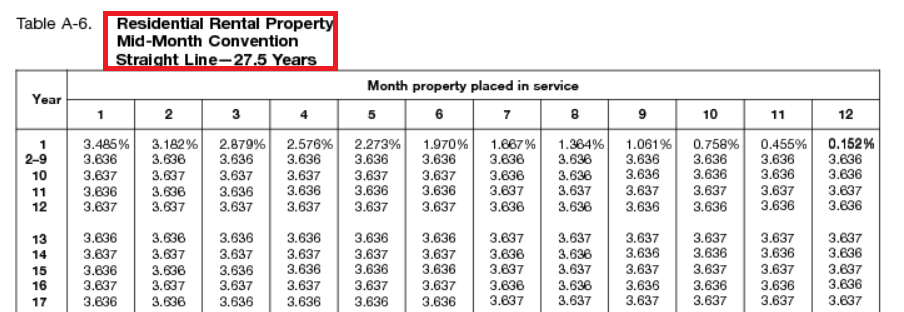

A rental property is depreciated using a 27.5 year recovery period and then each month the property is in service during the year (12 assumedly). I have included a partial chart for you below. This can be found in IRS Publication 946.

If this was used originally it should be completed by now, however it may have been set up under the alternative depreciation system (ADS) at a 40 year life. You could simply divide the cost of the rental by 40 to see if it is close to the amount being used.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"