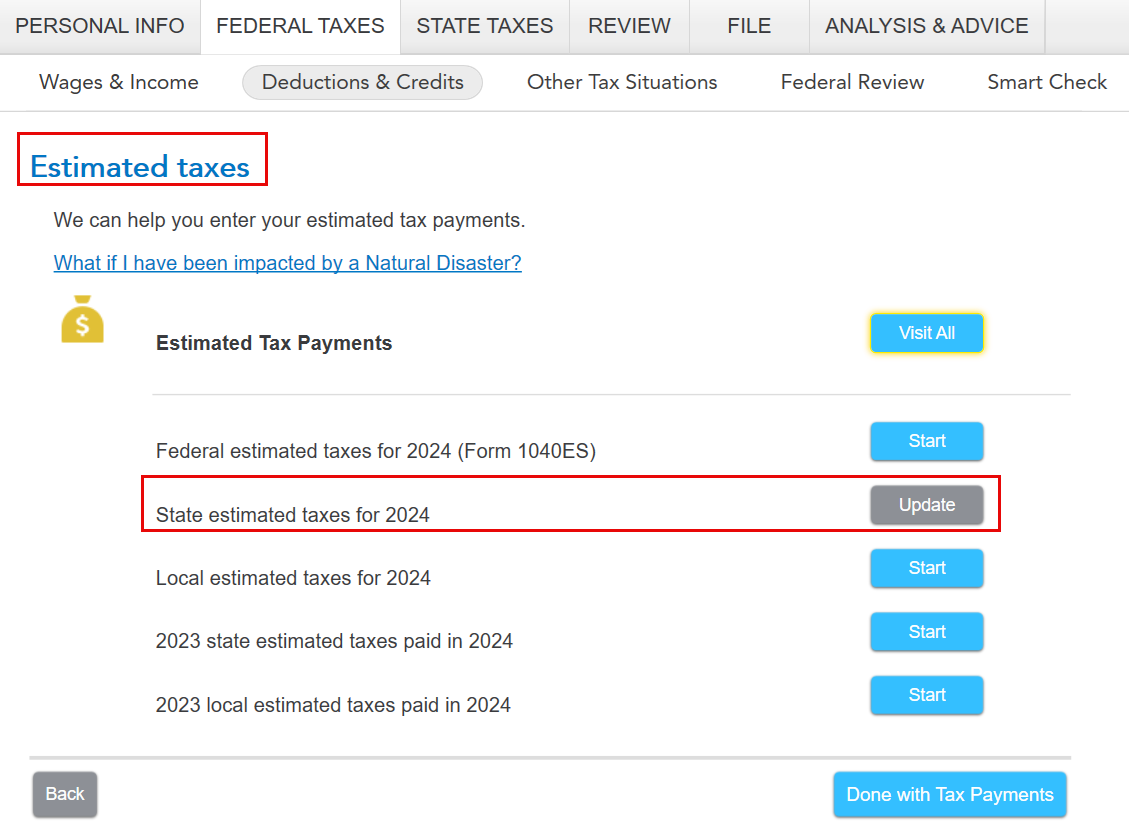

For the payment to Michigan, you can enter the amount actually paid in the federal interview section of the program under Deductions & Credits. Scroll down to the section titled Estimates and Other Taxes Paid and select start/update to the right of Estimates.

