- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Federal EV Tax Credit for 2023

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal EV Tax Credit for 2023

I am single

My last year AGI was < 150k

My current year AGI might exceed 150k (as I might receive pay raise) , so if I purchase eligible car in July 2023 will i be eligible for federal and state tax credit in 2024 return?

Further questions..

1) every pay cheque my employer deduct standard federal and state tax and at the end of year I generally get tax refund upon tax filling, so my question is: if i have more than 7500$ federal tax (regardless what i paid/owe) i will be getting whatever refund + 7500 right?

for ex 17000 total Federal tax, 20000 i already paid through out year, am about to get 3k refund + 7500 ev credit?

2) if not should i update my tax withholding so that at the end of year i owe tax and federal tax will reduce it out?

for ex 17000 total Federal tax, 12000 i already paid, i owe 5k +7500 = 2500 refund

3) are there any state rebate criteria (ie income limit?) i live in colorado

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal EV Tax Credit for 2023

Hi @pr8993 ,

1. If your filing status is Single or Married Filing Separately and your MAGI/AGI exceeds $150,000 in 2023, you cannot take the credit in that year but you can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less. If your modified AGI is below the threshold in 1 of the two years, you can claim the credit.

2. The credit is nonrefundable, so you can't get back more on the credit than you owe in taxes. You can't apply any excess credit to future tax years. Your tax liability is calculated first then IRS applies all payments (withholdings ) paid through the filing period and calculates balance due or refund due (if you paid more than your tax liability).

3. In Colorado , the incentive comes in the form of a reduced tax bill and possibly a tax refund depending on your personal tax situation. Beginning on July 1, 2023, the Colorado EV tax credit increases to $5,000 for vehicles with MSRP up to $80,000.

In 2024, EV shoppers will have the option to apply their federal tax credit as a rebate instead, providing immediate savings off the purchase price of an EV.

For more details regarding the EV credits for Colorado and Federal , please visit the following links:

Truck Credits for Electric and Plug-in Hybrid Electric Vehicles

Credits for New Clean Vehicles Purchased in 2023 or After

Thank you and good luck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal EV Tax Credit for 2023

Hi pr8993,

Great job planning ahead for the tax credit! One piece of information that would be needed is your filing status, as there are income limitations. For example, if you filing status for 2023 will be single, your Modified Adjusted Gross Income can not exceed $150,000.

IF you are below the income limitation , and meet the other clean vehicle eligibility requirements, the refund will reduce your tax liability prior to applying your withholdings. In your example, your $17,000 of tax would be reduced by the $7500 tax credit, and then the $20,000 tax withholdings applied to remaining tax, and resulting refund. In your example, there would be no need to reduce your withholdings to receive more of the credit.

Here are details about qualified vehicles, https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after.

I hope you find this information helpful!

Connie

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal EV Tax Credit for 2023

Hi vvkp8993, thanks for joining the tax forum today.

If you purchase an eligible EV during 2023, when you file your tax year 2023 Federal income tax during 2024,

Quote

You can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less. If your modified AGI is below the threshold in 1 of the two years, you can claim the credit.

Unquote

Credits for New Clean Vehicles Purchased in 2023 or After

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

The credit is to offset tax liability, for example, tax year 2022 form 1040, line 22 to zero. Unused portion is lost and cannot be carryforwards.

Your payroll withholding is considered tax payments, which has no bearing if the EV credit can be used to offset the tax liability as described above.

As a very simple example, if your tax liability is zero, you receive all withholdings back as refund (if no other tax complications.)

Hope this helps,

Kochu Kitty

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal EV Tax Credit for 2023

Hi @pr8993 ,

1. If your filing status is Single or Married Filing Separately and your MAGI/AGI exceeds $150,000 in 2023, you cannot take the credit in that year but you can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less. If your modified AGI is below the threshold in 1 of the two years, you can claim the credit.

2. The credit is nonrefundable, so you can't get back more on the credit than you owe in taxes. You can't apply any excess credit to future tax years. Your tax liability is calculated first then IRS applies all payments (withholdings ) paid through the filing period and calculates balance due or refund due (if you paid more than your tax liability).

3. In Colorado , the incentive comes in the form of a reduced tax bill and possibly a tax refund depending on your personal tax situation. Beginning on July 1, 2023, the Colorado EV tax credit increases to $5,000 for vehicles with MSRP up to $80,000.

In 2024, EV shoppers will have the option to apply their federal tax credit as a rebate instead, providing immediate savings off the purchase price of an EV.

For more details regarding the EV credits for Colorado and Federal , please visit the following links:

Truck Credits for Electric and Plug-in Hybrid Electric Vehicles

Credits for New Clean Vehicles Purchased in 2023 or After

Thank you and good luck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal EV Tax Credit for 2023

@pr8993 wrote:

I am single

My last year AGI was < 150k

My current year AGI might exceed 150k (as I might receive pay raise) , so if I purchase eligible car in July 2023 will i be eligible for federal and state tax credit in 2024 return?

For the new clean vehicle tax credit (purchases after December 31, 2022), your modified adjusted gross income (AGI) may not exceed:

- $300,000 for married couples filing jointly

- $225,000 for heads of households

- $150,000 for all other filers (including single filers)

You can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less. If your modified AGI is below the threshold in 1 of the two years, you can claim the credit.

