- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

In regards to the K-1 information, as long as you have entered all of the information, it will match what was reported to the IRS and should not be an issue.

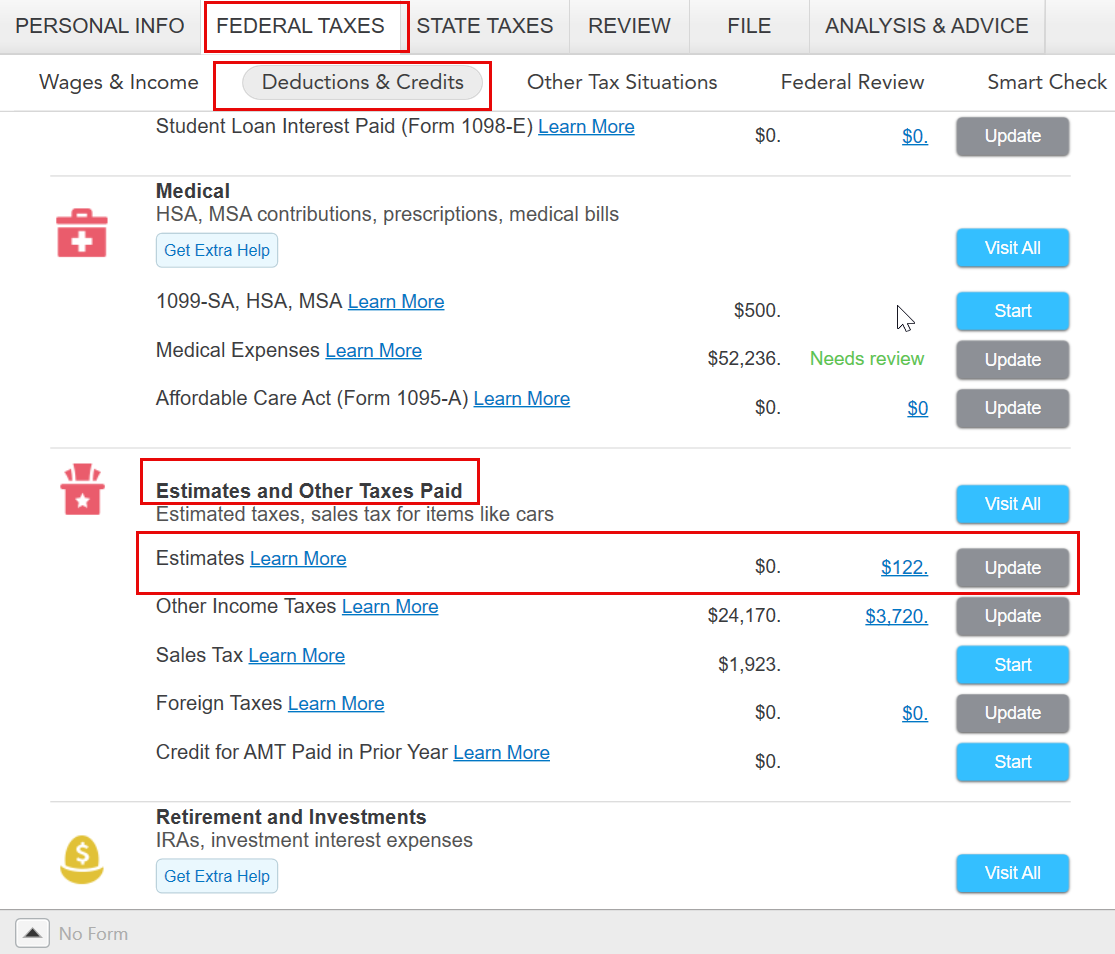

For the payment to Michigan, you can enter the amount actually paid in the federal interview section of the program under Deductions & Credits. Scroll down to the section titled Estimates and Other Taxes Paid and select start/update to the right of Estimates.

