- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Donations to charity

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

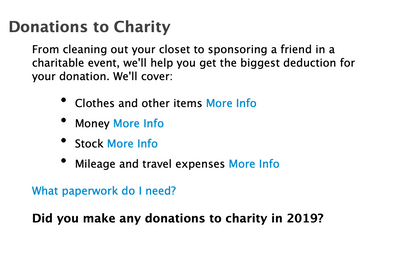

Donations to charity

Hello,

I got married last year. In this section of TurboTax, do we just add the amounts to we gave to particular charities? Also do we list all the charities we gave to last year here for both of us?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Donations to charity

Yes and yes. If you file a Married Filing Jointly return, all of your spouse's and your donations get reported on the same tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Donations to charity

noncash donations totaling over $500 need to go on form 8283. for cash contributions save yourselves some time. total the amounts contributed by both that are deductible and enter as a single number. Only this single number shows up in schedule A. if TT wants a description use cash. the names of the charities for cash contributions are not sent to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Donations to charity

Thank you!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ataguchi

New Member

Dchackert

New Member

muajyeejjay

New Member

pix1059-yahoo-co

New Member

Simonr78248

New Member