- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

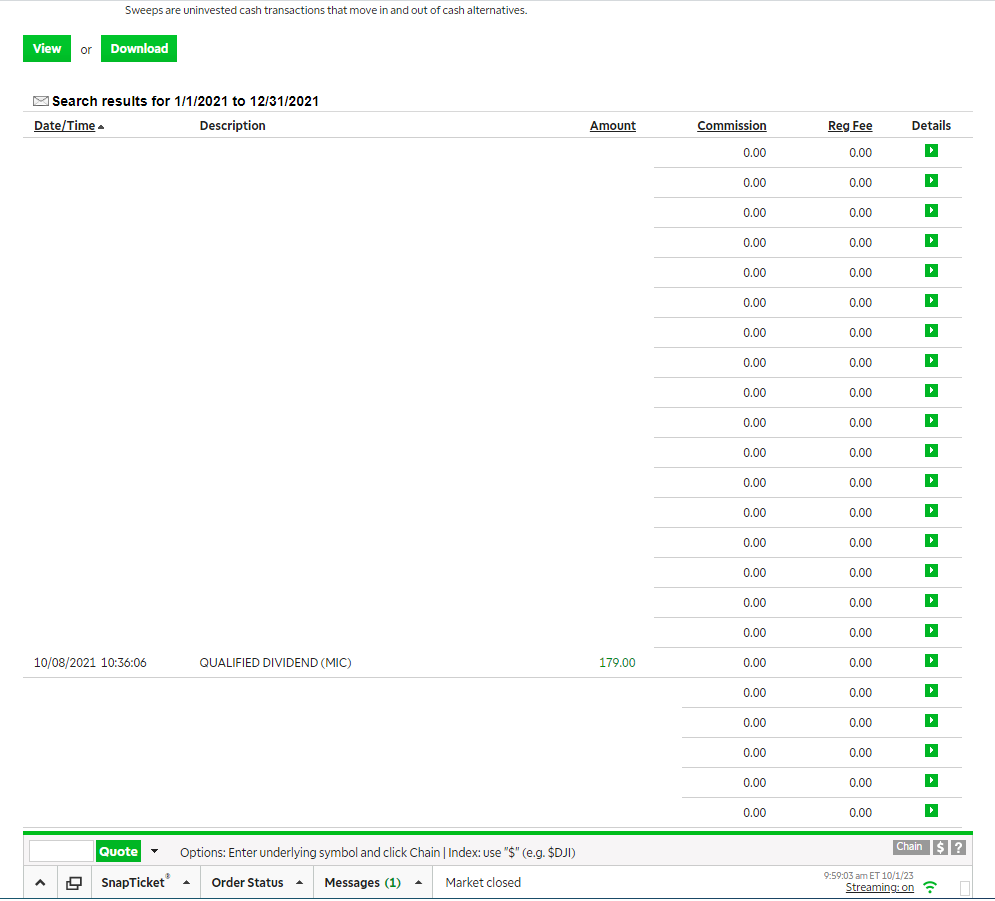

So this is going to get more complicated. I received a qualified dividend of $179 in October 2021. See the attached screenshot of my brokerage account.

A little more background. MIC paid excellent dividends. After acquiring MIC, the company made the decision to start selling off it's operations. I received several special dividends, which were all reported as qualified dividends. When MIC converted to MLP in 2021, there was no transaction reported on my brokerage account and a large distribution was made that did not show up as a dividend. After consulting with the forum and a retired CPA, I calculated my profit assuming the distribution was an adjustment to the basis.

I've done all the math, and if you consider purchase price, dividends, and distributions, I still can't figure out what the $174 cumulative adjustment to the basis is for.

I applied the large distribution as an adjustment to the basis based on this information in the 2021.

"The Company distributed cash proceeds from the sale of a business to unitholders on October 7, 2021. A unitholder (including a unitholder who sold his/her units after the cash distribution record date of October 4, 2021) who received a portion of that cash is treated as having sold the majority of his/her Macquarie Infrastructure Corporation common stock contributed in the merger in exchange for the cash distributed (a “disguised sale”)."

I went as far as calling the company, and they weren't any help. They simply told me to consult a tax attorney.