Modified AGI, or MAGI, is calculated by adding certain deductions taken back to your AGI, potentially including:

- Student loan interest

- One-half of self-employment tax

- Qualified tuition expenses

- Tuition and fees deduction

- Passive loss or passive income

- IRA contributions

- Non-taxable social security payments

- The exclusion for income from U.S. savings bonds

- Foreign earned income exclusion

- Foreign housing exclusion or deduction

- The exclusion under 137 for adoption expenses

- Rental losses

- Any overall loss from a publicly traded partnership

Assuming your MAGI is similar to your AGI, you would still qualify for the credit based on your prior year income, even if you receive the raise this year taking you above the income limit.

1) every pay cheque my employer deduct standard federal and state tax and at the end of year I generally get tax refund upon tax filling, so my question is: if i have more than 7500$ federal tax (regardless what i paid/owe) i will be getting whatever refund + 7500 right?

for ex 17000 total Federal tax, 20000 i already paid through out year, am about to get 3k refund + 7500 ev credit?

Your example here is correct. The New Clean Vehicle Credit reduces any tax liability. So with your example, if you have a $17,000 tax liability and $20,000 withheld throughout the year, the result would be:

$17,000 tax liability - $7,500 tax credit = $9,500 remaining tax liability

$20,000 withholding - $9,500 = $10,500 refund

Important to note - this credit is not refundable, nor can it be carried forward to future years. If you do not have a tax liability, no credit is available. Also, if you have less than $7,500 in tax liability, the credit will only be equal to the amount of the tax liability.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal EV Tax Credit for 2023

Thank you ,

Here is my 1040 (year 2022) line no 11 which is less than 150k

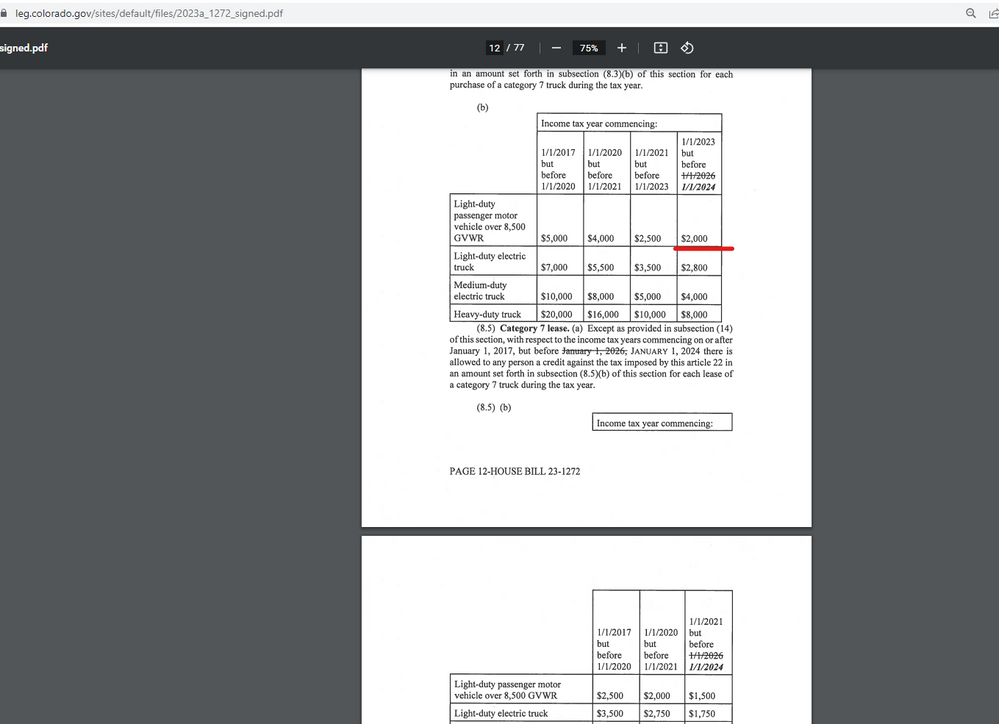

For the State Tax, i will get only 4409 return not full 5000 as shown in below picture right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal EV Tax Credit for 2023

The Federal EV Tax Credit is a nonrefundable credit. There are also income limitations. Single individuals or married filing separately have an $150,000 income limitation (MAGI). MAGI is very similar to adjusted gross income, but there are some differences. The credit is called nonrefundable, because you can not use the credit if your tax liability was Zero. Also, when I mention tax liability it does not mean what you owe when you file the return. Tax liability is the tax computed in your return based on your income and deductions and it does not take into account any amount withheld or paid in estimates. For example, the return may show a tax liability of $10,000, but your employer withheld $11,000 and you are getting a refund of $1,000 before applying the tax credit. The tax was still $10,000 and you would be able to get the credit as long as all the other requirements were met, such as income, purchase price, etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal EV Tax Credit for 2023

For Colorado EV Tax Credit, it still shows old 2000$ not 5000$ (starting july 1 2023)

https://leg.colorado.gov/sites/default/files/2023a_1272_signed.pdf

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

girishapte

Level 3

mjlee999

New Member

jtmcl45777

New Member

jesse_garone

New Member

jenrlo

New Member