- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Entering 1099-B transactions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

I have 3 sections in my 1099B with many transactions in each section. I would like to enter 2 of the sections using the Sales Total method. However, for the 3rd section, I would like to enter each transaction manually.

Two of the sections are all RS sales - can I assume I can use the total cost basis and total proceeds for those?

One of the sections are all ESPP sales, so I would like TT to ask me the appropriate questions for each sale.

I have already entered the two sections of RS sales (using Sales Total method).

How can I now enter the 3rd section of sales manually? It only lets me enter Sales Totals.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

Yes, all of that is fine. The important thing is that your sales as listed on your Schedule D and Form 8949 match the sales listed on the Form 1099-B, as the IRS will check for that. Also, it would be good if the cost basis entered matched the cost basis listed on the 1099-B forms before you enter the adjustment for the ESPP basis. And also, you need to make sure you get the short term and long term gains to match what is on the 1099-B. It is not likely the IRS will even look at the detail, they will just pay attention to the total sales, cost basis and status as short or long-term. There should be subtotals on your 1099-B that you can easily match to what is reported on your Schedule D and Form 8949.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

When you go to the investment sale entry screens in TurboTax you should see the option to enter sales "one by one" :

When you choose that option, you will have the ability to indicate that you are entering ESPP stock and TurboTax will walk you through entering in the correct cost basis:

You enter investment sales in the Wages and Income section of TurboTax, then Investments Sales, then Stocks, cryptocurrency, Mutual Funds, Bonds, etc... Skip the section where it asks if you want to upload your tax documents.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

Hi,

The problem is that I can no longer get to that screen.

I had first gone to that screen and selected "Enter Sales Total instead", because I wanted to enter the 2 sections (of RS transactions) as sales totals.

But it seems I can only enter Sales Total now.

How can I manually enter some of the transactions one by one?

If I entered the transactions one by one first, can I later add 2 of the sections as Sales Totals?

To summarize: I want to enter 2 of the sections as "Sales Totals", and one of the sections "one by one"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

An update to this question:

I restarted this 1099-B, and selected "Enter sales one by one".

I then entered all of my transactions that were in one section (Long term transaction where basis is reported to IRS). All of these were ESPP sales, so I wanted to have TT compute my adjusted cost basis.

I have 2 other "sections" in this same 1099B. Instead of entering all of these transactions "one by one" - how can I enter the "sales total" in these 2 sections instead?

Should I make note of the adjusted cost basis from this first section, and then reenter the entire 1099-B using "Enter Sales Total"? And when I enter the total for this section, I can adjust the cost basis? Do I need to show how this was done somehow?

There doesn't seem to be a way to mix the 2 different ways of entering transactions in the same 1099B. You have to either enter ALL one by one, or use sales total for ALL.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

Your broker may allow you to download the IRS form 1099-B in Excel format.

If this is the case, and ten transactions lines are reported on the IRS form 1099-B, two of the transaction lines may be entered using the One by One method.

The remaining eight transaction lines on the IRS form 1099-B may be reported as a summary transaction. Create a .PDF of the Excel file to upload into TurboTax Online. Follow these steps.

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click the down arrow to the right of Investments and Savings.

- Click to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B).

- Click Add investments.

- On the Let's import your tax info screen, select Enter a different way.

- On the OK, let's start with one investment type screen, select Stocks, Bonds, Mutual Funds, then Continue.

- At the screen Which bank or brokerage, enter the information. Click Continue.

- Do these sales include any employee stock, enter No.

- Do you have more than three sales, enter Yes.

- Do these sales include any other types of investments, enter No.

- Did you buy every investment listed, enter Yes. Continue.

- On the screen Now, choose how to enter your sales, select Sales section totals. Select Continue.

- At the screen Look for your sales on your 1099-B, select Continue.

- You will now be able to enter the total proceeds (sales) and cost basis, along with the sales category. Refer to your IRS form 1099-B, IRS form 8949 and / or Schedule D Capital Gains and Losses for the amounts and category. When finished, select Continue

- You can add additional sales totals by selecting the Add another sales total on the Review your sales section totals screen.

- When completed, close the record and click Continue.

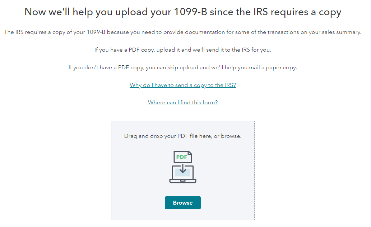

- At the screen Now, we'll help you upload your 1099-B since the IRS requires a copy, browse and select your document. Select Continue.

- When you upload your document, your filing instructions will not show that anything needs to be mailed in, and no IRS form 8453 will be generated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

Hello,

Thank you for the detailed response. However, I am using the Desktop version of TurboTax, not the online version. Your instructions don't seem to work with Desktop.

I cannot convert my 1099B to an Excel spreadsheet either.

Is there a way to do this with the Desktop version?

I am about to resign myself to adding in all the transactions one by one...it will be very painful (and possibly error prone) because there are 25 pages of transactions (totaling about 250-300 transactions).

