- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Excess social security tax being miscalculated- again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security tax being miscalculated- again

When we filed our 2022 return with Turbotax, we received our refund many months later, was significantly lower than claimed, and came with a letter from the IRS that we claimed an excess social security contribution that was not valid. Thinking the IRS had made a mistake, I contested in a letter that our total contributions exceeded the 2022 limit of $9,114. They responded at the end of the year that there was no excess because that limit applies to each spouse, not a total when filing married jointly.

I have our 2023 return prepared but haven't filed yet. I see that again that a substantial excess is claimed on1040 line 11, even though my wife's three W2s do not go over the 2023 limit of $9932.40, individually or collectively. My W2 does not exceed that limit either. The excess claimed happens to be the entire amount contributed to social security (W2 line 4) for her teacher job W2. I haven't been able to figure out why Turbotax is calculating this as an excess. Help is greatly appreciated!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security tax being miscalculated- again

Yes, this can happen when the ownership of the W-2 forms on a joint return is entered incorrectly in the program.

Here's how to review this:

- Open you return.

- Select Federal, then Wages & Income.

- To the right of Job (W-2), select Edit/ Add.

- Expand the section by selecting the down arrow to the right

- Select Edit below the W-2 information.

- Check the name on the first screen.

- Review each W-2 and make sure the correct owner is indicated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security tax being miscalculated- again

Yes, this can happen when the ownership of the W-2 forms on a joint return is entered incorrectly in the program.

Here's how to review this:

- Open you return.

- Select Federal, then Wages & Income.

- To the right of Job (W-2), select Edit/ Add.

- Expand the section by selecting the down arrow to the right

- Select Edit below the W-2 information.

- Check the name on the first screen.

- Review each W-2 and make sure the correct owner is indicated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security tax being miscalculated- again

I can tell you how that happened. Did you transfer from 2022? Then the W2s transferred with the wrong person again. The best way is to delete the W2s and re enter them being very careful to enter them under the right person. THEN for next year, if you transfer over from 2023 you should delete ALL the W2s and re-enter them from scratch making sure to assign them to the right spouse.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security tax being miscalculated- again

Thanks Julie,

This fixed the problem. Understand that wrong owner of the W-2 was the cause of the miscalculation, but after uploading the W2s (same as previous year) this wasn't obvious, since W2s are generally something I have not needed to review for accuracy over the many years I have filed. Other forms of income and credits/deductions tend to get more scrutiny before I file.

I spent quite a bit of time trying to find details in my return summary that would indicate an excess contribution- and why it was calculated as such, but couldn't find any.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security tax being miscalculated- again

Thanks VolvoGirl, we did have the same set of W2s as in previous years. My usual process is getting a clear scan of them when they come in the mail, or download them from the employer in one case. I then use the upload option to have Turbotax scan the details.

I don't recall this time around whether or not TurboTax asked me if each one belonged to me or my wife prior to uploading. It's possible it did and I just mistakenly accepted the default in this case, which would presumably be me instead of my wife.

I still do think though that it would have been helpful for Turbotax to highlight a calculation like this in the summary, since (I assume) it would not be particularly common scenario for an employer to withold excess social security for employees.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security tax being miscalculated- again

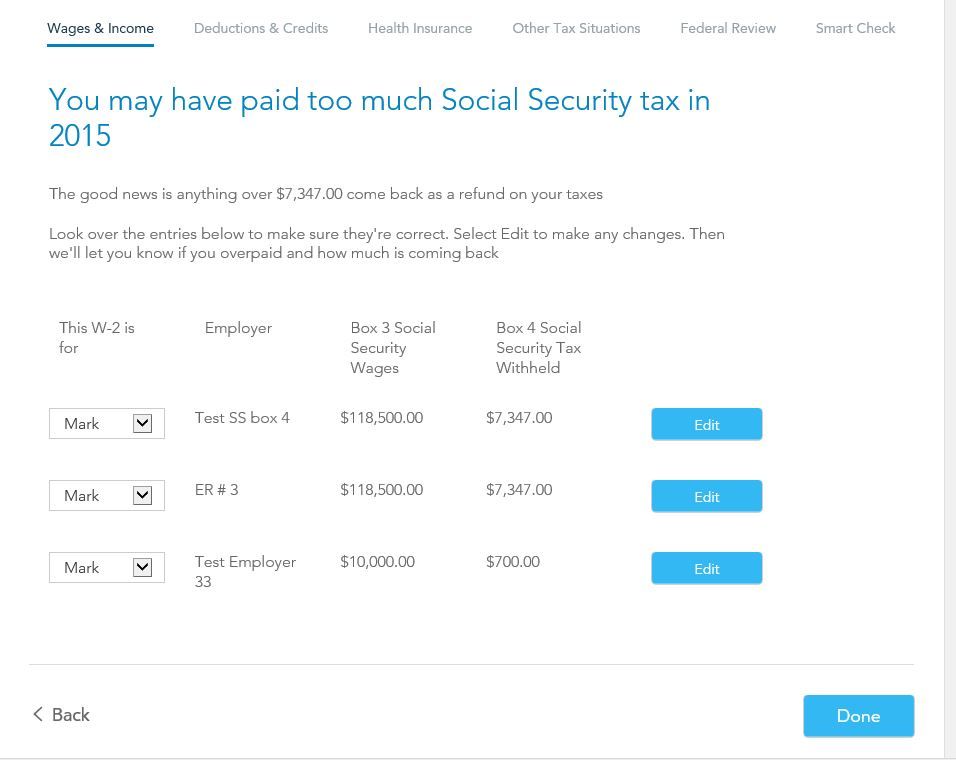

It should tell you. You should see a screen similar to this very old one with the names. Sorry I don't have a more current screenshot from the Online version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess social security tax being miscalculated- again

Does that screen still exist? it did not appear to me during the course of preparing our taxes for 2022 or this year. Would it appear upon wrapping up all income- or just finishing W2s?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

air1erb

Returning Member

heskm

New Member

jlf_spain

New Member

mitchden1

Level 3

Flanda

Returning Member