- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Amazon Vine 1099-NEC report as hobby

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

I received a 1099-NEC from Amazon for Amazon Vine reviews. This is not compensation and I reported as hobby income, but the tax return simply says "Nonemployee compensation from 1099-NEC Income" on Schedule 1. Turbotax online version does not provide an option to select “This is not money earned as an employee or self-employed individual, it is from a sporadic activity or hobby". How do I specify Amazon Vine review 1099-NEC as a hobby? I don't want the IRS to confuse with as income.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

Don't enter it as a 1099-NEC. Delete that entry and then scroll all the way down to the bottom of the 'Wages and Income' section to 'Miscellaneous Income.' Once you click on that click on 'Hobby Income and Expenses' on the next screen and enter the information there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

There are no hobby deductions allowed currently so that is a safe way to sail through if you are not a steady - profitable every year -business. I would recommend you enter it as an NEC since the IRS saw that on your return last year. You can continue the business or switch to hobby.

To enter it as a hobby, follow these steps:

- Open your return to the federal income section.

- Locate income from Form 1099-NEC

- Start/ Edit/ Revisit/ Review

- Select Yes to did you receive NEC

- Select add a 1099 -NEC or edit

- Enter payer, id, and compensation

- Continue

- Reason for NEC -hobby income

- Continue

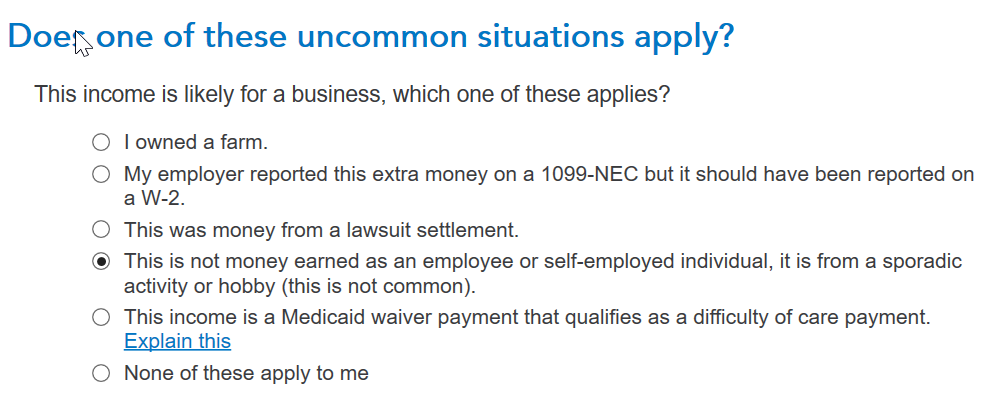

- Uncommon Situation - select not money as employee or self-employed. Sporadic activity

- Continue

- Done

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

Don't enter it as a 1099-NEC. Delete that entry and then scroll all the way down to the bottom of the 'Wages and Income' section to 'Miscellaneous Income.' Once you click on that click on 'Hobby Income and Expenses' on the next screen and enter the information there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

That worked. Thank you for your help. 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

Are we sure this is the best way to go about it? I'm not an expert, just want to avoid raising any flags on my return. Last year I filed my vine income as 1099-NEC Self Employment with no expenses. Is it better to do it as a hobby? I heard filing as a hobby causes the IRS to take a closer look at your returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

There are no hobby deductions allowed currently so that is a safe way to sail through if you are not a steady - profitable every year -business. I would recommend you enter it as an NEC since the IRS saw that on your return last year. You can continue the business or switch to hobby.

To enter it as a hobby, follow these steps:

- Open your return to the federal income section.

- Locate income from Form 1099-NEC

- Start/ Edit/ Revisit/ Review

- Select Yes to did you receive NEC

- Select add a 1099 -NEC or edit

- Enter payer, id, and compensation

- Continue

- Reason for NEC -hobby income

- Continue

- Uncommon Situation - select not money as employee or self-employed. Sporadic activity

- Continue

- Done

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

I will try this, thanks Amy!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

I am really confused by this. So are you saying to enter it as 1099-MISC? Or as Other Income that was not reported on a W2 or 1099? I feel like both of these would be wrong, as Amazon sends out 1099-NEC. None of these things seem to be working for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

You will need to enter it as a 1099-NEC. For most participants in Vine, this is going to be self-employment income subject to self-employment tax because you are performing a service (writing reviews) in exchange for compensation (the items, which have been assigned values.)

If you wish to report it instead as a hobby and feel that you're qualified to do so, you will need to enter the 1099-NEC and then on the follow-up screen select "This is not money earned as an employee or self-employed individual, it is from a sporadic activity or hobby."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

Thanks for the reply, the problem I'm having is that it doesn't get to the point of asking that question. Once I enter in the info from the 1099-NEC it's done, and it goes back to the Income and Expenses page. I'm using the online TurboTax Premium. Maybe it's different.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amazon Vine 1099-NEC report as hobby

When you enter a Form 1099-NEC in the section named for it, rather than directly as business income, TurboTax asks if one of several non-business options applies. See screenshot below:

If you choose one of the non-business options, the program will just add the income separately and not add it to business income.

If instead, you choose "None of these apply to me", the follow up screen asks you to add a business or choose an existing business to which to add the income. See screenshot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sambb

Returning Member

user17693062481

Returning Member

muhannadabbasi

New Member

gangleboots

Returning Member

user17580028127

Level 1