- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Can anyone advise on how to input LT care insurance premiums?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can anyone advise on how to input LT care insurance premiums?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can anyone advise on how to input LT care insurance premiums?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can anyone advise on how to input LT care insurance premiums?

To enter your long-term care premiums:

- Open or continue your return. Make sure you are signed in for link in Step 2 to work.

- Navigate to the Schedule A section:

- TurboTax Online/Mobile: Go to Schedule A or click magnifying glass to Search for Schedule A, then select the Jump to link.

- TurboTax Desktop: Search for Schedule A, then select the Jump to link.

- Proceed through the medical expenses section and go past the Tell us about anything paid for long-term care services screen. This screen is for actual care expenses, not insurance premiums.

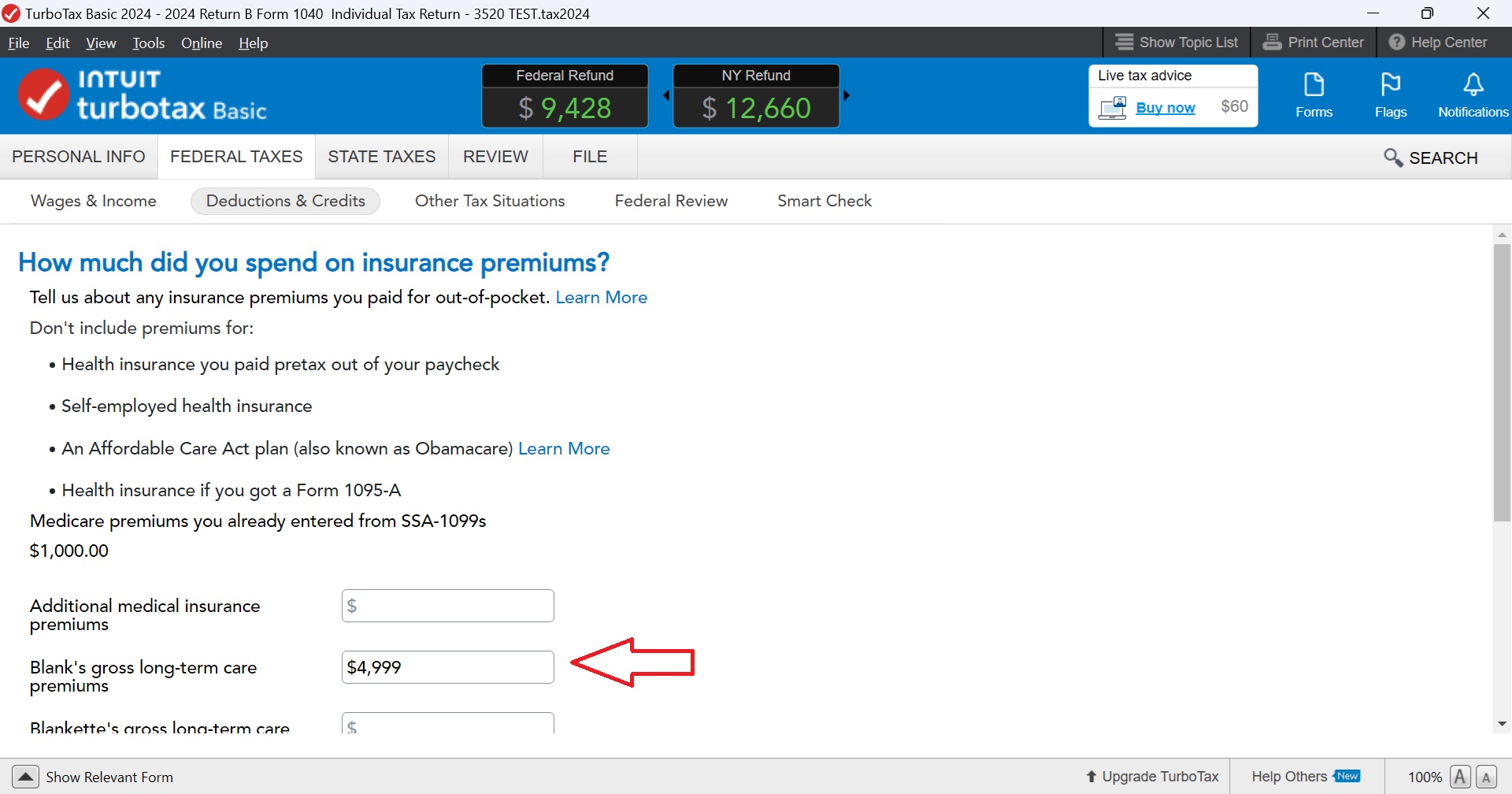

- When you reach How much did you spend on insurance premiums?, enter your gross (total) long-term care premiums.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can anyone advise on how to input LT care insurance premiums?

Thanks but I have tried that many times without success. Also tried to input the amount into my NY return (credits section) and that did mot work either. Simply cannot get the software to recognize these premiums to reflect the NY credit which I qualify for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can anyone advise on how to input LT care insurance premiums?

So when you did what Sabrina suggested ( the LTC premiums on Schedule A for LTC premiums specifically), did TurboTax create an IT-249?

Things that might prevent this from appearing to work:

1. Individual taxpayers (including nonresident and part-year resident taxpayers) may claim the credit only if the taxpayer’s New York adjusted gross income is less than $250,000.

2. This is a non-refundable tax, so if you have no tax to apply it against, the credit will not appear.

3. You didn't enter it in the right place on Schedule A - see image

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amy

New Member

user17524531726

Level 1

jenneyd

New Member

swick

Returning Member

jackkgan

Level 5