- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Capital gains seems wrong

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains seems wrong

Line 6 on 1040 says capital gains are $6,177

Schedule D line 8b says long term capital gains are -$37 which reflects two investment sales.

BUT, line 15 says net long term capital gains are $6,177 which goes to line 6 on 1040

I did have some taxable distributions from IRA's and those show up on line 4b on 1040

Form 8949 shows gains as -$37

I simply cannot understand where that capital gain of $6177 comes from.

Any help out there? Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains seems wrong

The amount on line 15 of Schedule D includes:

- Long term capital gains or loss.

- Gains from Form 4797, Part I (sales of business property)

- Long term gains from installment sales.

- Long term gains from Forms 4684, 6781, and 8824.

- Long term gains from K-1 forms.

- Capital gains distributions from 1099-DIV, box 2a.

- Capital loss carryover from prior years.

The easiest way to figure it out is to check boxes 11, 12, 13 and 14 on Schedule D. The two most overlooked items are gain from business property, which can be just trading in a car used for business; and capital gain distributions from 1099-DIV.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains seems wrong

The amount on line 15 of Schedule D includes:

- Long term capital gains or loss.

- Gains from Form 4797, Part I (sales of business property)

- Long term gains from installment sales.

- Long term gains from Forms 4684, 6781, and 8824.

- Long term gains from K-1 forms.

- Capital gains distributions from 1099-DIV, box 2a.

- Capital loss carryover from prior years.

The easiest way to figure it out is to check boxes 11, 12, 13 and 14 on Schedule D. The two most overlooked items are gain from business property, which can be just trading in a car used for business; and capital gain distributions from 1099-DIV.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains seems wrong

My issue is pretty simple. I'm trying to see how my capital gains rate is 0%. My wife and I are well below the taxable income of $80,000 (more like 36,000). We had $14,003 in long term capital gains. TurboTax figured our tax to be $1796. Then I went back and changed the basis of our stock sales to render a zero ($0.00) long term capital gain, to see what would happen. I changed nothing else. With this the only change, TT figured our tax to be $613. Taxable income was significantly lower. How can this be, if we are supposed to be paying 0% on capital gains? Is TurboTax wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains seems wrong

I did this calculation using multiple scenarios, and TurboTax seems to handle it well. The form that the calculation ids done on is Qual Div/Cap Gn.

As a married couple the benchmark earnings is $80K. If you have earned income less than $80K, and you have Long Term Capital Gains. A portion or all of the LT Capital gain will incur zero tax.

Example: A married couple has an income of $85,000 from wages, social security, retirement income etc. They also have $25,000 of long term capital gain.

On you tax form 1040:

- Line 9 Total income: $85K + $25 K = $110

- Line 14 Standard deduction = $20,800

- Line 15 Taxable Income = $110,000 - $20,800 = $89,200

- This calculation is done on Qual Div/Cap Gn

- Taxable earned income: $89,200 - $25,000 (L/T) = $64,200

- Tax from tax table on $64,200 = $7,306

- Exempt L/T Gains: $80,000 - $64,200 = $15,800

- Taxable L/Y: $25,000 - $15,800 = $9,200

- 15 % tax on $9,200 = $1,380

- Line 16 of 1040: $7,306 + $1,380 = $8,686

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains seems wrong

That all seems fine, but it is not reflective of our situation. As a married couple filing joint return, our taxable income is well below the $80,000 threshold. As I mentioned in my query, I figured our tax with the capital gains included, and we were still well under the $80,000 threshold, and I came away with figure X. I then excluded the capital gains (and only the capital gains) and income was even lower, and our tax was over $1000 less.

No amount of calculations and line entries can refute the fact that, assuming TurboTax is correct, by reporting around $13,000 of capital gains, we incurred an increase of over a $1,000 in taxes. It really is as simple as that. What I don't know is how are my taxes calculated--from a table or from a rate schedule. TurboTax doesn't tell me that.

If you like, I can share the line numbers from our return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains seems wrong

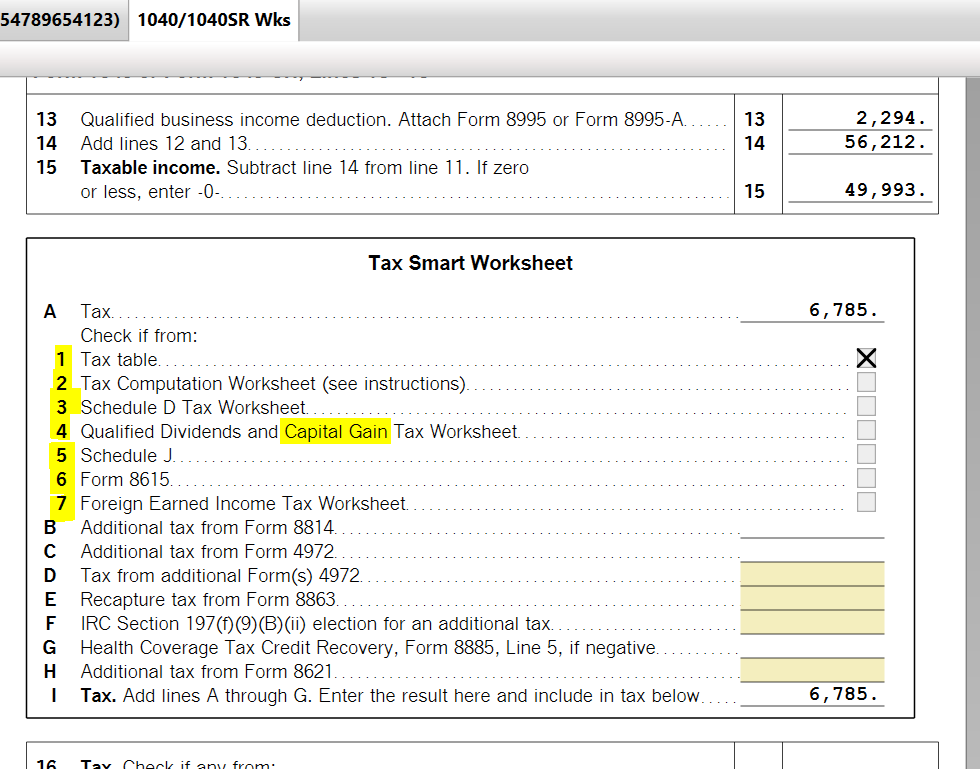

Some of your tax is computed from the tax table but your capital gains tax is calculated from a rate schedule. To see the details of the tax calculation, look at your Form 1040 Worksheet. About a third of the way down, you will see Tax Smart Worksheet which will detail how the tax was calculated. In my example below, only the tax table was used. But on your worksheet, you will see an X in one of the other options 1-7. @Matthew0304

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains seems wrong

I have capital gains on long term investments however they don't appear on schedule D. What is wrong?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ch-t-chandler

New Member

r8rgirl

New Member

wrightjoyce740

New Member

jmk199302

New Member

jx6m121198

New Member