in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

Yes. Mine didn't "save" the un-check either! Here is what worked for me and I was able to e-file. Do this: Leave checked the "not a person" checked. I then selected llc partner in the drop down but that probably doesn't matter which one. Go back to the "step by setp" method and "edit" each partner. Re-do the interview about each partner and DON'T check or else UNCHECK the question (I had to un-check) .. "Is this partner the designated partnership representative"...for whichever one you checked before. There is a list of "select all that apply". That is one of the check boxes. Re-finish the interview for each partner. Go back to the forms method and now in the "designated representative section" there will be only ONE AREA to enter the name and address. That stops the endless loop. The only thing that worked for me was editing both partners in the interview with NEITHER being a designated partnership representative. Good luck. Reply if it worked for you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

Not only unchecking, I had to select "No Entity" or the first choice in the box below (I was based on memory). After that it was working for me. Good luck

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

How about a 3rd year in a row?

I have a Trust entity and it is revocable it carries my SSN.

However, in the partnership TIN, I enter by Trust TID (e.g. my SSN) in the format of an EIN (ss-sssssss).

This makes that error go away.

It is a pain as I have to relearn this step each time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

Just wasted an hour on the loop. Found this thread and boiled through all the "from memory comments" and things that did and didn't work, and did this exactly:

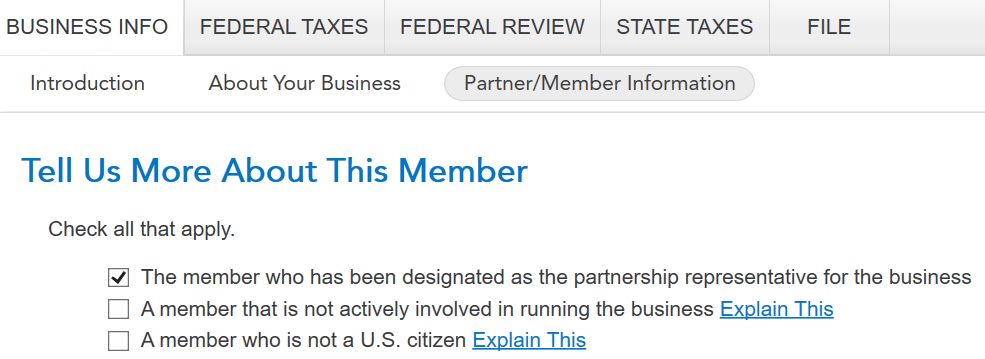

1. Click the "Business Info" Tab. Click the "Partner/Member Information oval". Edit each member by unchecking the "this member is not a person box", and uncheck the "the member who has been designated the partnership representative for the business" box.

2. Go to "Forms" Information Wks on top left of sidebar. Scroll down to Part V, and uncheck "Partnership Representative" Box

3. Go to form 1065 1-3, scroll to the bottom of page 3. All name/address info should be wiped out. Enter your name, address, phone, and SSN (with dashes) in the top lines of the "Designation of Partnership Representative" area.

Run your error check again and it should work. Good luck! - Paul

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

Hi David,

My partner has an EIN number but TurboTax will only allow me to enter a social security number. Any ideas how to fix this?

Thanks,

Eric

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

Thank you David for this solution and I will try this evening. DUE DATE today, so I do not have my hopes high.

It is a VERY frustrating endless loop with this PR and entity address stuff. This seems like a very common bug so not sure why TurboTax folks do not take this as a priority.

Tax regards,

-Chris

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

Thanks David for that information it helped me out.

The only thing I did differently was I put in a random name for Corporation Name and Address (for example None). Then clicked to the on going pages and went back to "update" the S-corp. Then I was able to "delete" the corporation name I listed. For me once I clicked to update the S-Corp the first time the code seems buggy so it doesn't realize nothing means to close out that portion of code. This is just my assumption.

Either way your info helped so thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

I hit on this method myself, entering my SSN in the format of an EIN number. I could then properly leave my designation as a revocable trust (for both members of this LLC) in place, in my Form 1065.

This is a truly stupid bug.

Glad to see you posted this hint, too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

What I have discovered is that filing an LLC, you will find that the individual members that are designated as not people (check box), if you leave that checked and in the pulldown below designate that person as an Individual (I) that gets around the problem of the PR representative loop.

Business Info tab, Partner/Member Information

Select Member Name -> Edit

Bottom checkboxes -> This member is not a person

If there is a dropdown list under that - select Individual (I)

Continue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

In TurboTax Business 2021 when you go through the step-by-step for partner information, regardless of whether the partner is an individual or corporation, you get this screen:

The top box asking for which member is being designated as the partnership representative will show up until you have designated one of the partners, You cannot file a Form 1065 without a Representative being designated.

@RONMCKIE212

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

It's March 2022, and the issue is still there.

Went with this fix.

There is a bug, since every time I edit a member, the box "this is not a person" is automatically checked.

But the important part was to clear (uncheck) the representative flag. This wiped out the PR section, which I then filled up (the first part) and errors went away, I was able to e-file.

Intuit, this is bizarre, having this going for years. Do not expect a gold star in my review, I spent two hours fighting this thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

I just had the same issue with the 2021 Business on the 1065. After MUCH telephone time and music the only solutions were to add attachment?, check my RAM, my Processor, my Browser, etc. I kept insisting it was a software error and suggested this be noted and forwarded to correct department since there is nowhere in the program I can go to to report these kind of issues. Surprise, I was sent an e-mail link to this site. Don't think it'll be fixed anytime soon. Only solution is to print out return and mail it rather than e-filing because this counts as an error and it won't let you e-file it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

This does not work for 2021. The program has us fill in all the information then immediately shows it as an error if the PR has a SSN because the additional PR info is not needed in such cases. So then removal of the information not needed immediately shows up as an error to be fixed again. And the loop starts again no matter how many times you correct as prodded by the program. The programmed code needs to be corrected so this loop will not continue to happen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

Followed your steps. I guess the 2021 software is immune to this fix. Solution: print and mail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Intuit have ANY plans to fix the 1065 Partnership error that has existed for 2 filing years now?

According to the On-Demand Guidance within TurboTax Business for the Designation of Partner Representative (right click on PR Name at the bottom of Form 1065 p1-3) --

To designate a partnership representative, either complete Part V of the Partnership Information Worksheet and check the Partnership Representative (PR) box or check the "PR" (Partnership Representative) box for a partner on the Schedule K-1 Worksheet.

Note: If the partnership representative is an entity, complete the information for the individual that the partnership designates to act on the entity's behalf.

If you prepare Schedule K-1 for at least one trust, partnership, disregarded entity or estate, you cannot opt out of the Centralized Partnership Audit Regime (Form 1065 p1-3 Line 29), which could resolve the situation.

Instead, open Forms Mode and confirm that the two forms mentioned above (Partnership Information Worksheet and Schedule K-1 Worksheet) contain the correct information.

The PR checkbox on Schedule K-1 Worksheet is in the right-hand column under the Profit/Loss percentages as "Check applicable boxes:"

On the Information Worksheet, Part V, confirm that there is no SSN under the Partner's information. Either the Partner or LLC Member and PR boxes must be checked.

Do not return to the Step-by-Step section for Partner/Member Information in case this action is resetting your entries. Save your return. Close, reopen, and run Federal Review again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

Raph

Community Manager

in Events

Raph

Community Manager

in Events

Raph

Community Manager

in Events

Tchelo

Returning Member