- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Do I really need to list all the states where I got tax exempt interest? TT asks for it, but Texas has no state I.T. Does this info go anywhere on my federal return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I really need to list all the states where I got tax exempt interest? TT asks for it, but Texas has no state I.T. Does this info go anywhere on my federal return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I really need to list all the states where I got tax exempt interest? TT asks for it, but Texas has no state I.T. Does this info go anywhere on my federal return?

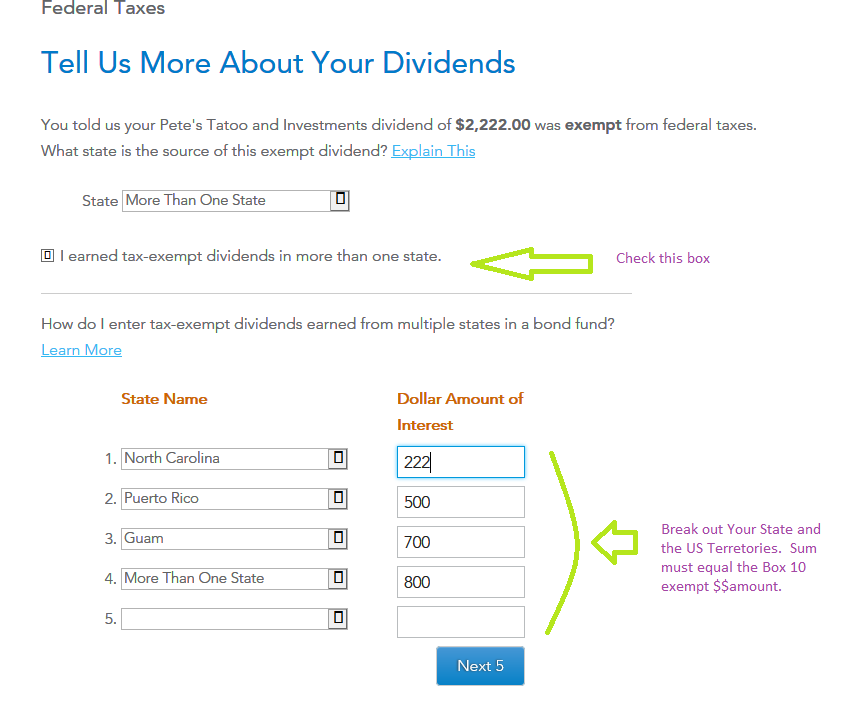

No...if you live in TX, you just get the drop-down list of states to display, and go to the END of the list of states, and select, "More than one state". Even if you live in TX....usually something needs to b selected.

_____________________

Not for a TX resident...but

....for a person living in an income taxing state (like NC), they could break out their own state (and any US territory bond interest), and then the rest of the $$ are just "More than one state":

Example for NC and a 1009-DIV (Similar on a 1099-INT):

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dgurreri

New Member

dgurreri

New Member

ronscott2003

New Member

caitastevens

New Member

bob

New Member