- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Calculating gain/loss from sale of MLP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

@tagteam @nexchap I want to thank you guys again for help last year.

Several years back, I bought a stock called MIC. In 2021, MIC converted to a MLP (master limited partnership). Per the instructions in the 2021 K-1, the conversion was treated as a "disguised sale". which meant I had to treat it like I sold the stock and bought the MLP on the conversion date After some discussion on the forum, I determined my basis for the MLP was the "Capital Contributed During the Year" shown on the 2021 K-1.

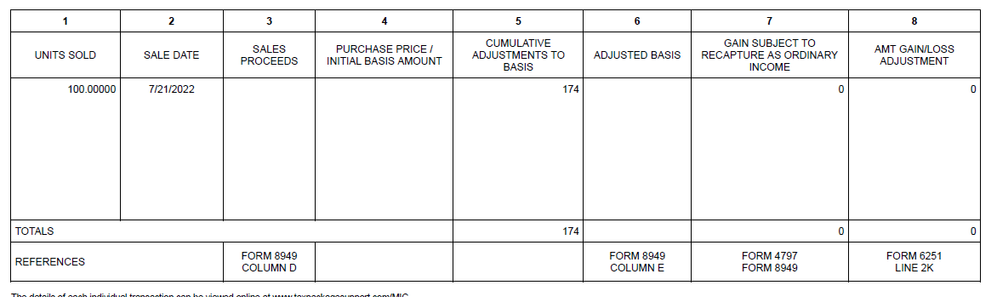

In 2022, the MLP sold it's assets and I was cashed out. Everything so far has been fairly straight forward, with the exception of the data in column 5, "Cumulative Adjustments to the Basis". I am not sure what to do with this amount. Incidentally, it is about 80% of my basis amount.

The K-1 contained this statement:

Column 5: Your Cumulative Adjustments to Basis includes your cumulative allocable partnership income, deductions, distributions, etc. and has not been adjusted for any gains recognized under §731 or §737. If you were allocated excess business interest expense, you may be able to add back this amount to Column 5 if you sold all or substantially all of your units. For additional guidance please consult your tax advisor.

Any suggestions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

@poncho_mike With an MLP your basis changes throughout your ownership. Now that you've sold, you'll need to adjust the basis you're using on your 1099-B to reflect the adjustments given you on Col 5. This will obviously increase your Cap Gain. But that increase will be offset by the suspended losses you'll also be showing on Sched E, as well as any distributions (which were untaxed) you received while you owned it.

On the reference to EBIE: some partnerships may have shown an EBIE deduction on the K-1. You probably weren't able to get any credit for that, but if this partnership reported that its also included in the Cum Adjustments. So you could add that back to column 5.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

I went to my 1099-B and the data is very wrong. When MIC transitioned from a listed stock to a MLP, it was not reported as a sale on the 2021 1099-Composite and the ticker symbol did not change. The 2021 K-1 said to treat the conversion as a "disguised sale". which I did with the help of this forum and a retired CPA. A sizable distribution was reported on the 2021 1099 Composite that was not taxed. II calculated my profit as the sale price minus purchase price plus distirbution. My basis in the MLP was established by the cash in at what is best described as a "disguised purchase" (my term, since I didn't actually buy it.

There have been no distributions from the MLP in 2022. In 2021, it paid some qualified dividends. The MLP basically sold it's holdings off and shut down. To me, it seems fairly straightforward, the cash in in 2021 was the purchase price. The sale price in 2022 is my sale. I'm not seeing where the adjustments come from. I checked my 2021 1099-B and saw no distributions, only the qualified dividends. I also have no distributions shown on the 2022 1099-B.

On my 2022 1099-Composite, the sale of MIC was reported as significant loss. In reality, it was fairly profitable. I imported the data from Ameritrade and deleted the transaction, then entered the data treating it as a sale of a MLP. I tried to understand where the adjustments number came from and called Ameritrade, and they tell me they report it based on the information fed from the MLP. Will the IRS scrutinize my return because Ameritrade reported it as a stock sale, but I reported it as a MLP sale on the K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

"the conversion was treated as a "disguised sale". which meant I had to treat it like I sold the stock and bought the MLP" as you surmised your beginning tax basis in the MLP was the "sales price of the stock" since gain or loss should have been recognized on the stock sale.

