- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone please explain certain numbers in a TurboTax Student Worksheet?

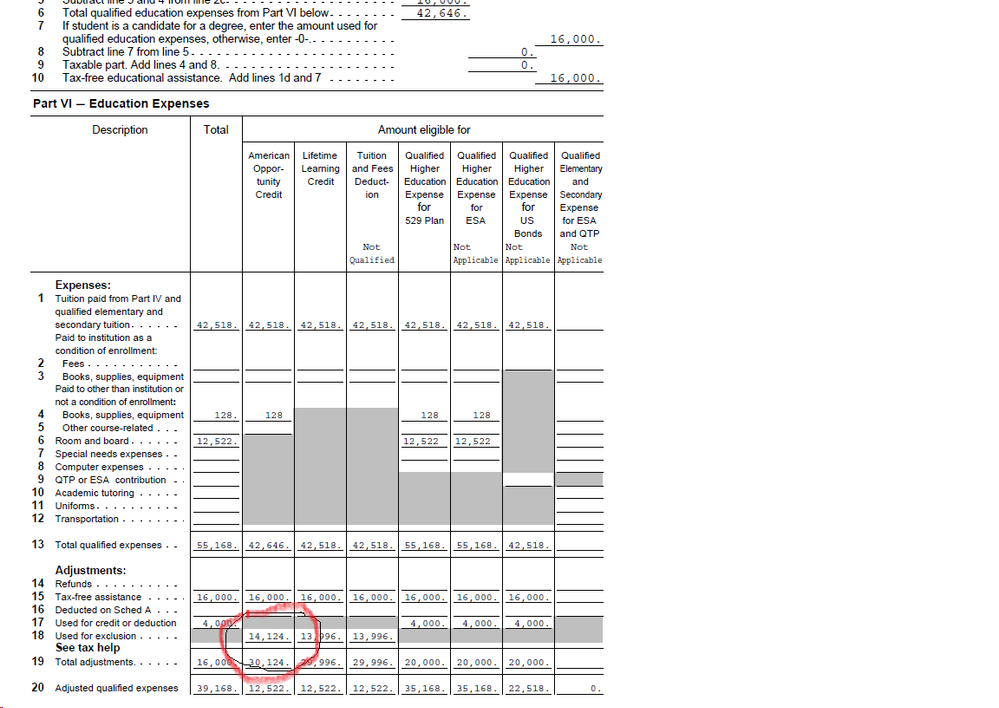

I attach an image at the bottom of this post of a relevant part of my student's information worksheet related to education expenses.

The input numbers (provided via the interview process) are:

Tuition and related expenses: 42,518

Book: 128

Room and Board: 12,522

Scholarship: 16,000 (non taxable)

When I look at the generated Student Information Worksheet (image attached at the bottom) I cannot understand the number $14,124 in item 18 "Use for exclusion" in the column for AOTC. I don't know how it was arrived at. I thought it should be $4000/-, the exclusion for taking the AOTC (just as it is for the 529 plan - see three columns over).

Please can someone explain how this number ($14124) was arrived at?

Any help would be appreciated.

March 8, 2019

7:47 AM