- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Can someone please explain certain numbers in a TurboTax Student Worksheet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone please explain certain numbers in a TurboTax Student Worksheet?

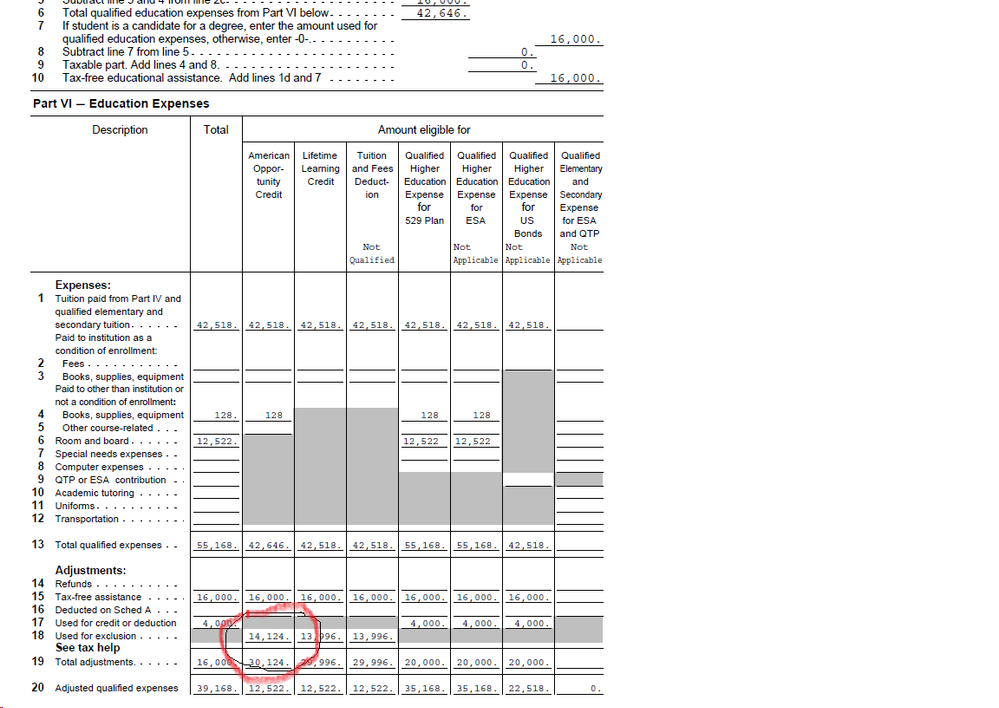

I attach an image at the bottom of this post of a relevant part of my student's information worksheet related to education expenses.

The input numbers (provided via the interview process) are:

Tuition and related expenses: 42,518

Book: 128

Room and Board: 12,522

Scholarship: 16,000 (non taxable)

When I look at the generated Student Information Worksheet (image attached at the bottom) I cannot understand the number $14,124 in item 18 "Use for exclusion" in the column for AOTC. I don't know how it was arrived at. I thought it should be $4000/-, the exclusion for taking the AOTC (just as it is for the 529 plan - see three columns over).

Please can someone explain how this number ($14124) was arrived at?

Any help would be appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone please explain certain numbers in a TurboTax Student Worksheet?

I can;t figure it out either, but it really doesn't matter, expenses for AOC are capped at $4000 in any event

look at line 27 for the IRS form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone please explain certain numbers in a TurboTax Student Worksheet?

Thanks for your response @NCperson and apologies for my belated reply.

Yes, I do realize that the max cap on AOTC is 4000/- and, indeed, on another child's student worksheet, the number in row 20 ("Adjusted qualifying expenses") is 4000/-

While it does not make any practical difference to the overall credit obtained and the form filed, it worries me that there is a calculated number in a worksheet which cannot be adequately explained.

Is there a way to get TurboTax to respond to this issue? Or are there other members in the community who also have this problem?

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone please explain certain numbers in a TurboTax Student Worksheet?

I have the same question about Line 18. How is the Used for Exclusion adjustment value derived? Is there an income phase out in effect? If so I'd like to understand how it works.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone please explain certain numbers in a TurboTax Student Worksheet?

No, that line does not relate to an Income Phase-out.

The number on Line 18 of the TurboTax Student Info worksheet relates to the amount of income you reported to be "Excluded" from tax for education purposes.

The amount on Line 18 of the TurboTax worksheet is usually derived from an entry of a 1099-Q reporting a distribution from a 529 or other education savings account.

Please see this TurboTax Tip regarding Form 1099-Q

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mdktech24

Level 3

user17674020775

New Member

Sherry B

Returning Member

kudoqs

Returning Member

Handyman

Level 2