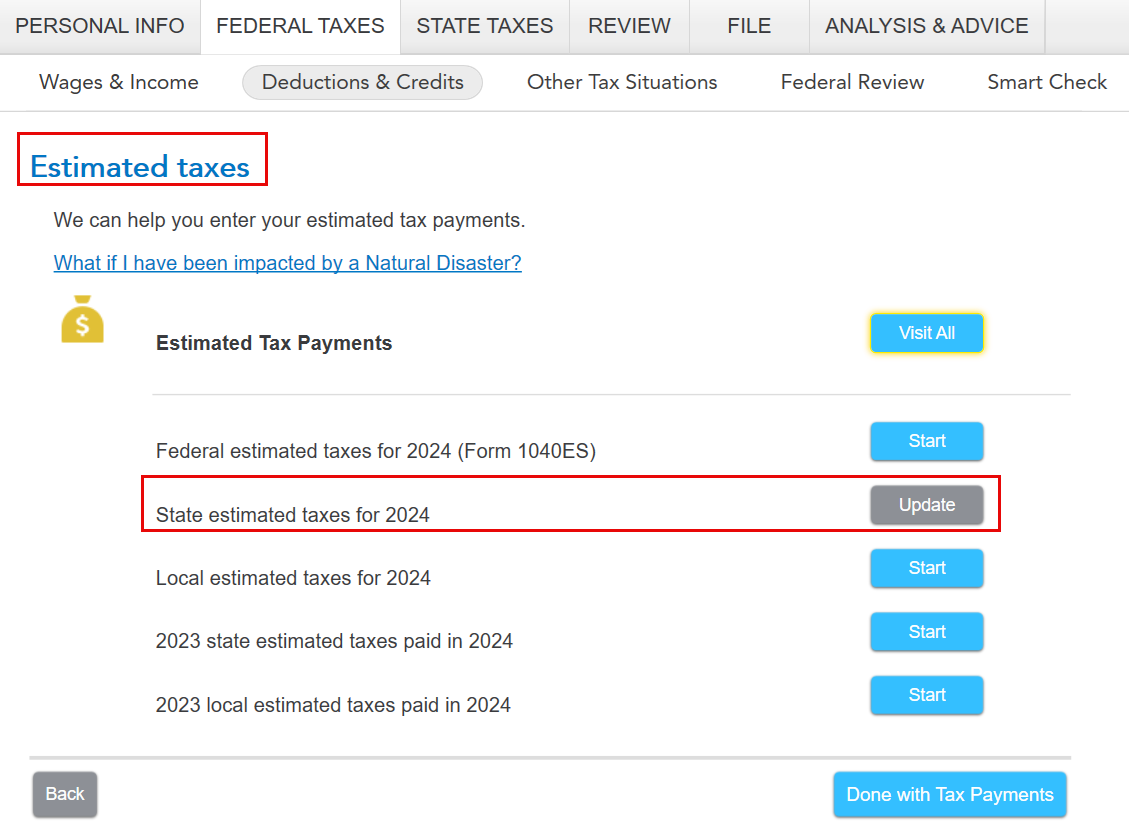

You will then see a screen titled "Estimated taxes." Select start/update to the right of State estimated taxes for 2024.

