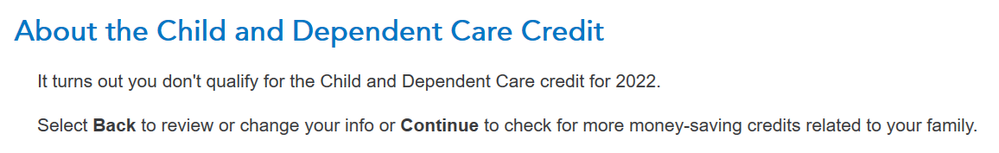

When completing the "Child and Dependent Care Credit" section, Turbotax asks me if my spouse was either disabled or a full-time student b/c my spouse did not meet the minimum $6,000 earned income requirement. I answered "none of the above" and so Turbotax gives me the following message:

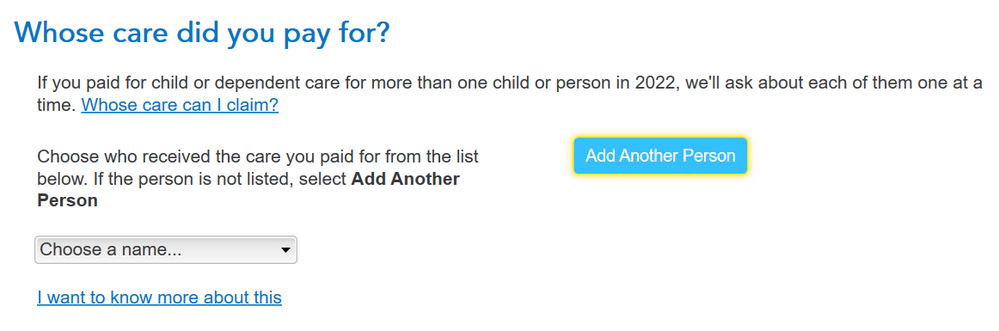

That makes sense to me. What doesn't make sense to me is that I then hit the "Continue" button and Turbotax starts asking me whose care I paid for:

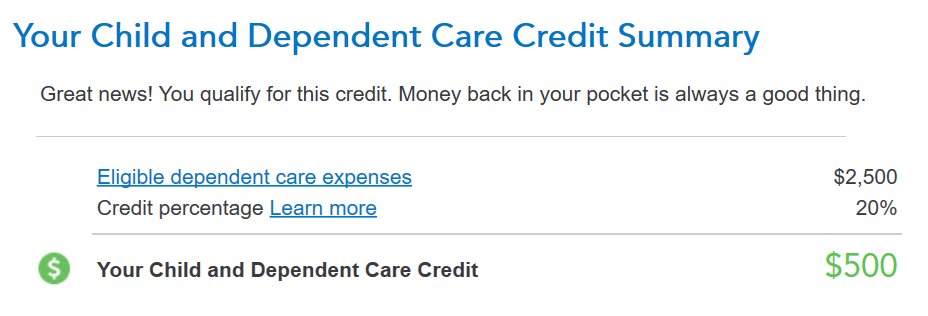

We did technically send our child to preschool for the year so I went ahead and entered the requested info and now Turbotax has decided to give me a 20% credit on those expenses. Is this credit somehow different than the "Child and Dependent Care Credit" I was told we didn't qualify for in the first image above? It seems like this new credit is also called a "Child and Depended Care Credit" too? Any help is greatly appreciated.