- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Deferred Social Security Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

Why does TurboTax say I deferred some of my Social Security taxes last year? I'm pretty sure I didn't defer any taxes, unless my employer did it. What makes the application think I did this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

You probably did not defer anything. Your employer was allowed to defer this tax.

Check the amounts in box 3 of your W-2 and the amount in box 4. Box 4 should be 6.2% of Box 3.

This does not affect your tax return, only your social security account. For most employees no action is required.

Review the IRS Notice 2020-65 which explains more about this topic.

To Employers:

If you deferred the employee portion of Social Security tax under Notice 2020-65, when reporting total Social Security wages paid to an employee on Form W-2, Wage and Tax Statement, include any wages for which you deferred withholding and payment of employee Social Security tax in box 3 (Social security wages) and/or box 7 (Social security tips). However, do not include in box 4 (Social security tax withheld) any amount of deferred employee Social Security tax that has not been withheld.

To Employees:

If you had only one employer during 2020 and your Form W-2c, Corrected Wages and Tax Statement, for 2020 (if you get one later), only shows a correction to box 4 (or to box 14 for employees who pay RRTA tax) to account for employee Social Security (or Tier 1 RRTA tax) that was deferred in 2020 and withheld in 2021 pursuant to Notice 2020-65, no further steps are required.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

You probably did not defer anything. Your employer was allowed to defer this tax.

Check the amounts in box 3 of your W-2 and the amount in box 4. Box 4 should be 6.2% of Box 3.

This does not affect your tax return, only your social security account. For most employees no action is required.

Review the IRS Notice 2020-65 which explains more about this topic.

To Employers:

If you deferred the employee portion of Social Security tax under Notice 2020-65, when reporting total Social Security wages paid to an employee on Form W-2, Wage and Tax Statement, include any wages for which you deferred withholding and payment of employee Social Security tax in box 3 (Social security wages) and/or box 7 (Social security tips). However, do not include in box 4 (Social security tax withheld) any amount of deferred employee Social Security tax that has not been withheld.

To Employees:

If you had only one employer during 2020 and your Form W-2c, Corrected Wages and Tax Statement, for 2020 (if you get one later), only shows a correction to box 4 (or to box 14 for employees who pay RRTA tax) to account for employee Social Security (or Tier 1 RRTA tax) that was deferred in 2020 and withheld in 2021 pursuant to Notice 2020-65, no further steps are required.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

Social Security tax was not deferred for 2019. SSI wages was entered in error at a lessor amount. The SSI tax withheld was correct. How do I correct the 1040 for 2019?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

If the social security tax or social security wages was the only item that was not correct on the 2019 tax return, the W-2 was filed with the Social Security Administration (SSA) and the IRS. There may be no reason for you to correct your tax return for this reason.

Go to 'My Social Security' to review your account or create an account. Once you sign in, review your social security statement to confirm the actual wages were correct for your social security account.

If you cannot handle your business through their automated services, you can speak to a Social Security representative by calling toll-free at 1-800-772-1213 (TTY 1-800-325-0778) between 8:00 am – 7:00 pm., Monday through Friday. (call early or late for lowest hold times)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

In that case, TurboTax should change the wording on that screen.

t told me: "Since you deferred some of your Social Security taxes last year, you'll get Form W2-c from your employer once you've repaid what you deferred." I did not defer any of my taxes last year! It made me briefly distrust Intuit, because if I didn't do it, maybe TurboTax did it without my permission? This had me scratching my head until I searched for this on the web.

Instead, it would be better to say: "Since some of your Social Security taxes were deferred last year" ...

or

"Since your employer deferred some of your Social Security taxes last year" ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

