- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- For W2, Box 14, For TurboTax Deluxe 2020, Category do i associate with the following text on my W2 form: "NY-PFL"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

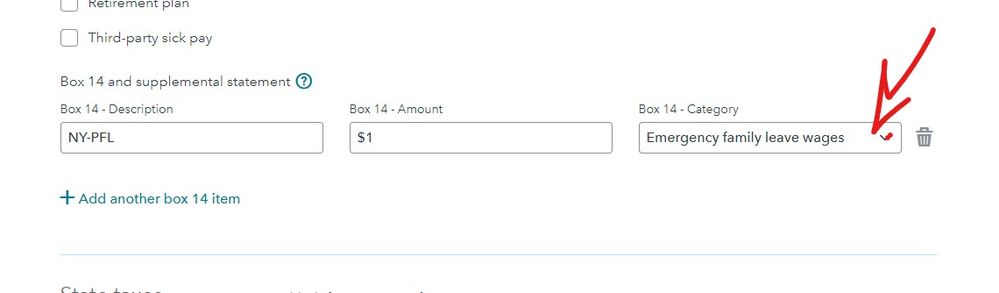

For W2, Box 14, For TurboTax Deluxe 2020, Category do i associate with the following text on my W2 form: "NY-PFL"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For W2, Box 14, For TurboTax Deluxe 2020, Category do i associate with the following text on my W2 form: "NY-PFL"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For W2, Box 14, For TurboTax Deluxe 2020, Category do i associate with the following text on my W2 form: "NY-PFL"

NYPFL on a New York W-2 is usually not family leave wages. It's usually the tax that you pay for the PFL program. If that's what it is, select "Other mandatory deductible state or local tax not on above list." The exact wording may vary slightly depending on where in TurboTax you make the selection.

If you did not receive paid family leave in 2020, then the NYPFL is the tax. Every New York employee pays the tax. If you did receive paid family leave, you may have to ask your employer to clarify what the box 14 entry is.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sheikhb786

New Member

turbotax

New Member

dandvwilliams

New Member

davidrshostak

New Member

Rsachdeva

New Member