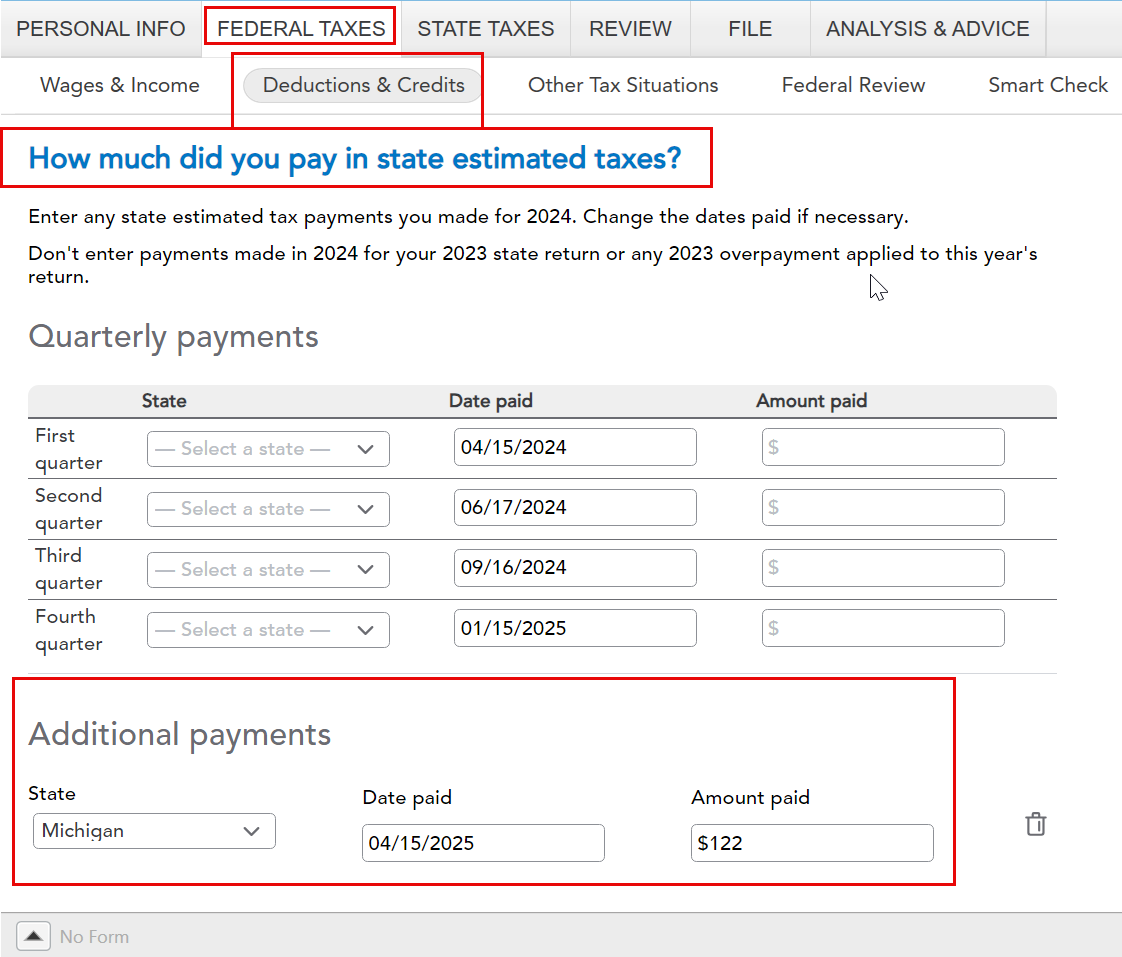

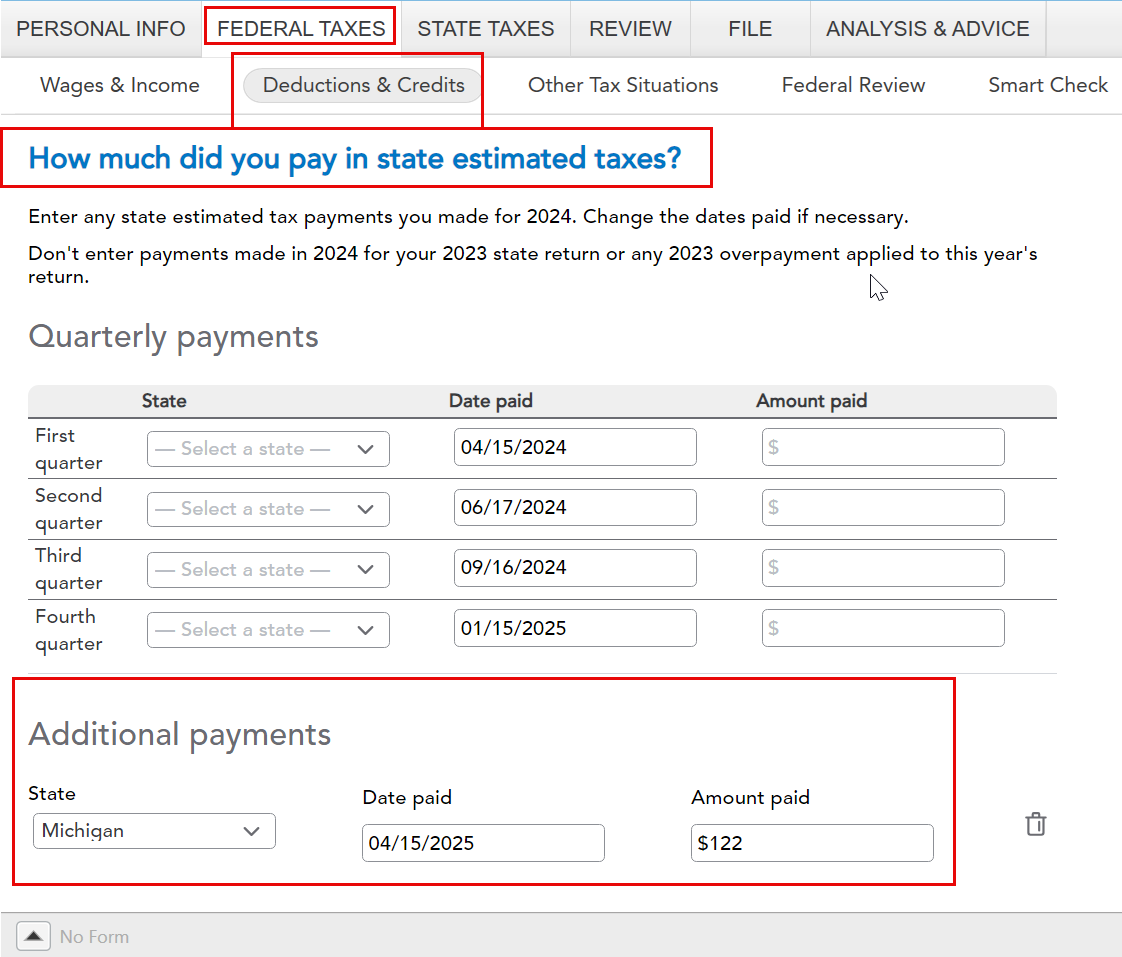

On the next screen titled "How much did you pay in state estimated taxes," scroll down to the section titled Additional payments. Enter the portion for the interest and penalties previously paid here. This will carry over to your amended return as a payment and reflect the total amount paid with your original return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1065 and Amended tax question

Yes, you will need to enter it as if it were two separate K-1 forms. On one K-1, you will enter the business activity and on the other, you will enter the rental activity. As for box 20, code Z, this is for qualified business income so it would most likely be related to the business income as reported on line 1. Therefore, you should report it to match the entries for box 1.