MLP and PTP reporting k-1 and 8949

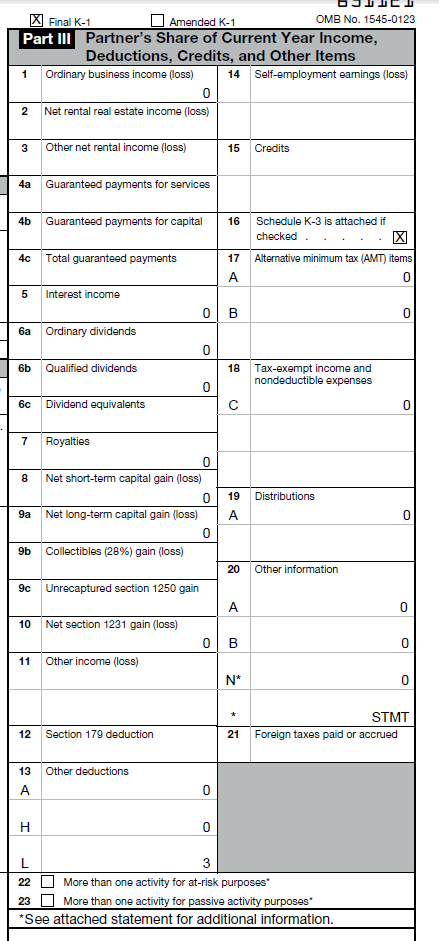

Please follow these instructions. Incorrect entries can result in entering the sale twice or otherwise incorrectly. Also see the sales schedule that was included with the k-1

Enter the k-1 info

Check the PTP box

If total disposition proceed as follows:

Check final K-1 (s/b marked on actual k-1)

Check sold or otherwise disposed of entire interest

On the k-1 disposition section for sales price use the ordinary income (sometimes you’ll see a column with the “751” or the words “Gain subject to recapture as ordinary income” or similar wording. This info comes from the supplemental sales schedule that should have been provided. It's also now on the k-1 box 20AB - no 20AB, no ordinary income column then then sales price is zero. The numbers I’m using represent the line numbers in forms mode (desktop only)

- Sales Price = line 20AB (1065 k1)

- Selling expenses = 0

- Basis = 0

- Gain is computed and should be same as the sales price.

- Ordinary gain = enter same as sales price

This amount flows to form 4797 line 10 and is taxed as ordinary income. This step is necessary, so any suspended passive losses are now allowed.

10,11,12 should be blank

Now for the 8949.

The broker’s form is probably coded as B or E – sales proceeds but not cost basis reported to the IRS. This is because the broker does not track the tax basis. It used what you paid originally which is not correct.

The correct tax basis is:

What you paid originally, should be the same as what is on 1099-B as cost,

Then there is a column on the sales schedule that says cumulative adjustment to basis. If it’s positive add it to the original cost. If it’s negative subtract the amount.

Finally add the amount of ordinary income reported above, if any.

The result is your corrected cost basis for form 8949.

Some other things. Look at lines 20AB. That number should be added to the ordinary income above for reporting the 199A (qualified business income from the PTP). You don’t have to enter this but then you lose out on a tax deduction = 20% of this amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

@poncho_mike A couple things:

- Your broker does not see the K-1, or the details of the MLP, so has no idea what the correct cost basis is. They should be reporting to the IRS with box B/E checked, basically saying that they're only reporting revenue because they don't know cost. If they're doing that, there's no disconnect for the IRS to look at. If they're reporting with code A/D though, then you may want to get them to correct that.

- Its worth figuring out, at a high level, what amount of income you should be paying tax on. Then you can make sure TT is reporting correctly. Blindly plugging numbers into TT and "hoping" its correct doesn't always give good results.

- Overall, you pay tax on cash out (sale, distributions) - cash in. You can go back and look at all the cash you invested (before it was a partnership as well as during the partnership phase), any distributions, and your current sale.

- Once you know the total amount of income you should be paying tax on (for the whole period of ownership), and you back out the amount you've already reported on prior returns, you should have a pretty close idea of what you need to have show up on this return.

- When you complete this return, your final income is going to show up primarily in 3 places: your cap gain/loss (Sched D), any suspended losses that are released (Sched E), and any Ord Income (form 4797). The may also see small amounts if any of the K-1 items were reported directly on Sched B/D and taxed.

- The instructions for entering the sale have been posted many times, so if you follow them and the income makes sense given the above, you're probably good.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

I'm still struggling with this.