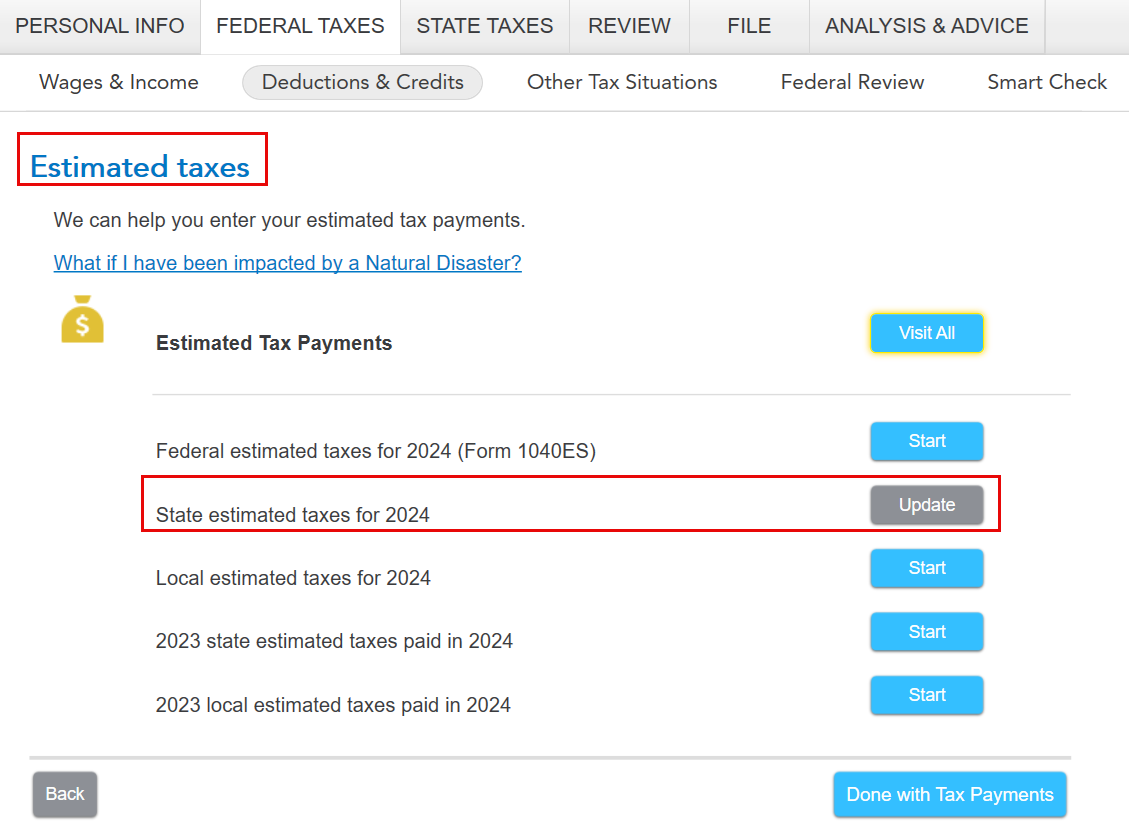

You will then see a screen titled "Estimated taxes." Select start/update to the right of State estimated taxes for 2024.

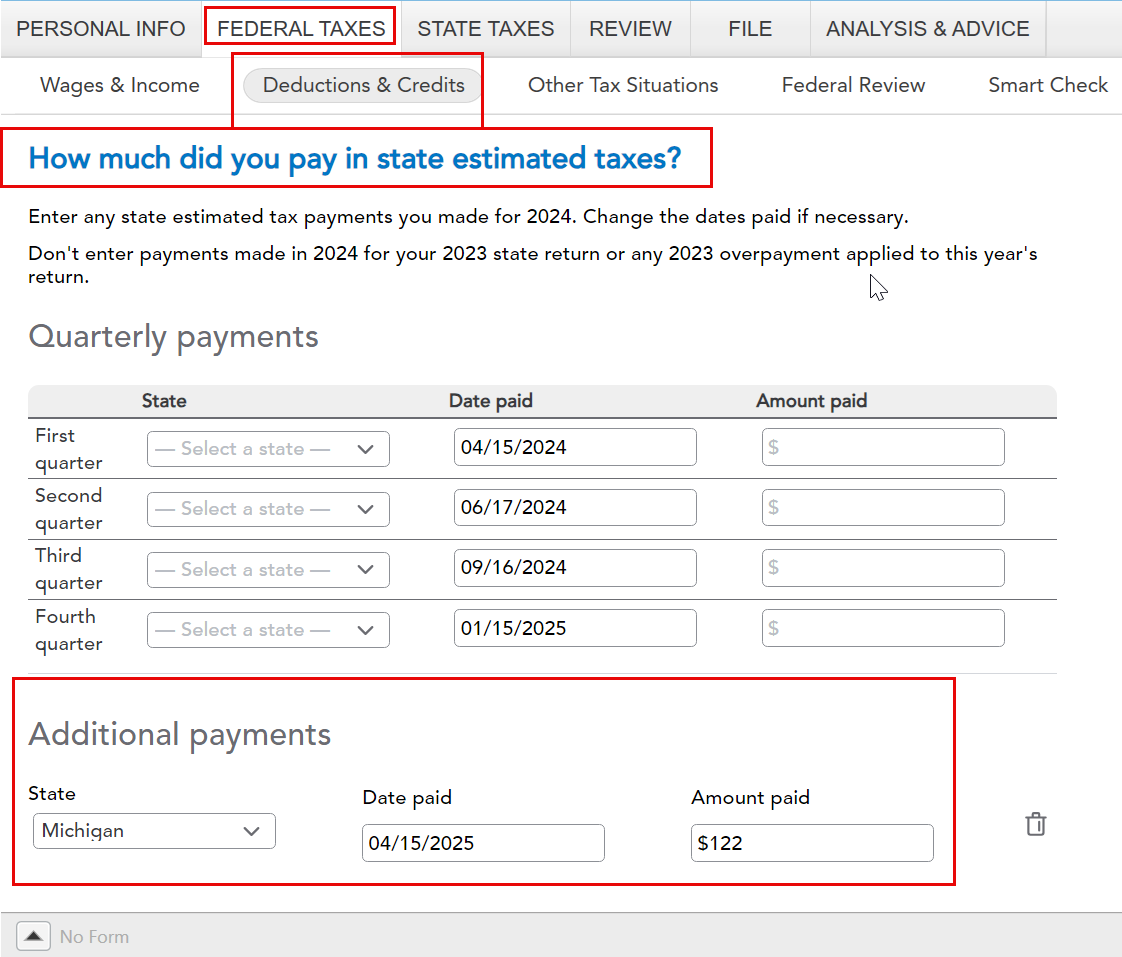

On the next screen titled "How much did you pay in state estimated taxes," scroll down to the section titled Additional payments. Enter the portion for the interest and penalties previously paid here. This will carry over to your amended return as a payment and reflect the total amount paid with your original return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"