- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

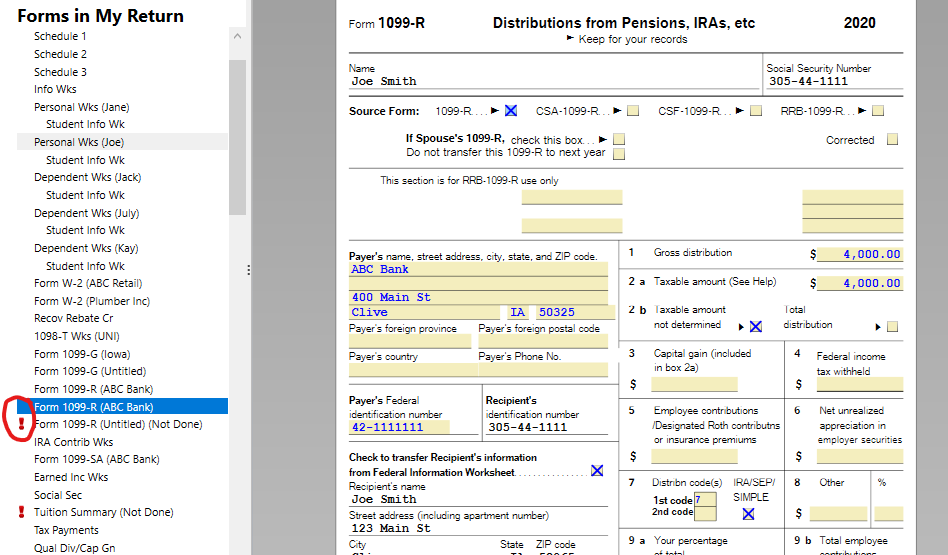

You must be using TurboTax Desktop. You do not need to enter the plan information into TurboTax. The IRS requires that information from the 1099 issuer so if you have a problem with your 1099R, you will have a place to call. Normally, this information is the plan administrator that issues the 1099Rs. No need for concern about the coding. If this was an IRA rollover, box 7 would be check for IRA. You also can review your input in Forms mode. In the upper right hand corner of the screen select the "Forms" link. This will take you to the forms view of your input to that point, You can scroll to the 1099R and select. Now scroll down the screen and you will see your input as it appears on the form. As you continue to scroll down, you will see other areas of input related to the 1099R form. You can scroll to the Rollover section and make sure box for total rollover is checked.

Additionally, any forms with a red ! indicates an error that needs corrected before you e-file. To get back to the input forms, select "Step by Step" in the upper right hand corner.