- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Death of Spouse - What to be aware of?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Death of Spouse - What to be aware of?

Spouse passed last year in Nov. still trying to get everything in order as accounts and funds begin to settle.

He was a former Air Force Retiree as well as post office with pension in both. I'm trying to understand when I file taxes this year. What should I be aware of? I currently take care of my grandchildren and file them as dependents. What things should I be aware of to mark on this years tax return? Do I still file married since he passed in Nov. If so where do I mark that he passed in that time? Do I mark head of household this year? or Next year? Are insurance payouts taxed? if so how?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Death of Spouse - What to be aware of?

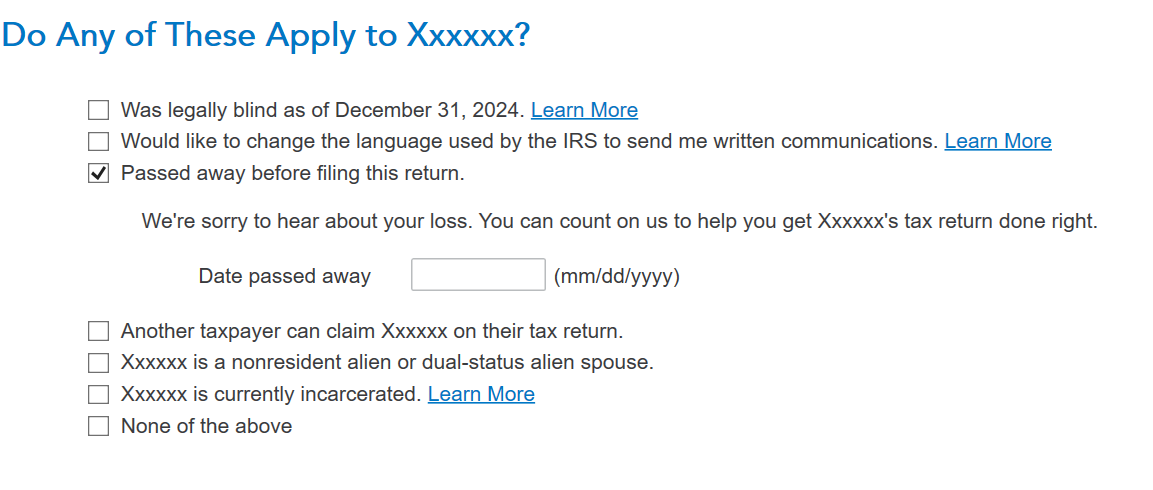

For 2024 you will file a joint return and there will be a question in TurboTax in the Personal Info section where you can check a box indicating that your spouse passed away before filing the return. Once you've checked that box, you will be asked to enter the date of death.

Next year, since you have qualifying dependents, your filing status will most likely be "Qualified Surviving Spouse" and then in years following your filing status will likley be Head of Household. Each year, TurboTax will ask you the questions necessary to determine the appropriate filing status based on current tax law and your circumstances for that year.

The screen that you will be looking for this year will look similar to this one:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Fasi

New Member

jeeps

New Member

jschoomer

Level 3

CW62

Level 1

cynthiawayne12

New Member