Another idea I had if I go this route is can I at least group the transactions so that I enter the total of all stock sold on the same day? So I can at least group a few together in one transaction, and then list the date purchased as "various"?? Will TurboTax Desktop at least allow that?

Or are there any other suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

The sales on your 1099-B form should be summarized by category, such as category A for short-term basis reported to the IRS, category B for short for term basis not reported to IRS, etc... There are as many as six such categories, but you probably have less than that listed on your Form 1099-B. You can make one entry for the summary total of each category, which should be listed on your 1099 form, so you may need to only make six entries theoretically. If you have sales for which the cost basis is not reported to the IRS (code A and E) you are supposed to enter each sale for those, but you have the option of listing the summary amount and then attaching the Form 1099-R detail to your tax return that you would then mail in.

For the ESPP stock, any ordinary income component would be listed on your W-2 form in box 1, with a note identifying the amount in box 14 typically. You can determine your total gain on all of those by subtracting the cost of the stock from the sales proceeds. You can then subtract the ordinary income portion reported on the W-2 to determine your capital gain. Once you know what the capital gain is, you can subtract that from the sales proceeds to determine the correct cost basis. So, it is possible to enter all the ESPP stocks in one entry and adjust the cost basis to the correct amount in one entry.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

Thank you for your response.

Unfortunately, my company does not list out the ordinary income component on my W-2 form. The only way I can figure it out is by going through the TT questions, and entering the corresponding data on the 3922 forms for the ESPP stock. I did go through the ESPP stock transactions (entering each transaction one by one) and have written down the "adjusted cost basis" computed by TT.

Can I use this "computed" cost basis if I enter the ESPP stocks as one entry? I assume I would then enter all 3 sections as a "sales total" if I did this. If I go this route, I assume I would delete this 1099B entry, and then restart it again and choose "enter Sales Totals", to enter all 3 sections. And If I do this, I would need to mail my 1099B to the IRS? (There is no way to upload it to TurboTax if I efile?)

The ESPP stock transactions are in one section (long term, cost basis is reported to IRS). The other 2 sections are codes B and E (cost basis not reported to IRS).

Alternatively, can I enter the stock transactions in the other sections (which are codes B and E) using the "one by one" method, but instead of entering all 250 transactions individually, can I do the following:

If several transactions have the same "sale date", but different "purchase dates", can I enter all of those transactions as one transaction and list the purchase date as "Various" instead? Note that my 1099B does not list the date as "Various", but shows the actual date. I would have to total the # of shares, as well as the cost basis and proceeds of this group of transactions, but I would list it as a single transaction instead.

This would save me some time. Can I do it this way? Also, would I still need to mail in the 1099-B if I list the transactions in this way?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

Yes, all of that is fine. The important thing is that your sales as listed on your Schedule D and Form 8949 match the sales listed on the Form 1099-B, as the IRS will check for that. Also, it would be good if the cost basis entered matched the cost basis listed on the 1099-B forms before you enter the adjustment for the ESPP basis. And also, you need to make sure you get the short term and long term gains to match what is on the 1099-B. It is not likely the IRS will even look at the detail, they will just pay attention to the total sales, cost basis and status as short or long-term. There should be subtotals on your 1099-B that you can easily match to what is reported on your Schedule D and Form 8949.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

Thanks - I am leaning towards my second idea (entering transactions "one by one", but also using "various" for the purchase dates on some of the transactions). That way, I can use the TurboTax guided questions for the adjusted cost basis of my ESPP sales.

However, if I go this route, will I still need to mail in a copy of my 1099B to the IRS? (I am hoping not.)

If so, is there a way to send it electronically if I am e-filing through TurboTax?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

If you enter the transactions individually, not in summary form, or in summary form except for the ones that say cost basis not reported to the IRS you can e-file your return without mailing in the form 1099-B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

Last I heard, desktop TurboTax does not let you attach a PDF of transaction detail to your e-File.

If you summarize one or more box catetogies other than A or D, or Box A or D with adjustments, you have to supply details of those transactions to IRS.

you can separate out the applicable pages to be mailed to reduce bulk and save postage.

include the cover sheet that TurboTax will give you so IRS knows who you are.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

So, am I allowed to enter "various" as the purchase date for multiple transactions, assuming all of those transactions have the same "sale date" - and just add up the # of shares, cost basis, and proceeds for those transactions?

EX: I have 20 transactions with the same "sale date", same stock symbol, but different "purchase dates". Can I enter these transactions using the "one by one" method (not the sales total), but list all 20 transactions as one transaction - where I set "purchase date" to "various"? I continue to enter transactions in this way, but group all transactions with the same "sale date" together. (These transactions are in a section where cost basis is NOT reported to the IRS.)

Can I do this?

If I can, will I still need to mail in the 1099B to the IRS?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering 1099-B transactions

Securities sold on the same date must have the same LT./ST aspect to be bundled in that way.

LT - Box E - is for securities held for more than one year.

No mailing is necessary.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KBCPA1

Level 3

alonsotx

New Member

cakillorin7

New Member

ThomasKirchner54

Returning Member

dcwongny

New Member