- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I'm still struggling with this.

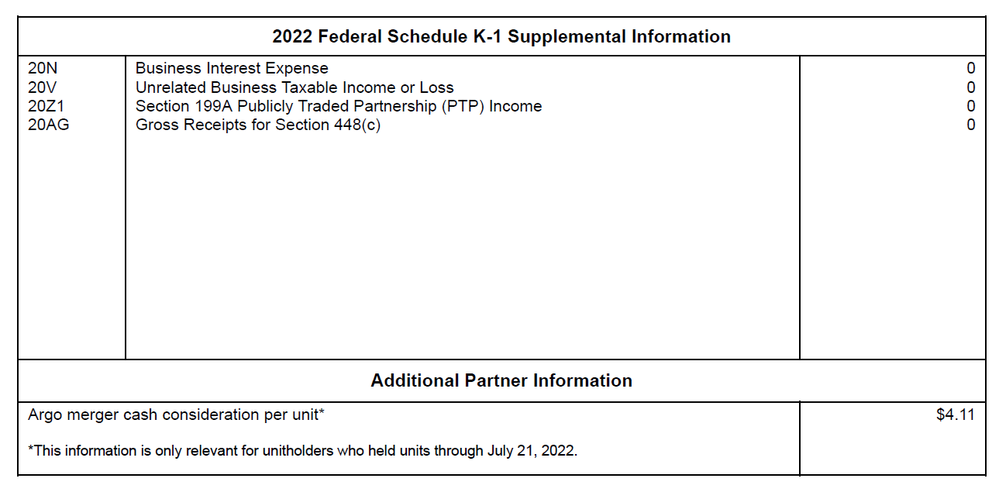

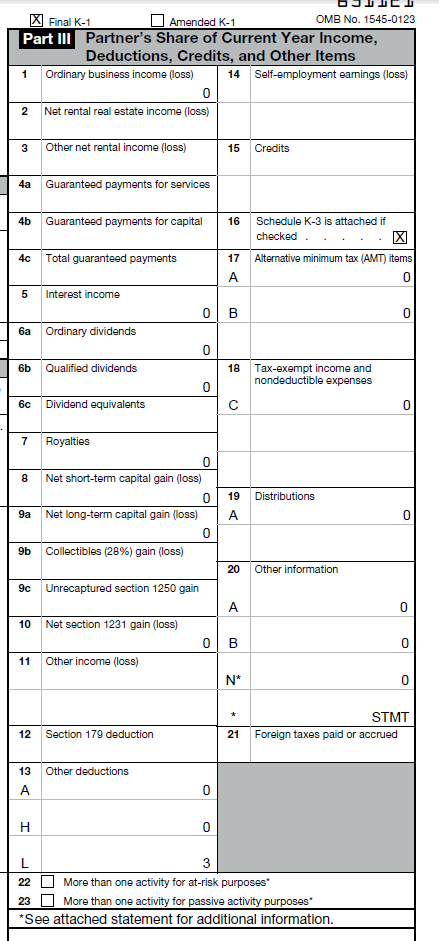

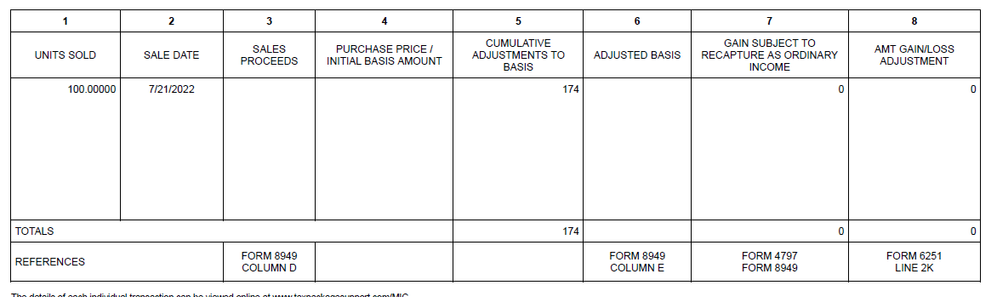

Here are some snapshots from the K-1 and the 1099.

I bought 100 shares of MIC about 5 years ago for $3139.79 as a stock. It converted to MLP in September 2021. When it converted to a MLP, it paid out a $3700+ distribution. On my 2021 taxes, I reported a sale of the stock and had capital gains and qualified dividends.

As an MLP, I show the basis in the MLP was $191 and it paid me $179 in qualified dividends in 2021, which I paid taxes on.

My K-1 and 1099 does not show any partner distributions in 2022, The sales price was $411.

If I understand the snippet from Ameritrade, the sale was reported with Box D checked.

Your statement "

Overall, you pay tax on cash out (sale, distributions) - cash in. You can go back and look at all the cash you invested (before it was a partnership as well as during the partnership phase), any distributions, and your current sale."

When I treated it as a disguised sale on my 2021 taxes, I reported a hefty capital gains and paid taxes. I would assume that I only look at distributions and sales as an MLP since I've already paid tax when the conversion was done.

As a result, I'm currently reporting a basis of $191, a sale price of $411, no dividends, no distributions while a MLP. I'm still not sure where the box 5 data came front.

I apologize for being annoying, but this has been very confusing.