- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Entering complete payer's information on 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering complete payer's information on 1099-R

On the 1099-R entry screen it says to enter the information exactly (bold) as it appears on my 1099-R.

I have received a 1099-R that includes two extra lines in the box beyond payer's name, street, etc. I can enter the first and second line of the payer's name, street address, city, state, zip and federal ID number. However, the payer also added two extra lines in the box to add plan number, plan name and phone number.

How do I add the plan number and plan name to the 1099-R information I report?

This 1099-R is for a direct nontaxable distribution or rollover from an old employer 401(k) plan to a new IRA. Although the G option is specified in block 7, I wonder if it still leaves open the possibility that this could be confused for a direct IRA to IRA rollover. I understand there is a limit to one IRA to IRA rollover in a twelve month period. I want to make sure this transaction is not factored into that limit.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering complete payer's information on 1099-R

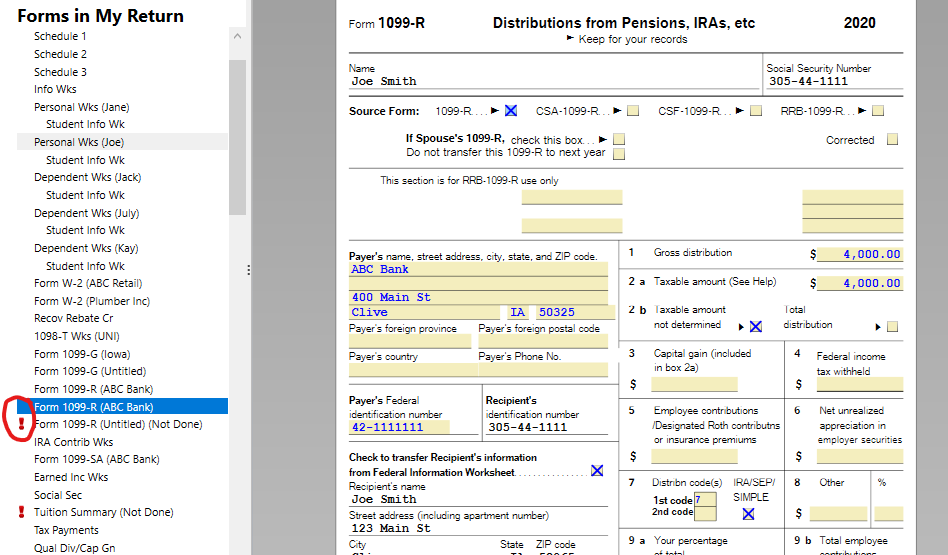

You must be using TurboTax Desktop. You do not need to enter the plan information into TurboTax. The IRS requires that information from the 1099 issuer so if you have a problem with your 1099R, you will have a place to call. Normally, this information is the plan administrator that issues the 1099Rs. No need for concern about the coding. If this was an IRA rollover, box 7 would be check for IRA. You also can review your input in Forms mode. In the upper right hand corner of the screen select the "Forms" link. This will take you to the forms view of your input to that point, You can scroll to the 1099R and select. Now scroll down the screen and you will see your input as it appears on the form. As you continue to scroll down, you will see other areas of input related to the 1099R form. You can scroll to the Rollover section and make sure box for total rollover is checked.

Additionally, any forms with a red ! indicates an error that needs corrected before you e-file. To get back to the input forms, select "Step by Step" in the upper right hand corner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering complete payer's information on 1099-R

SamS1,

Thank you very much for getting back with a reply so quickly. So if I understand you correctly the check box in block 7 is the key to distinguishing between a distribution from an IRA versus an employer plan like a 401(k) or 457(b). Since that is unchecked on my 1099-R it confirms the distribution is not from an IRA, which is what I expect.

Also thanks for the tip on the forms view. No red mark there, so everything looks good.

Thanks again,

Steve

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eriklindemann

New Member

user17705936669

New Member

ranger75230

Level 2

mollyrplester

New Member

blakeliddle

New Member