- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Covid 19 Stimulas checks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Covid 19 Stimulas checks

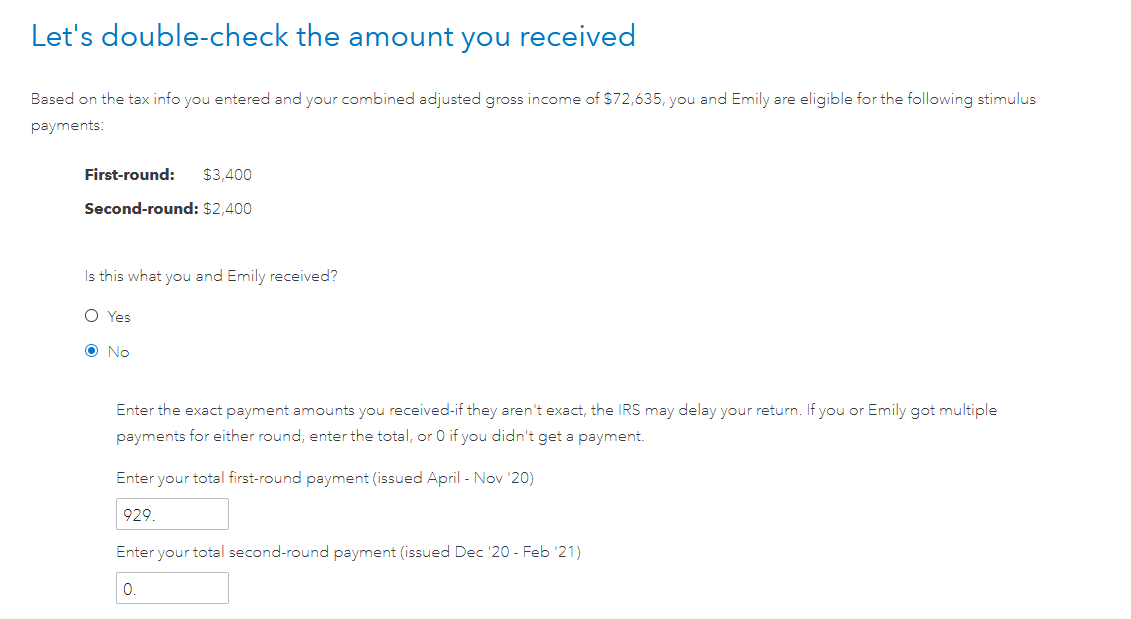

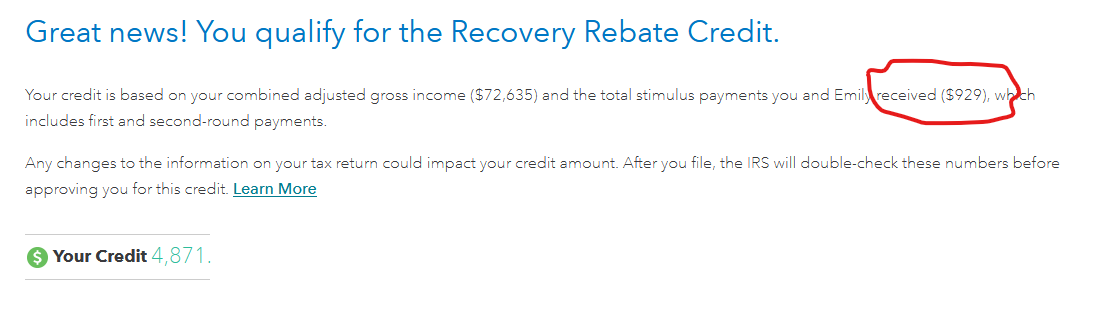

We only received 1 stimulus check for 929.12 in 2020, Turbo Tax is giving us the whole 2400.00 automatically.

I've put in $0 in the second box but it still wants to give me the whole $2400.00. ???

Windshadow

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Covid 19 Stimulas checks

You should be able to enter the amount received for each payment and this will decrease the Recovery Rebate Credit on your return. We don't have specific information on the income qualifications or procedures for the third stimulus payment because the measure hasn't been passed yet. However, If you had issues receiving your earlier stimulus, then the best way to ensure that you are one of the first to receive any future stimulus payments is to file your 2020 tax return as early as possible and use direct deposit so that the IRS will have your updated information.

You can find the most up to date information from the IRS here, and updates from TurboTax here as they develop.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Covid 19 Stimulas checks

where do you put in the amount received for stimulus check. Is it considered income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Covid 19 Stimulas checks

It is not considered taxable income.

The questions in the Recovery Rebate Credit portion of the TurboTax software will assist the software in determining how much you are entitled to receive based on at least the first and second stimulus checks.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JoannaSmith

New Member

hornbergermichael555

New Member

Garyb3262

New Member

NancyWolfe

Level 2

slabz

New Member