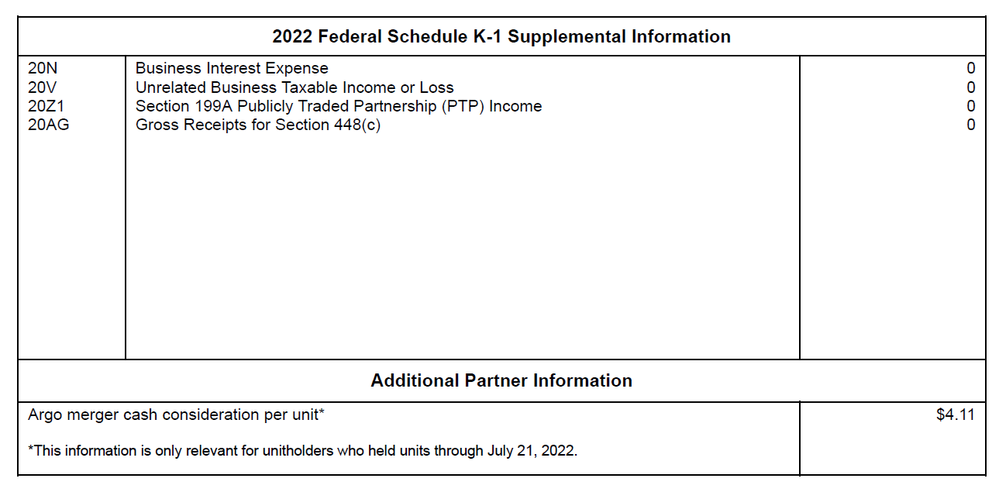

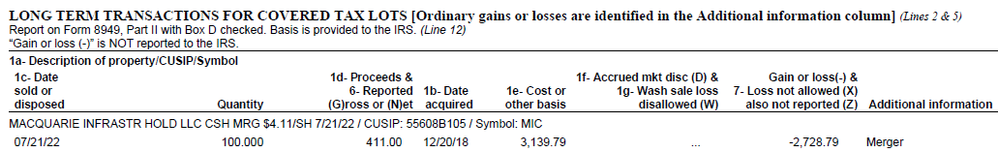

Here are some snapshots from the K-1 and the 1099.

I bought 100 shares of MIC about 5 years ago for $3139.79 as a stock. It converted to MLP in September 2021. When it converted to a MLP, it paid out a $3700+ distribution. On my 2021 taxes, I reported a sale of the stock and had capital gains and qualified dividends.

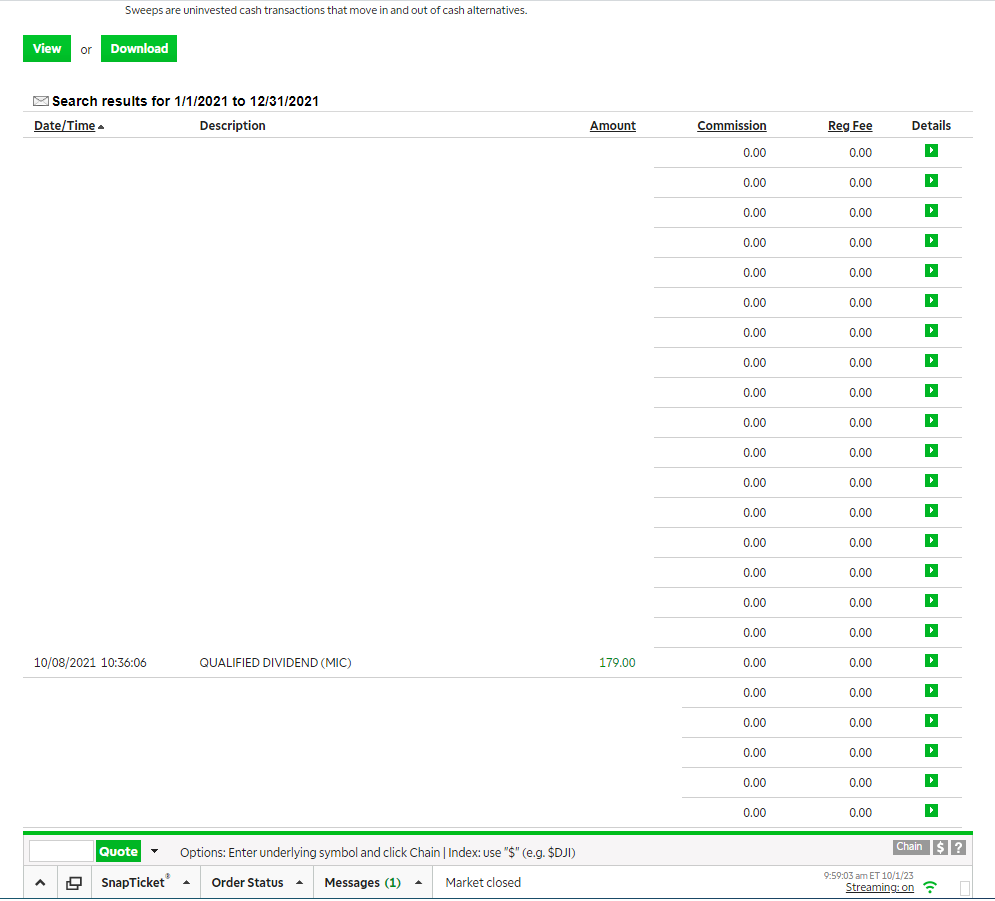

As an MLP, I show the basis in the MLP was $191 and it paid me $179 in qualified dividends in 2021, which I paid taxes on.

