- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Already mailed my taxes out. can i still e file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

No, it is never recommended that you file the same tax return twice (once you've mailed your taxes they are considered filed).

Attempting to e-file your return, after mailing them, may result in the IRS rejecting the e-filed return due to someone already filing using that name, social security number and birthdate.

Additionally, if there is a refund due, submitting two returns will slow down your receiving your refund because a person will need to investigate why two returns were received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

My taxes were amended. how can I efile if I had sent the original ones in already ???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

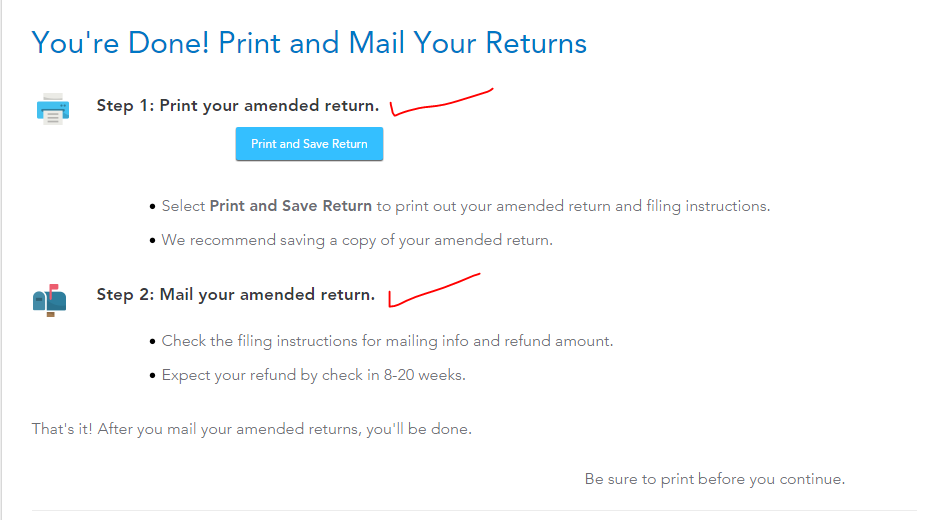

You can not efile an Amended return. Amended returns can only be mailed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

Amended returns MUST be mailed in ... you cannot efile them. In the FILE tab choose to mail in the return and then the filing instruction page that prints with the amended return tells you how and where to file it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

How long do I wait? I did the mail in option because my wife did not have a pin but it has been several months and no signs of it being received by the IRs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

Did you get a tracking number from the post office when you mailed it? And you mailed federal and state in separate envelopes? They go to different places.

Sorry the IRS has limited staff due to Covid-19. They didn't start opening the mail until June that's been stacking up. Back in March the IRS closed their processing centers and stopped processing mailed tax returns. An IRS spokesperson recently said that they have about 11 million pieces of unopened mail. The IRS says....."We’re experiencing delays in processing paper tax returns due to limited staffing. If you already filed a paper return, we will process it in the order we received it." So it may take longer if you mailed in June or later. So you have to keep waiting.

See this IRS page for the latest information

https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

In that case should I try to get what I need to efile and just have them reject the one mailed to them when they finally get around to it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

NO! Do not efile or file again. That will just confuse them and delay it even more. See this IRS page for the latest information

https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue

It says not to file again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

I sent paper tax return in on Feb 3 and nothing shows on IRS website. How do I know it isn't lost. 10 or more weeks and nothing. Doesn't IRS image all mail received?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

No. IRS keeps the original document if received. They also enter the data from the information into their system and create a transcript of the information received.

Paper document more than 10 weeks is normal THIS year! IRS id behind in processing refunds due to issuing Stimulus payments. You can check on the IRS webpage the status of your return by using this link. Where’s My Federal Refund?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

There is a reddit page on paper tax return: https://www.reddit.com/r/IRS/comments/m9dqc0/paper_tax_return/?utm_source=share&utm_medium=web2x&con...

The delay is widespread, I heard a case that someone sent in 2019 tax return in April, 2020 and IRS didn't show they received it until February 2021. It takes them 10 months to open the envelope. That is how slow it is!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

If they have not even processed my mail-in return (around March 9th), then they will not have information on file for me, so why would e-filing be an issue? They said they might not get to this years returns for a while so what is the point in waiting if they haven't gotten to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Already mailed my taxes out. can i still e file

That would be considered duplicate filing and therefore would hold up processing. Now there will have to be investigations into the double filing to ensure there is no identity theft issues. It will definitely cause delays.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lilbit_countrygrl

New Member

deesandra-g00

New Member

bobby_chris30

New Member

lynn

New Member

kathy-brandenburg2016

New Member