- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Arizona form 301 included with form 309

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona form 301 included with form 309

Because of income earned in a state other than Arizona (CT in this case) - Turbotax has me filling out AZ form 309, applying for a credit for taxes paid on income while in another state. On AZ form 309, it says that I also must include form 301 in this situation (nonrefundable tax credits). However, I don't see form 301 listed in my documents for my state filing. Anything I'm missing here?

Thanks kindly,

Pat.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona form 301 included with form 309

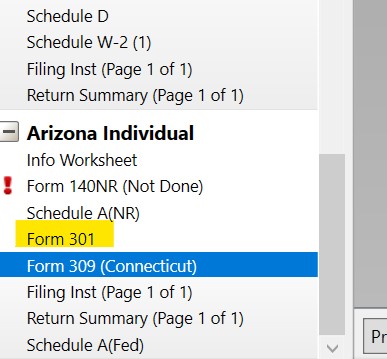

If you are using the desktop software (it appears you are), you can click on Forms in the upper left and scroll all the way down the forms list until you get to the Arizona section. If you do not see both Forms, click on Open Form at the top, then choose 301 from the Arizona list; this will add it to your Forms list. Enter the amount of the credit on Form 309 (CT) into Line 3 of Form 301.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona form 301 included with form 309

Thanks for reply. I'm using the online version and I don't see any place where I can add a form. I've searched the Q&A database but none of those results explain how to add this form or even how to add a form generally.

Should I just fill in a downloaded copy of AZ form 301 and then upload it manually? Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona form 301 included with form 309

Once you complete your credit for taxes paid to another state then TurboTax will generate Form 301 to reconcile all nonrefundable credits. It's not a form that you need to select manually.

Please update here if you have more questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cmiller842

Returning Member

cannmum

New Member

I_Outpost

New Member

threeloops

Level 1

gaulandy

New Member