- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Does entering K-1 (Form 1065) duplicate Schedule D entries from the import

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does entering K-1 (Form 1065) duplicate Schedule D entries from the import

I completely sold a REIT security in 2019 which issues a K-1.

When I imported tax forms from my brokerage using TurboTax, it massively bumped up my capital gains, as the brokerage reported my cost basis for this holding as zero. I therefore need to enter the K-1 (Form 1065) information for this security.

My question is, does entering K-1 data automatically enter Schedule D info (the security was completely exited therefore there was a capital gain)?

Or, should I first delete the Schedule D entries which show zero cost basis first, and then enter the K-1 data?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does entering K-1 (Form 1065) duplicate Schedule D entries from the import

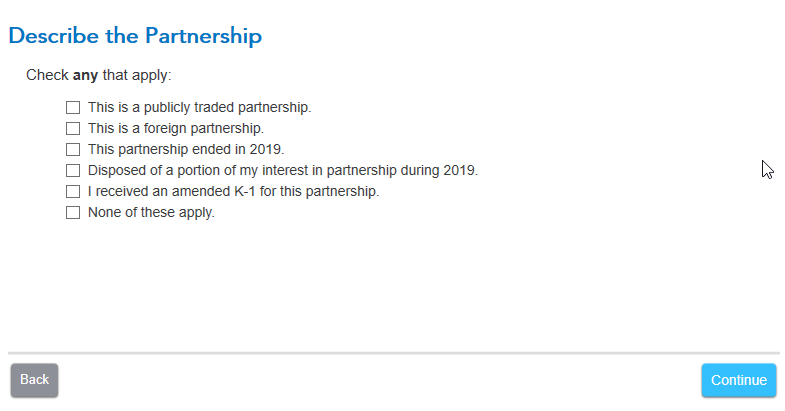

In the K-1 entry section, there is a screen "Describe the Partnership". On that screen is a line you need to check for "Disposed of a portion of my partnership interest in 2019". When you check that box, TurboTax will present you with the questions to report the disposition and correctly report the gain on your tax return. You'll need the proceeds reported on the 1099-B, and the cost basis from your records (if not reported by the broker in the supplemental information that came with your 1099-B).

Once you are satisfied your gain is properly reported from your K-1 entries, you can delete the entry for the 1099-B sale, to avoid reporting a duplicate gain.

Click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to begin edit the entry for your Schedule K-1.

Here's that "Describe the Partnership" screen you need:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

honcho864

New Member

Ebonyfox

New Member

Canonical

Level 2

amyonghwee

Level 5

AbTrack

Level 2