- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Can sales tax deduction encompass two states?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can sales tax deduction encompass two states?

We have recently constructed our new primary residence in TN (Cert of Occupancy 12/20/19). TN has a 9.75% sales tax and we have accumulated over $10k in sales tax for items for the new home. Our MD state tax deduction as less than $6k. Does the same rule of "one or the other" (state or sales) apply if it involves two states?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can sales tax deduction encompass two states?

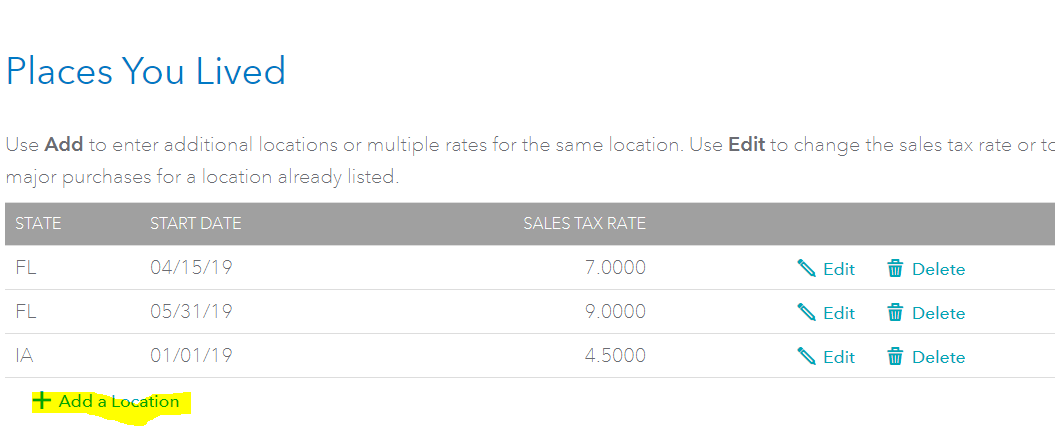

Yes, you can add more than one taxable location into TurboTax. Here is how:

- While in your Tax Home,

- Select Search in the top right corner of your screen,

- Enter Sales Tax Deduction,

- Select Jump to Sales Tax Deduction,

- Select Easy Guide,

- On this screen you will be able to add all your locations, and in subsequent screens you can add major purchases to the location.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can sales tax deduction encompass two states?

These instructions do not work on Delux. I need to input data for two states but when I click Add A Location the app assumes it's another location in the same state!

We just did the updates and it still only allows one state!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TEAMBERA

New Member

itsagirltang69

New Member

phillips_lp

New Member

cindy-zhangheng

New Member

av8rhb

New Member