I'm trying to figure out how to determine my at-risk amount for an LLC that I'm non-active partner of (I did not materially participate in). The LLC is also not related to oil and gas. The partnership was formed in 2022. I did received a schedule K-1 for my 2023 return. When I filed my 2023 taxes other than the loss shown on line 14A I didn't showed any at-risk amount on form 6198 when I filed my 2023 return. I have two questions:

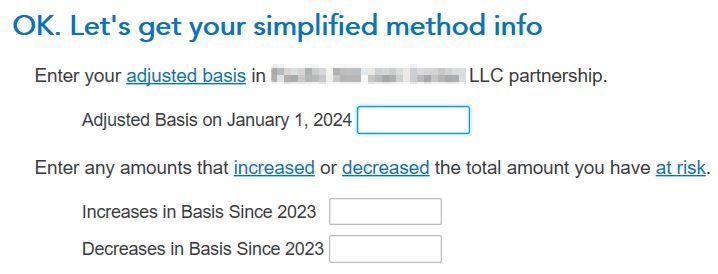

1. How do I determine my at risk amount when filing my 2024 return. The schedule K1 I received for 2024 has beginning and ending values in line item K1 under the qualified non-recourse financing. It also has values in section L with the beginning and ending capital account. I am not sure which values to use in the screen below - I'm assuming I need to use the simplified method - I did file form 6198 but I didn't declare any at-risk amount other than the loss.

2. Do I need to amend my 2023 return since I didn't use the simplified or detailed method and didn't declare my at-risk amount?