- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Capital Loss Carry Over - Help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Carry Over - Help

Hi - I'm working on my Capital Loss Carry over, and it's asking for form 6251 from my 2020 taxes. I do not have form 6251 from my 2020 taxes.

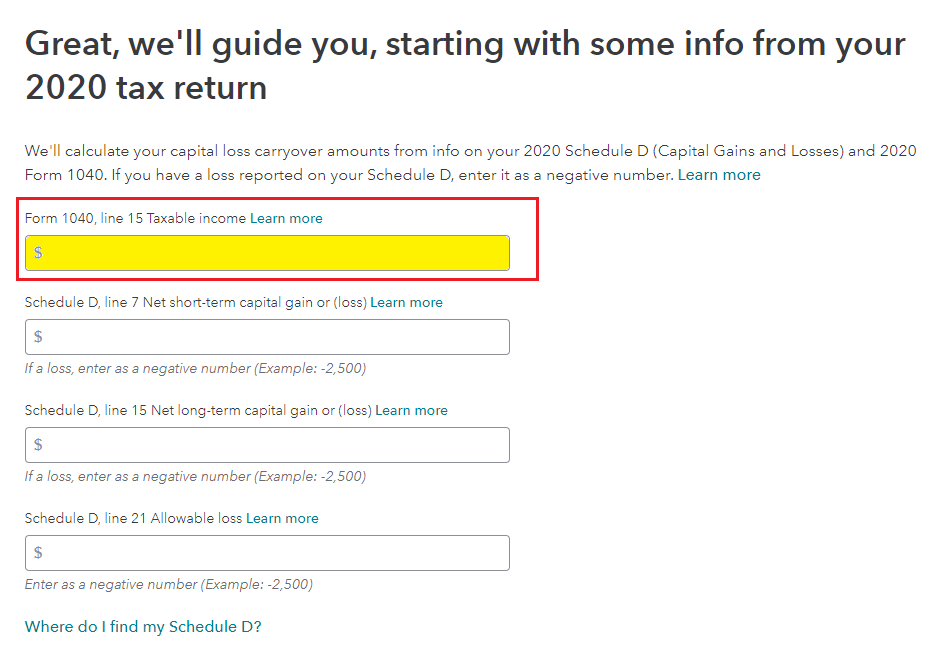

I'm trying to figure out what I am supposed to put in this box.

In the "On Demand Tax Guidance", it sayd you can use your "regular" taxable income from 2020 Form 1040, 10.

I do not have anything in line 10.

If someone can help, I would appreciate it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Carry Over - Help

The taxable income figure from your 2020 tax return is found on line 15, Form 1040. This is the figure you need for your entry when entering your capital loss carryover. Once you have that information you can proceed to complete your capital loss carryover.

- The image below if from TurboTax Online version. I will review TurboTax CD/Download as well.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Loss Carry Over - Help

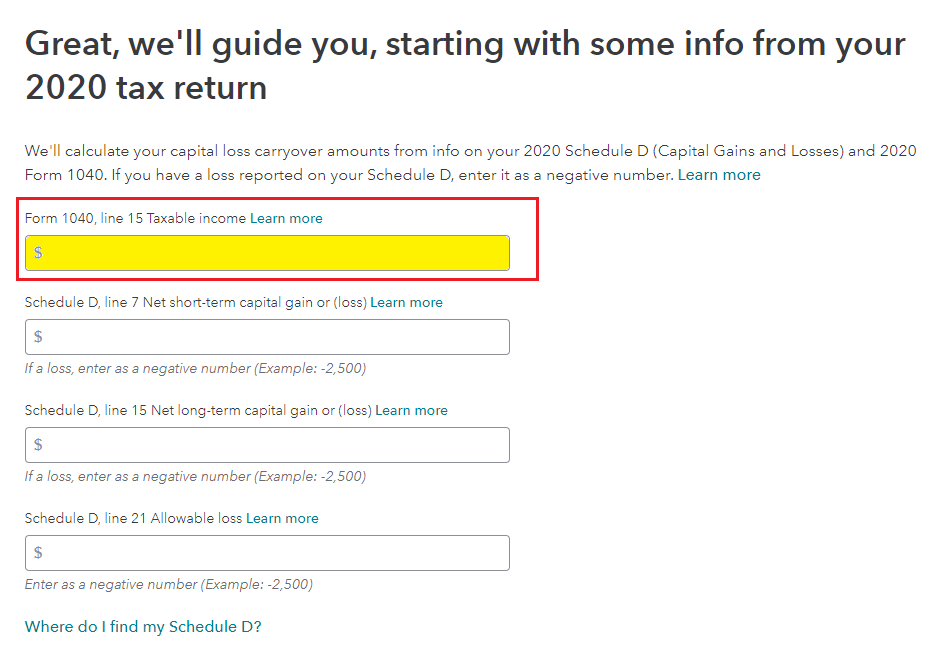

The taxable income figure from your 2020 tax return is found on line 15, Form 1040. This is the figure you need for your entry when entering your capital loss carryover. Once you have that information you can proceed to complete your capital loss carryover.

- The image below if from TurboTax Online version. I will review TurboTax CD/Download as well.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ianm12

Returning Member

user17720739034

New Member

gaurav-mishra-dce

New Member

user17720612194

New Member

ebroadhurst

Returning Member