- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Filing state return by mail - what to include?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing state return by mail - what to include?

I am confused about what exactly to print out and mail for my state (California) tax return by mail and if or if not I include the check for money owed. Do I mail the payment voucher and check separately from the printed state return? Or is that somehow only for folks e-filing their state return? In past years the state return to print was clearer and didn't have the payment voucher.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing state return by mail - what to include?

If you mail your return and include a check for payment, you do not send the voucher. The 8453-OL is a voucher that is used if you mail the payment separate from the tax return. @spruegal

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing state return by mail - what to include?

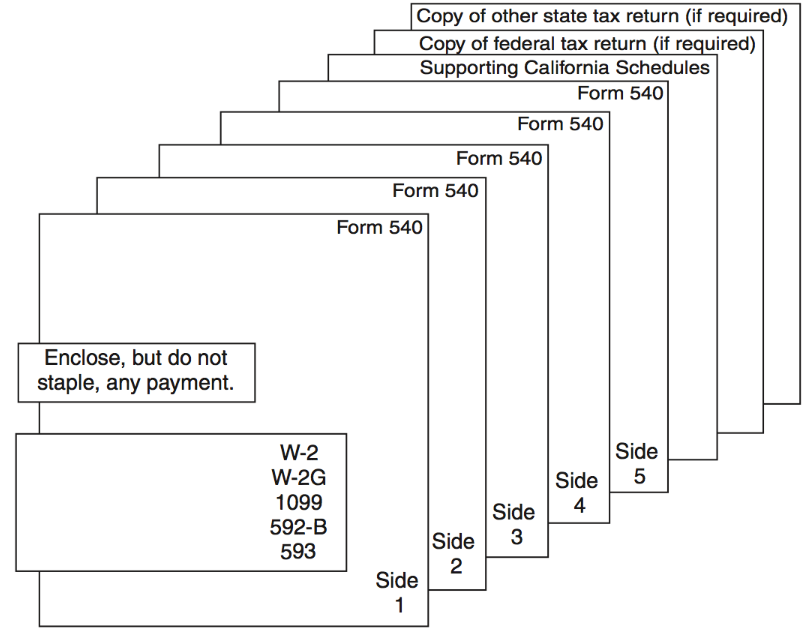

When you print the return the mail the first page is a cover sheet. It has the address to mail the form to and a lis of what documents to put in the envelope with the form. Remember to sign the form and to use a mail service that notifies when the form has been delivered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing state return by mail - what to include?

Mail everything that TurboTax prints out except for the cover sheet mentioned by awesome Community member taxlady28.

We suggest sending your return by certified mail with proof of delivery.

You can enclose, but not staple, a payment with your return, but it’s better to pay online on the Franchise Tax Board’s website. Go to Pay.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing state return by mail - what to include?

Thanks but you're not answering my question. The state return pdf also includes Form 8453-OL that states in big print "do not mail this form to the FTP" yet that's the one with the line for signature?? There is also the payment voucher yet it says in all caps DO NOT MAIL A PAPER COPY OF YOUR TAX RETURN WITH THE PAYMENT VOUCHER. So - back to my question: do I send the voucher and check separately from the printed forms, and which form do I print and send with my signature? TurboTax has made this extremely confusing and discouraging people to save $25 by mailing instead of e-filing state returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing state return by mail - what to include?

If you mail your return and include a check for payment, you do not send the voucher. The 8453-OL is a voucher that is used if you mail the payment separate from the tax return. @spruegal

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing state return by mail - what to include?

I have the same questions. I just want to print out State return. In the print center, I've the 2022 California Tax Return checked. Why the print out inculde Form 1040, Schedule A, Sch A, B, D, 2, 3, and other Forms 8949, 8959, 8960? Do all the Schedules, and forms required to mail in for State return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing state return by mail - what to include?

Yes. California (CA) requires a complete copy of your federal return.

Before you mail (CA File by Mail)

Make sure you:

- Sign your tax return

- If you’re filing a joint return both people must sign the return

- Make sure your name, address, and social security number(s) are correct

- Check your math

- Attach a copy of your federal return (if not using form 540 2EZ)

- Attach a copy of your W-2

- File your original return, not a copy

Mail your tax return

Visit our mailing addresses page to find out where to mail your return. The address will be different if you’re sending a payment with your tax return versus without a payment.

If you expect a refund, make sure your address is up to date. Visit how do I change my address for more information.

If you owe taxes, visit our payment options.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing state return by mail - what to include?

It took some digging, but I figured it out - I filed my federal online and said I'd file state later.

Then I went back to the beginning of the filing process and switched from efile to file by mail (which makes it look like you are going to file your federal return by mail - but I've already efiled it!)

Then it will direct you to print the state forms correctly.

NOT AS EASY AS IT USED TO BE

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

adamhaggerty30

New Member

user17688764610

New Member

Linette

New Member

clydesoldotna

New Member

clydesoldotna

New Member