- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Are my federally exempt dividends that are not from NYState automatically listed on my NYState return, or do I have to list them manually on my state return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are my federally exempt dividends that are not from NYState automatically listed on my NYState return, or do I have to list them manually on my state return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are my federally exempt dividends that are not from NYState automatically listed on my NYState return, or do I have to list them manually on my state return?

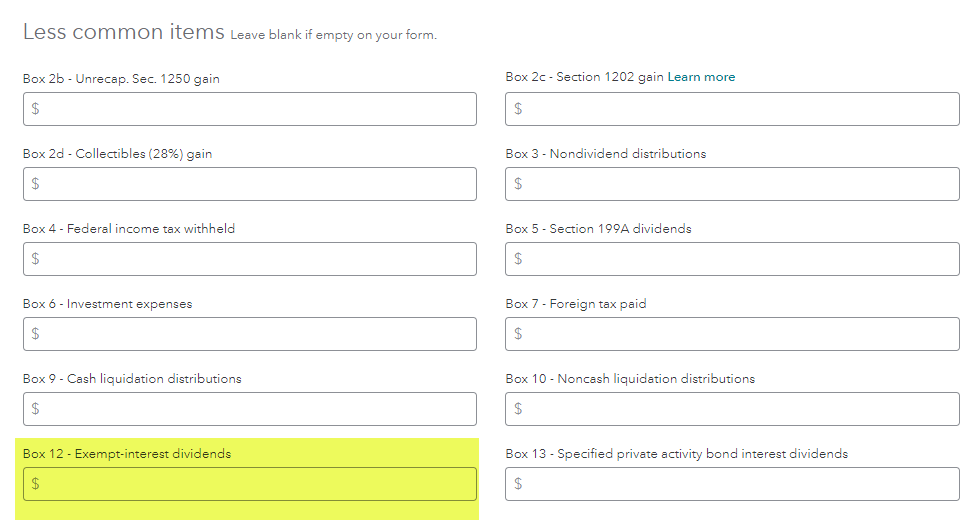

No, you do not need to list them manually and there is a way to determine if you entered them as non-taxable for NYS although it is a bit of a roundabout way to see. First thing is how did you enter the dividends on the main screen? Below is a typical dividend entry screen and the numbers showing are for example only:

The above shows that the checkbox after box 2a indicates additional information from the 1099-DIV needs to be entered. Box 12 that is highlighted indicates that there are exempt interest dividends to be entered. If they are fully exempt you would enter them here. If they are only State exempt enter what is shown on the 1099-DIV and click continue.

The next screen shown below tells TurboTax that some of the dividends would not be taxable at the state level. Place a check in the first box as indicated and click continue.

The next screen will ask you what portion of the dividends represents a non-taxable distribution for state tax purposes.

After entering the above you will return to the Investments and savings summary screen. At this point click on the left side of your screen and scroll down to Tax Tools and click on Tools, then View Tax Summary. The screen will show your federal tax summary so look back to the left and click on NY Tax Summary. Take note of the amount that shows on the fourth line for New York Subtractions. If you did not have any other subtractions for New York income the amount of the exempt dividends should be shown here.

If there are other subtractions, take note of the amount and write it down, click on the left where it says "Back" and you should revert back to the Investments and savings summary page. Scroll to your dividends, click on the down arrow and then edit and continue to where you entered the amount for exempt dividends.

Change the amount that shows in exempt-interest dividends from whatever you entered to $1 and then navigate back to the New York Tax Summary as we did above and check line 4 for New York Subtractions. Did it change? It should have from what you had in there to a smaller number. After reviewing, navigate back to the exempt-interest dividends and enter the correct amount and you should be good to go. I understand this seems somewhat cumbersome but it should give you the reinforcement that you are not going to be taxed at the state level on exempt dividends you received.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pauldhanaraj10

New Member

claire-hamilton-aufhammer

New Member

catoddenino

New Member

Yahaira-Chacon

New Member

jacquelynbullock

New Member