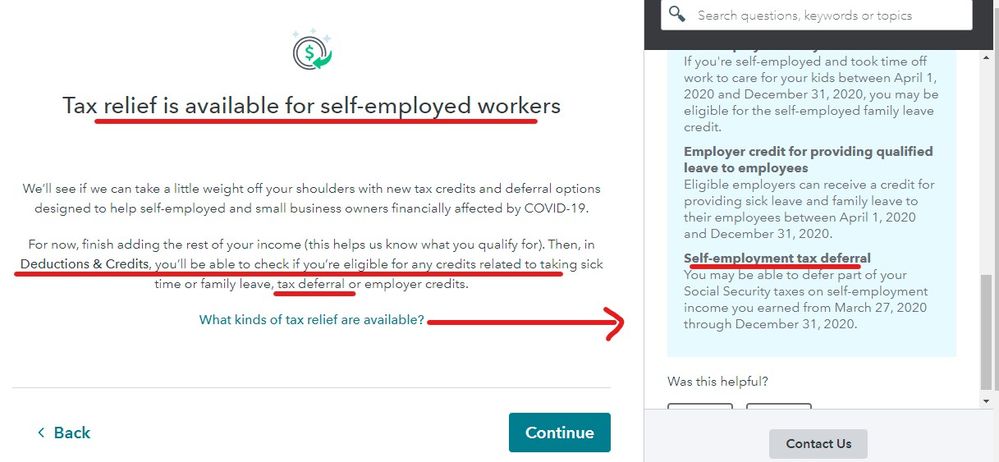

TurboTax took it upon itself to defer Social Security taxes from my husband's self-employment income. I did not request this when entering our tax info. Now we have a scary letter from the IRS about what we owe by the end of the year and had to read through our entire tax return to realize that it was the Self Employment income, not my W-2 income from an employer, and that we really do need to pay this by the end of December. It isn't much money, but I use Turbo Tax to avoid this kind of thing and the confusing IRS letters. Why did Turbo Tax DO this to us? And why are there no instructions on how to deal with it? This is probably happening to thousands of self-employed Turbo Tax users right now.

Readers, if you have only W-2 income, you can accept the earlier answer. If you have self-employment income, you are the employer and need to deal with this yourself.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

Sorry but the program doesn't do anything by itself ... there were several screens you had to navigate to get the taxes deferred ... do you remember these ?

Since you did not want to defer the taxes then you can simply pay them now ... review the notice for the correct way to do it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

I have the same issue as @Critter-3 of deferred SS tax from self-employment income. I definitely did NOT go through all the screens you show above, I would remember that! And even if I did, TurboTax should add a cover page indicating the deferred amount and deadlines for payments, similar to estimated tax stuff. So whether or not I went through all those screens, TurboTax needed to give the user a record of the deferral in the cover page instructions!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

I did NOT see those screens. The only screen I was shown asked when the self-employment income was earned during the year, before or after a certain date. That was it. I filed quite early and perhaps those explanatory screens were not up yet, but I assure you, I did not see them and did not understand that I was deferring anything.

The IRS letter says "use 1040" with no further instructions. I assume I am supposed to amend the return, but it is not proving easy to do on Turbo Tax.

I was an early user of TT, and it used to be so easy to see what the program was doing with my answers. I find myself increasingly frustrated with current form of the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

I agree, Cliff Thurber. Turbo Tax should have issued a payment coupon like it does for estimated taxes with the deadline for payment. What's really frustrating is that we don't owe a lot, but it's very difficult to pay it so it credits correctly. The IRS letter has all sorts of warnings about how they will misapply it if we don't do it right. We really could use some help from Turbo Tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

Thanks @AnneS4. I didn't file particularly early, but I would be shocked if I saw those screens and didn't remember at all! I will be calling the IRS tomorrow to get clarification on how to make the payment and will post their answer here. Fingers crossed I can actually get an answer! -- Cliff

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

No matter if you intended to do it or not you are on the hook to pay the deferred taxes as required ... the fact that TT didn't tell you how to do this is because the IRS just recently posted that information since they had to figure it out themselves and program the system to handle this unique change ...

The IRS is just now sending out reminder letters about this repayment and the specifics on how/when to pay them. You can wait for your notice or go online ... they recently published instructions ...

This link has the information needed for the Self Employed - https://www.irs.gov/newsroom/how-self-employed-individuals-and-household-employers-repay-deferred-so...

How individuals can repay the deferred taxes

Individuals can pay the deferred amount any time on or before the due date. They:

- Can make payments through the Electronic Federal Tax Payment System or by credit or debit card, money order or with a check.

- Should be separate payments from other tax payments to ensure they are applied to the deferred tax balance on the tax year 2020 Form 1040 since IRS systems won't recognize the payment for deferred tax if it is with other tax payments or paid with the current Form 1040.

- Should designate the payment as "deferred Social Security tax."

Individuals making deferred Social Security tax payments in EFTPS should select 1040 US Individual Income Tax Returns and deferred Social Security tax for the type of payment. They must apply the payment to the 2020 tax year where they deferred the payment. Taxpayers can visit EFTPS.gov for details.

How to repay the deferred taxes for employers:

Employers can make the deferral payments through the Electronic Federal Tax Payment System or by credit or debit card, money order or with a check. These payments must be separate from other tax payments to ensure they applied to the deferred payroll tax balance.

https://www.irs.gov/newsroom/what-employers-need-to-know-about-repayment-of-deferred-payroll-taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

I'm retired (75 years old) and don't pay SS taxes anymore. So why am I being told that I will receive a W-2C for deferred SS taxes? My W-2 is for life insurance greater than $50,000 that my past employer pays for. They did not take our SS taxes, but that shouldn't matter since I am no longer required to pay SS taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deferred Social Security Taxes

That is not true ... just because you get SS benefits doesn't make you immune to paying FICA taxes on something reported on a W-2 ... the box 12 codes M & N are for the "uncollected" FICA taxes on the life insurance the company pays for. So all you need to do is enter the W-2 as printed and the program will do the rest.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jsolum

New Member

OhioGene

New Member

IPutman

Level 2

drobin909

New Member

Dunface

New Member