My K-1 and 1099 does not show any partner distributions in 2022, The sales price was $411.

If I understand the snippet from Ameritrade, the sale was reported with Box D checked.

Your statement "

Overall, you pay tax on cash out (sale, distributions) - cash in. You can go back and look at all the cash you invested (before it was a partnership as well as during the partnership phase), any distributions, and your current sale."

When I treated it as a disguised sale on my 2021 taxes, I reported a hefty capital gains and paid taxes. I would assume that I only look at distributions and sales as an MLP since I've already paid tax when the conversion was done.

As a result, I'm currently reporting a basis of $191, a sale price of $411, no dividends, no distributions while a MLP. I'm still not sure where the box 5 data came front.

I apologize for being annoying, but this has been very confusing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

@poncho_mike Did you actually receive a check for $179 in 2021, or just report it on your taxes? I ask because the $174 adjustment, plus the $4.11 cash consideration, are suspiciously close to $179.

If you didn't receive a check, but had to pay tax, then that raises your basis (reduces your Cap Gain). That might explain the $174 (which is an increase in your basis). I don't know what the $4.11 is unless you actually received that as cash at some point.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

The $4.11 was the per share sale price (I owned 100 shares), which is where I came up with the sale price of $411. I also confirmed that $411 was credited to my brokerage account when MIC was sold in 2022. There were no other distributions made from MIC in 2022.

My brokerage account also shows a distribution of $179 in 2021 from MIC, so the $179 was paid out. There were no other distributions in 2021 after converting to a MLP shown on the brokerage statement for 2021. Unless I'm missing something, I received and paid tax on the $179 as qualified dividends in 2021 and received $411 from the sale in 2022, and nothing else.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

this is actually more complicated than you realize because of the MIC Hawaii situation which is how the $179 dividend arose in 2021 yet you got no cash. you need to find out the effect, if any, of the deemed sale of MIC Hawaii on your basis in the MIC stock, if any. That basis is what gets transferred to the MIC MLP. Only partnerships report 751 gain/loss to their unitholders upon sale. There could have been 751 income/loss in 2021 due to the sale of MIC Hawaii. If the partnership converted to a corporation effective 1/1/ 2022 there would be no 751 to report in 2022 because 751 doesn't apply to corporations. Look back at your 2021 tax report from the brokerage this may give you some idea of the tax consequences and maybe even your tax basis in the MLP was adjusted for MIC Hawaii. You might not see this on the tax reports only on your 2022 monthly statements

https://www.micinc.com/about/news/2021/mic-announces-completion-reorganization-llc.html

As part of the reorganization, the businesses comprising the Company’s MIC Hawaii segment were distributed to and became a direct subsidiary of Macquarie Infrastructure Holdings, LLC. For tax purposes, the distribution was deemed to be a sale of MIC Hawaii and unitholders were deemed to have received a distribution of the fair market value of MIC Hawaii. The fair market value has been estimated to be $3.25 per unit of which an estimated $1.79 per unit has been characterized as a dividend. No cash will be distributed to unitholders.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

So this is going to get more complicated. I received a qualified dividend of $179 in October 2021. See the attached screenshot of my brokerage account.

A little more background. MIC paid excellent dividends. After acquiring MIC, the company made the decision to start selling off it's operations. I received several special dividends, which were all reported as qualified dividends. When MIC converted to MLP in 2021, there was no transaction reported on my brokerage account and a large distribution was made that did not show up as a dividend. After consulting with the forum and a retired CPA, I calculated my profit assuming the distribution was an adjustment to the basis.

I've done all the math, and if you consider purchase price, dividends, and distributions, I still can't figure out what the $174 cumulative adjustment to the basis is for.

I applied the large distribution as an adjustment to the basis based on this information in the 2021.

"The Company distributed cash proceeds from the sale of a business to unitholders on October 7, 2021. A unitholder (including a unitholder who sold his/her units after the cash distribution record date of October 4, 2021) who received a portion of that cash is treated as having sold the majority of his/her Macquarie Infrastructure Corporation common stock contributed in the merger in exchange for the cash distributed (a “disguised sale”)."