As far as your Michigan amended return, can you clarify what is happening? Was the entire amount you paid with your original state return comprised completely of penalties? Essentially, if your Michigan return has changed, you should still file the amended return.

Essentially, the amount to be entered on the page asking for payment should only be the total tax paid without interest and penalty payments.

Since you have already paid a portion of the penalty, another option is to let Michigan bill you for any remaining underpayment penalty. You will find this option in the Other tax situations, Underpayment of Estimated Tax in the state interview screens.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1065 and Amended tax question

Hi,

Thanks for the reply.

For the Federal, I'm putting the things from line 20 that look like they belong with Box 1 in the first 1065, and the things that look like they belong with box 2 (the real estate income) in the 2nd 1065. So far as I can determine, it doesn't make any difference wrt the overall refund where I put the box 20 items, so I think I'm good there. I'm just a bit concerned that box 20 has categories A, N and Z, and the Z is a statement. I think I have it correct, though.

AS FOR MICHIGAN:

When I originally paid, my taxes due were $1059, plus a $122 penalty on form 2210.

Now, when I go to the Amended return, the total tax is $3 less -- even though the adjustment is all for out of state income, I guess the change to AGI had a slight impact.

BUT... on the form, it says only to include the original amount I paid in April, without the penalty, that is $1059. So TurboTax immediately says I owe $119. But I already paid $122, so I should just be getting $3 back.

I see nowhere to note that I've paid that money.

The form says "payment with original return" with a note "do not include penalties or interest." So I can't put the $122 penalty from April there.

There's another line for "overpayment with original return" but I don't think the original penalties apply to that. I might be wrong about that?

That is, I don't want Michigan to bill me; I've already paid. Since my taxes are going down with the amended return, there should be no additional penalty nor interest. I've paid the entirety of the penalty already, and don't want to be sending any more money (I can't do that electronically, anyway, in an amended return, and also, I already paid it).

Technically, they owe me $3 now, but I can't figure out how or where to enter the $122 penalty that I paid them -- and that they cashed -- back in April.

The wasn't a problem with the Federal amended return in Turbo Tax, which immediately took in to account the federal form 2210 money that I had paid.

Thanks in advance for any help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1065 and Amended tax question

In regards to the K-1 information, as long as you have entered all of the information, it will match what was reported to the IRS and should not be an issue.

For the payment to Michigan, you can enter the amount actually paid in the federal interview section of the program under Deductions & Credits. Scroll down to the section titled Estimates and Other Taxes Paid and select start/update to the right of Estimates.

You will then see a screen titled "Estimated taxes." Select start/update to the right of State estimated taxes for 2024.

On the next screen titled "How much did you pay in state estimated taxes," scroll down to the section titled Additional payments. Enter the portion for the interest and penalties previously paid here. This will carry over to your amended return as a payment and reflect the total amount paid with your original return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1065 and Amended tax question

Wow, that was a GREAT reply! Thank you so much!

I had called the State of Michigan, and the person, after initially telling me to put the $122 on line 32c of the Michigan Amended return -- which I knew had to be wrong since that's exactly the line where it says "don't include interest or penalties" -- advised me to WRITE A LETTER (not even email -- on PAPER!!!) to Michigan Department of Treasury asking them to return the $122 so I wouldn't have to pay it twice! I knew it had to be there somewhere, but I never would have found it without your help.

Question: Now that I put that in there, line by line by your instructions, now it shows a refund of $66, which is $63 more than I expected. I'm not sure I understand that -- is it possibly because the impact to my AGI, though entirely for out of state income, impacted the basis for the form 2210 numbers? I see that the penalty amount went from $104 to $41, so for sure that's where it is, I guess I'm just surprised by it as the entirety to the adjustment was for out-of-state income.

Thanks again for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1065 and Amended tax question

Unfortunately, since this is a public forum, there's no real way to determine if that is correct. I'd recommend reviewing your return as originally filed to the amended return to determine if there was a reduction in the overall state tax due. It sounds like your overall tax due went down, which would explain the reduction in the underpayment penalty as less was actually due with the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

form 1065 and Amended tax question

Thanks.

The AGI did go down. Because I knew I was going to pay a penalty in April and that was going to carry interest, I opted to estimate an amount for the 1065 that was the most it could be -- essentially the amount of money I received on it, and I called it all box 1 with no associated expenses.

It turned out that the K-1 did show expenses, and when combined with how the money was distributed, my AGR went down by by $266. I did not expect that to have the impact it seems to have had -- $162 on the Federal return and $66 on the state return. On the state return, the penalty portion is responsible for $63 of the $66 (from $104 to $41), but on the Federal return it only appears to have gone down by $6. So it's still a little weird to me.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

matto1

Level 2

matto1

Level 2

MinouCali

Level 2

CRAM5

Level 2

jnstevenson

Returning Member