- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- California Small Business COVID-19 Relief Grant

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

I am a sole proprietor that received a California Small Business COVID-19 Relief Grant. How do I enter this into TurboTax iPad?

I have read on blogs that it is taxable for Federal but not taxed in California.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

You should receive a 1099-MISC from the state which you will includes as business income. When you get to the state return, you will be able to subtract out the income- look for the screen below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

You should receive a 1099-MISC from the state which you will includes as business income. When you get to the state return, you will be able to subtract out the income- look for the screen below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

You are amazing! Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

Same situation, but instead of a 1099-MISC I received a 1099-G. This seems like it would be entered under Personal > Personal Income > Other Common Income > Other 1099-G Income. The "More Info" link says this includes taxable grants, and the value of the grant is in box 6 (taxable grants). So is then then treated as personal income and not business income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

@ RMenschel Yes, you are correct in that the Form 1099-G you received should be entered in the Other Common Income section of TurboTax, although, depending on your situation, you may have to enter such income another way which we discuss below. As a way of background, federal, state, or local governments will send a Form 1099-G if they made payments of:

- Unemployment compensation.

- State or local income tax refunds, credits, or offsets.

- Reemployment trade adjustment assistance (RTAA) payments.

- Taxable grants.

- Agricultural payments.

Because it appears that you received a taxable grant, then Form 1099-G was the correct form to send you. Whether this taxable grant is just other income or part of your business income depends on your particular situation. For example, if you received the taxable grant not in connection with any business that you owned or operated, then the taxable grant will be treated as other income, and will appear on your Schedule 1, Line 8, and it will also appear on your Form 1040. You will pay tax on this taxable grant at whatever your applicable tax rate is.