I went as far as calling the company, and they weren't any help. They simply told me to consult a tax attorney.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

@poncho_mike The $174 Cum Adj on the K-1 is the partnership telling you that, at some point in its history, it reported a taxable event of $174 which required you to pay tax even though you didn't receive the funds. That's what causes an increase in basis.

If you're own records indicate that that didn't happen -- that increasing your basis would cause you to underpay your taxes -- ignore it. You won't get into trouble for skipping a deduction.

If the ambiguity just doesn't sit right, all you can do is re-examine every item reported on the K-1s over the years, as well as any decisions made on handling cash received and basis, looking for the $174 inconsistency.

Sorry I can't be more help.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

i found more info which I'll link to. The deemed sale of MIC Hawaii and the dividend were treated as a partnership distribution in 2021 of $37.3868/share so your k-1 should reflect on line 19 $3738.68 or $3739 (this reduces your tax basis in the MLP) of this $179 was taxed as a dividend as you are aware. Not sure if this was on k-1 or broker 1099-DIV. The other $3560 was either a short or long-term capital gain depending on your holding period of MIC. Again, I'm not sure if this was reflected on the K-1 or your 1099-B for 2021. depending on the acquisition date for MIC. things can get even more complicate because MIC paid return of capital dividends in early 2021. ROC dividends reduce the tax basis of the MIC stock you bought. so the question becomes was the proper tax basis reported to MIC when it became an MLP. that's your starting tax basis in the MLP. I can't see your K-1 so what was reported on the other lines is important to know if the $700+ increase in tax basis as reported on the sales schedule is correct (or how it was computed). Corporations subject to US tax laws must report reorganizations to the IRS on form 8937. Also, the corporation would have sent you documentation regarding the reorg and the tax consequences thereof. so you should have gotten it even if the shares were held in the brokerage.

https://www.micinc.com/investor-center.html

https://www.micinc.com/investor-center/tax-information.html look under Atlantic Aviation Transaction distribution.

MORE INFORMATION

when you sold in 2022 the 1099-B should have reflected as cost your basis in the MIC LLP (not adjusted for MLP activity) reduce by any ROC dividends when it was a corporation during the period you held it. ROC dividends (nondividend distributions) would have been reported on the 1099-Div issued by your broker on line 3. this should have been what the-1 showed as contributed capital because all ROC dividends occurred before conversion. then your tax basis in the MLP would have gone up by 2021 income and reduce by all losses, deductions and distributions for 2021 which I gather was the first and final year of the MLP. the final K-1 in 2021 probably plugged withdrawals and distrubutions so zero ending capital was shown.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

Mike9241, you stated the $3739 would reduce the basis of the MLP. I didn't take the $3739 as a distribution from the MLP, I took it as a distribution from the stock before it converted to a MLP based on the following comments in the 2021 K-1.

The Company distributed cash proceeds from the sale of a business to unitholders on October 7, 2021. A unitholder (including a unitholder who sold his/her units after the cash distribution record date of October 4, 2021) who received a portion of that cash is treated as having sold the majority of his/her Macquarie Infrastructure Corporation common stock contributed in the merger in exchange for the cash distributed (a “disguised sale”).

So I closed the book on the MLP stock in 2021, taking the cash distributions as an adjustment to the basis. The MLP was treated like a new purchase, which was only about $400. If the adjustment shown on the 2022 K-1 was in the neighborhood of $3800 or so, I would have concluded I should not have adjusted the basis of the stock on my 2021 taxes.

So best I can tell, I paid $191 for the MLP (cash in), I got a qualified dividend of $179 (which was deposited to my account), and I sold it for $411. There are no other distributions from the MLP. So I'm going to report a gain of $220 and be done with it.

I want to thank you guys for all your help. I hate it when 2 + 2 adds up to something other than 4, so I do my best to understand where the numbers come from. I'm just not going to be able to do that with this transaction, and nobody at MIC will explain it to me.

Again, thanks.

Do you see any errors in what I did in 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating gain/loss from sale of MLP

BTW, Ameritrade reported my basis as $3139.79 on my 2022 1099-B. I called them and told them it was wrong because the 2021 said to treat it as a disguised sale. Ameritrade told me they only report the information the company provides. I called the MLP, and they told me to report what was on the K-1 and don't bother us again, we went out of business.

This concerns me as the data reported to the IRS doesn't properly reflect the true basis. In all, I have paid tax on every bit of money I profited from this stock.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

angelaboone

New Member

taxquestion222

Returning Member

fc3d86cfabcc

New Member

kiera-agee

New Member

lydiagp7090

Returning Member