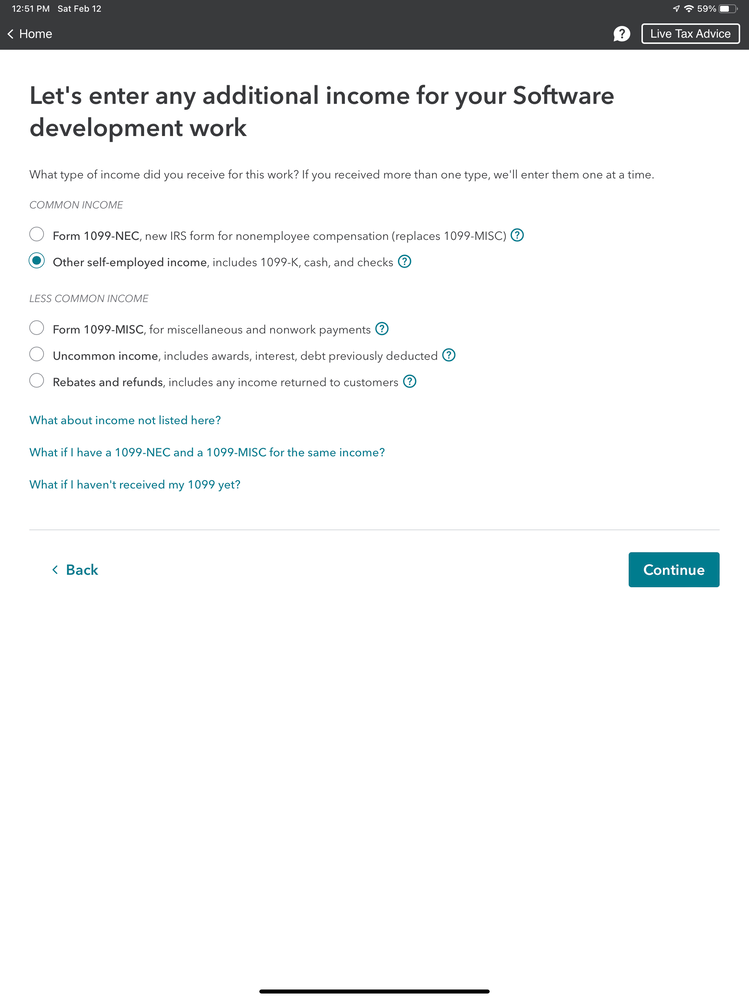

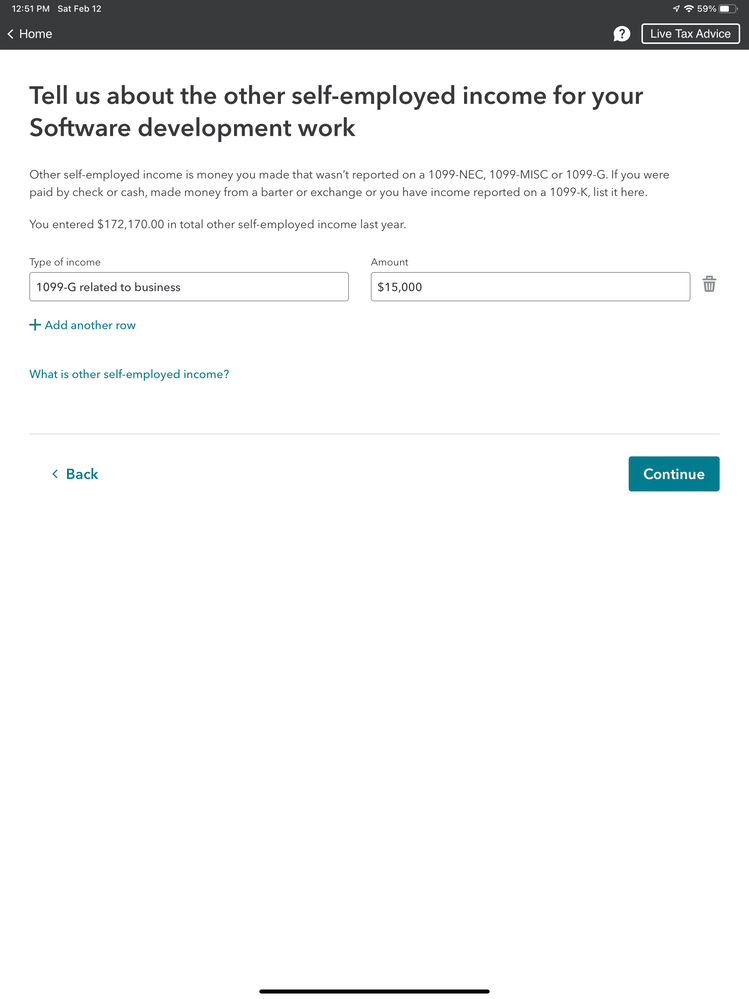

However, in the event you received the taxable grant in connection with your business, and in your business you are required to file a Schedule C, Profit or Loss From Business, Schedule C-EZ, Schedule E, Schedule F or Form 4835, then in that case, you would instead report the taxable amount allocable to the activity on the appropriate schedule or form. In other words, the taxable grant would not be treated as other income but would be considered business income, and you would enter the taxable grant in the Business Items section of TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

Yes, this taxable grant was specific to the business. And by moving it to the business section under other income rather than personal other income, I qualified for a QBI deduction, which I did not receive when it was entered as a personal 1099-G.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

It turns out I received a 1099-G as well. It is related to my business. I worked as a consultant for a previous employer.

Q1. Did I enter the information correctly?

Q2. QBI asks if all of the work is for a previous employer. Is the grant part of the previous employer . Do I mark ALL or SOME on QBI?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

Yes, that is the correct way to enter it @imgritz.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

I have a S corp. The business received the 1099 G for CA Relief Grant. Do I enter as business income or other income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

A follow up question. Since I have a S corp and received the 1099 G for CA COVID relief grant, I used Turbo Tax Business Version, do I just include the grant amount to my business income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

Yes, on the S-Corp 1120S you would include the grant amount as "Other income."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

Hello,

I'm using Turbotax Home & Business. I have a Covid Relief Grant in CA, which I understand by reading all the posts should be entered on my Schedule C as I'm self employed and a Sole Proprietor. My choices are General Business income and it says for sale or services not reported on 1099-Misc, 1099-NEC or 1099-G. The other choice is Other Income with examples of bad debt, cash prizes, interest earned on notes. I'm not sure which I should use to enter the Grant. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

Please use "Other Income" and enter Grant 1099-G as the description.

General Business Income would be for income you earned.

Other Income better covers the Grant as income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

What if you are using TurboTax Desktop Home & Business? The options compared to online are different. I have General Income or Other Income and it does pull it into my CA State portion, which I understand it's not State Taxable. I would appreciate any help. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California Small Business COVID-19 Relief Grant

Yes, you still enter your grant in the Federal section as other income.

When you start your state return you will be asked about all of the Covid grants by name. Just enter the amount you received when you get to the appropriate page and it will be adjusted on your state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ripepi

New Member

israelloera00

New Member

fkinnard

New Member

john

New Member

aubutndan

Level 2